This shall be my last post for BusinessofApps. After a decade of sharing insights, trends, and stories from the world of mobile apps, it comes with a mix of gratitude and sadness. If the app world teaches us anything, it’s that things move incredibly fast. So in the spirit of dynamic shifts, let me leave you with an overview of the top trends of 2023.

In 2023, the mobile app industry faced a range of challenges and opportunities that shaped its trajectory. From a decline in app install ad spending to the resurgence of iOS non-organic installs, here’s AppsFlyer’s overview of the top five predictions that defined the year:

1. App install ad spend declines by 6% to reach $82 billion

The global economic downturn cast a shadow over mobile app user acquisition budgets in 2023, resulting in a 6% year-over-year decline to a total of $82 billion worldwide. Interestingly, this decline was more pronounced for Android, with a 10% decrease, while iOS experienced a 2% growth.

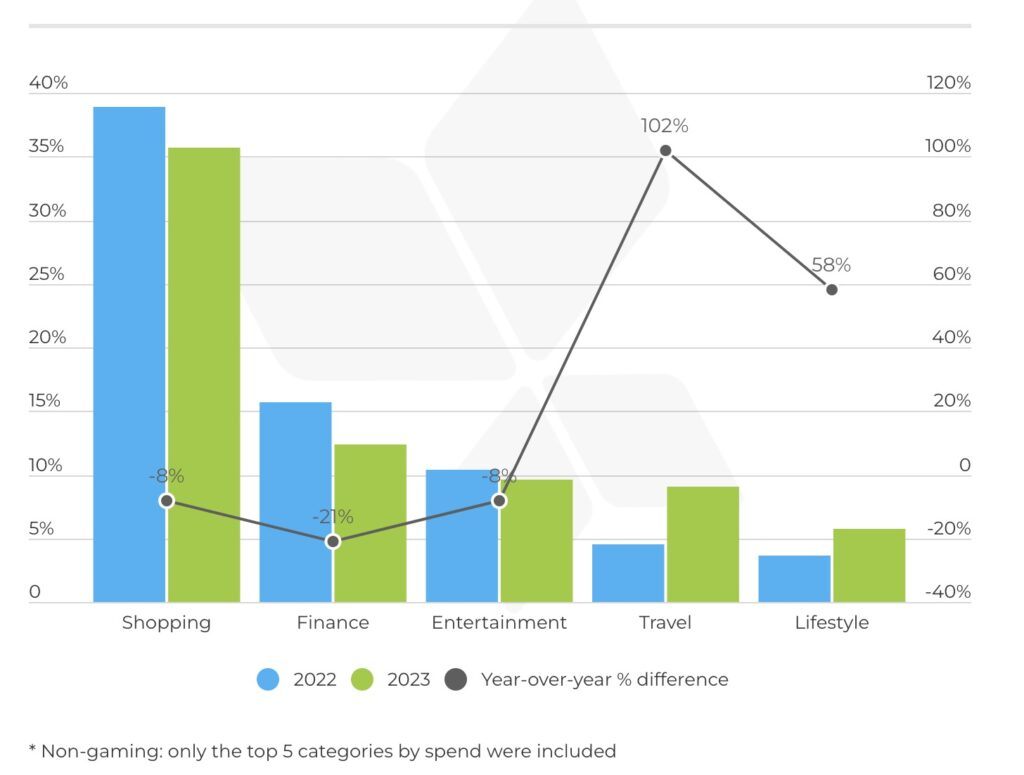

Share of non-gaming app install ad spend trend and % change by category

Source: AppsFlyer

2. iOS non-organic installs rebound with a 9% YoY increase

After enduring a 15% drop in iOS non-organic installs (NOI) in 2022, compared to the previous year, 2023 witnessed an impressive rebound. NOI experienced a 9% year-over-year increase, outpacing Android’s modest 3% growth. This resurgence can be attributed to a 10% reduction in media costs on iOS, along with improved adaptability among marketers and ad networks to the changes brought about by ATT and SKAdNetwork.

Fire Up Your Growth!

Moburst propelled leading brands like Google, Reddit, and Uber to the next level. Let’s ignite your Success journey today!

Claim Your FREE Growth Fuel!3. Total app downloads increase by a modest 2% in 2023

While 2022 saw a robust 10% rise in total app downloads, 2023 experienced a more subdued 2% increase. This slowdown was primarily due to a 4% decline in non-gaming Android apps, driven by declines in India, Indonesia, and Brazil. However, Android gaming installations increased by 6%, and iOS non-gaming installs grew by 7%.

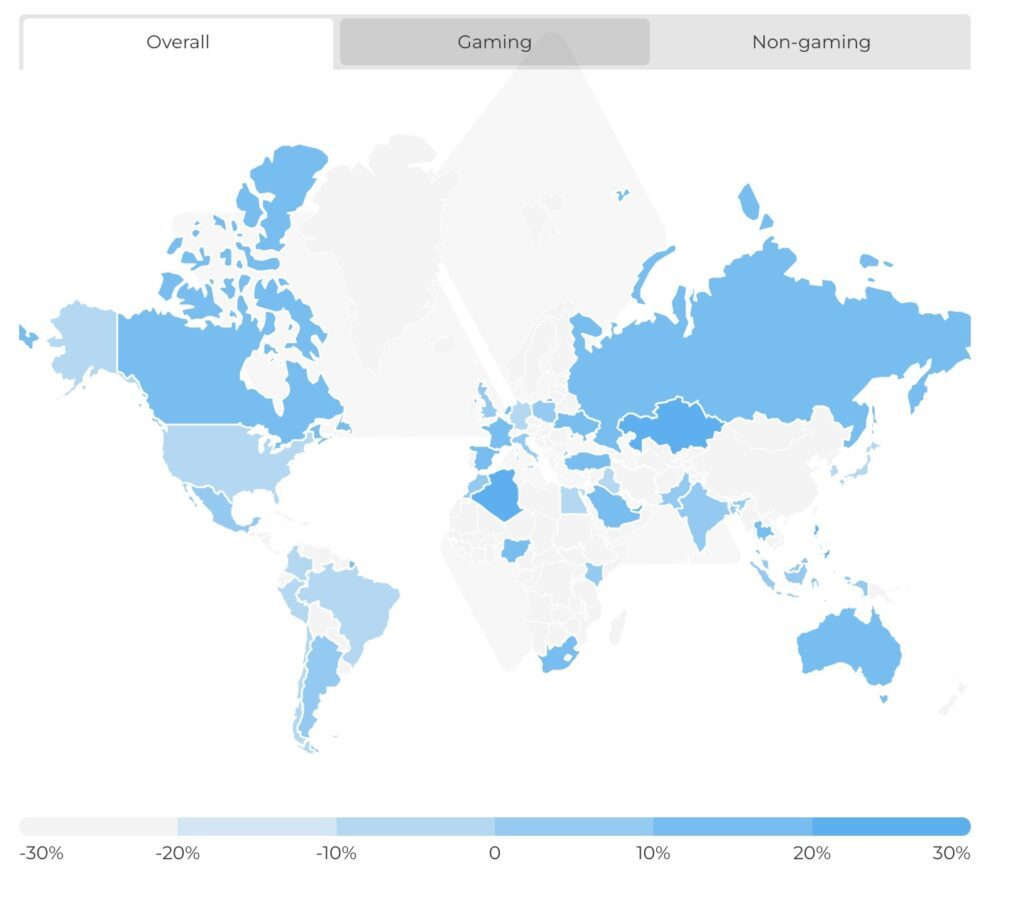

YoY % change in total app installs by country

Source: AppsFlyer

4. In-app purchase revenue thrives in both gaming and non-gaming apps

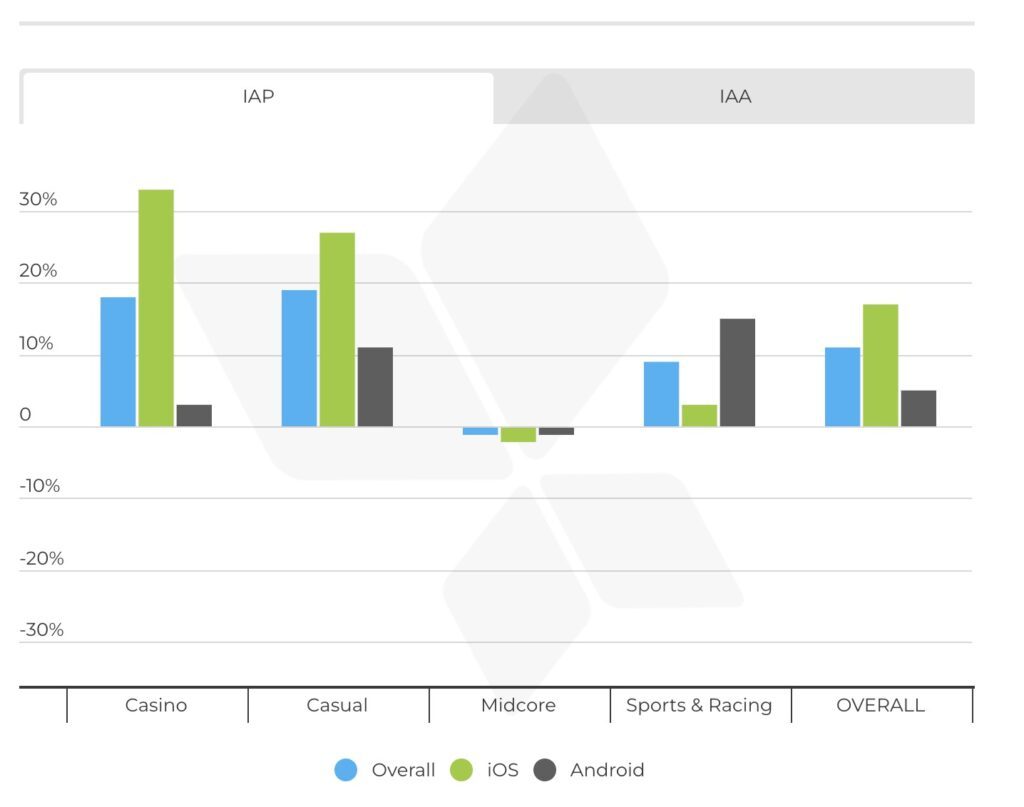

In-app purchases (IAPs) made a strong comeback in gaming apps, registering an 11% increase in 2023. This resurgence was driven by gains in casino and casual games, while midcore games saw slight declines. In the realm of in-app advertising (IAA) revenue in gaming, there was a 4% year-over-year increase, primarily driven by casual games.

YoY % change in revenue from in-app purchases and in-app advertising among gaming apps

Source: AppsFlyer

Among non-gaming apps, IAP consumer spending surged by an impressive 19% year-over-year. Travel, food & drink, utility & productivity, and lifestyle apps led the charge in this growth. Subscription revenue also soared, jumping 30% in 2023, emerging as a key revenue stream for non-gaming apps.

5. Android remarketing conversions decline by 9% YoY

Remarketing faced headwinds in 2023, particularly on the Android platform, where conversions dropped by 9% year-on-year. This decline was closely linked to the decrease in app install ad spend due to the economic downturn. While India and Brazil experienced declines, the United States witnessed an uptick in remarketing activity, particularly in entertainment, finance, and food & drink apps.

Looking toward the future, the state of the global economy will play a pivotal role in budget allocation for app install ad spending in 2024. Encouragingly, economic parameters like GDP growth, inflation, and market performance are showing improvement, fostering cautious optimism for increased budgets.

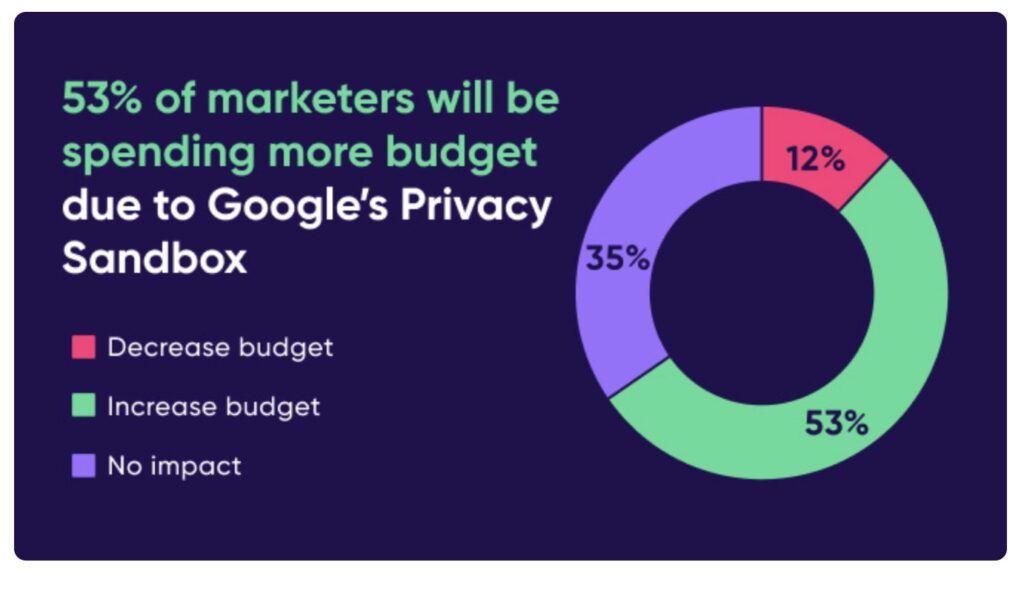

The digital marketing industry also continues to grapple with privacy-driven challenges following iOS 14.5. With Android’s Privacy Sandbox and Chrome’s cookie deprecation on the horizon, marketers will need to adapt to a shifting landscape.

The integration of AI will undoubtedly disrupt many industries. And such changes may be disruptive and aren’t always going to be positive.

Stay tuned and keep watching this space. And as always: thanks for reading!