France, the driving force behind Europe’s mobile revolution, has a thriving app ecosystem. With over 76% of its population actively using smartphones, the market is set to exceed $7.3 billion by 2027. That’s according to the latest data roundup provided by app experts Adjust. Let’s dive in.

Mobile game sessions rose 17%

In 2022, French users spent an average of 3.9 hours per day on mobile apps, up from 2.7 hours in 2019. Explore the latest trends shaping the French app market in 2023, from gaming and social apps to economic challenges affecting overall app sessions.

In the dynamic French Android market, gaming apps rule the revenue charts, with six out of the top ten grossing apps belonging to this category. Coin Master, a gaming app, reigns supreme in the first place, followed closely by TikTok (social) at second. Another gaming sensation, Monopoly Go, secures a high spot.

On iOS, the landscape shifts slightly. Deezer, a popular music and audio app, takes the top spot, with TikTok following closely in second place and Tinder (social) rounding out the top three.

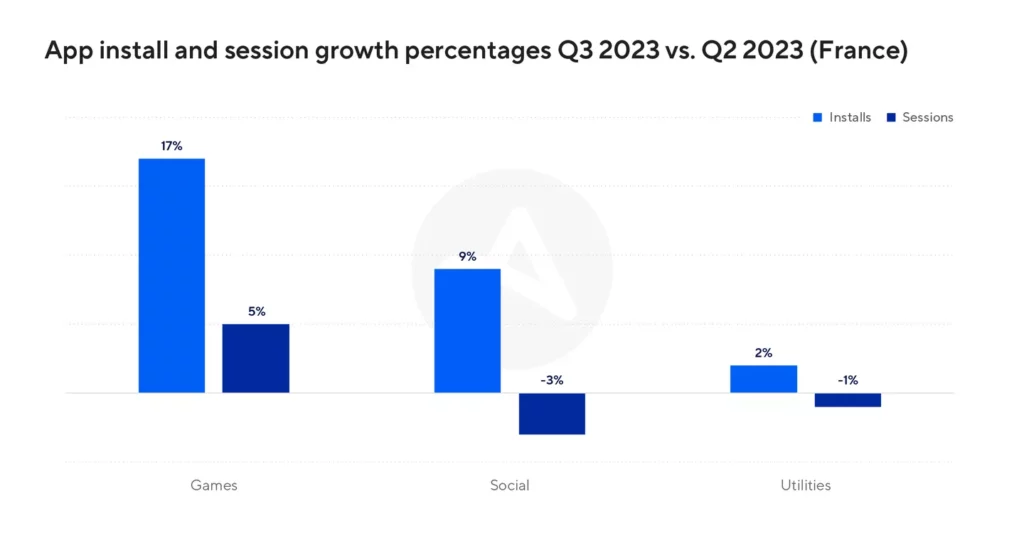

App installs and sessions – France

Source: Adjust

France’s mobile gaming sector is on quite the growth trajectory, with projected revenues of $0.83 billion by the end of 2023, expected to soar to $1.07 billion by 2027. Games already account for a substantial 43% of all mobile app downloads in France.

Context-aware tech: The secret to 81% more conversions

Learn how leading apps are using context-aware technology to deliver perfectly-timed offers, reduce churn & transform passive users into loyal fans.

Learn moreFurthermore, a recent study reveals that 71% of the French population engages in mobile gaming occasionally. This surging interest is supported by Adjust data, showcasing a significant 17% increase in gaming app installs from the second to the third quarter of 2023, along with a 5% rise in user sessions.

Gaming and social take highest retention rates

In January 2023, 86.9% of France’s internet users, spanning all age groups, actively engaged with at least one social media platform. TikTok emerged as a standout top-grossing social app, boasting approximately 21 million users aged 18 and above in early 2023.

According to Adjust data, while social app user sessions experienced a modest 3% decline from Q2 to Q3 2023, app installs surged by 9%. This presents a strategic window for mobile marketers to employ tactics like personalised content, gamification elements, and push notifications to attract and retain users in an increasingly competitive mobile app landscape.

The French app market demonstrates a notable shift toward utility apps. Despite a marginal 1% drop in user sessions from Q2 to Q3 2023, utility apps recorded a slight 2% increase in installations. Additionally, in October 2023, there was significant year-over-year (YoY) growth, with installs surging by 21% and sessions by 8% for utility apps.

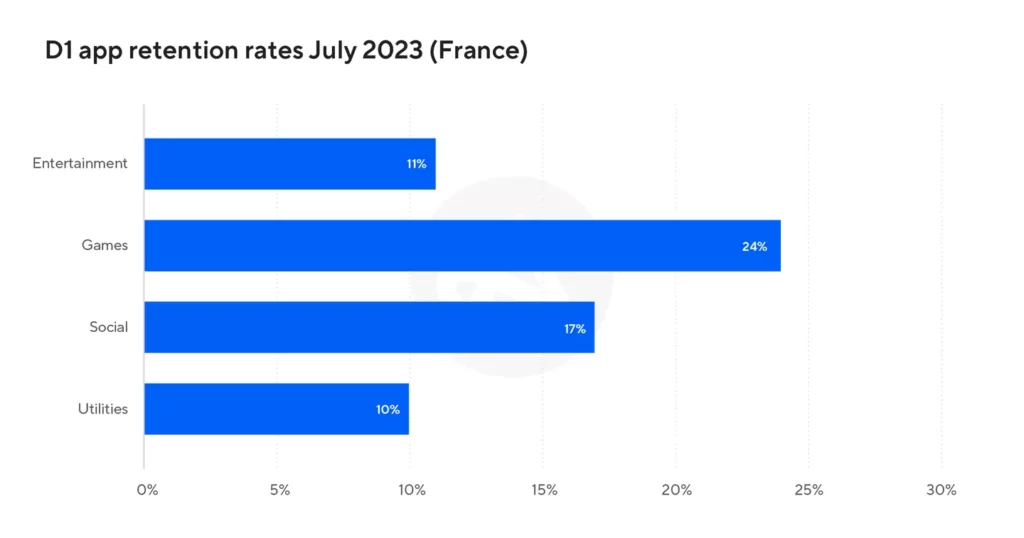

Strong game retention rates

Gaming and social apps in France exhibit the highest Day 1 retention rates, standing at 24% and 17%, respectively, as of July 2023. Entertainment and utility apps follow closely, with retention rates of 11% and 10%, respectively.

To foster further retention growth, gaming, social, and entertainment apps can enhance their personalised content offerings, while utility apps can focus on incorporating practical, everyday features and elevating the overall user experience.

To thrive, app marketers must prioritise French localisation, tapping into both the domestic and global Francophone audience. However, caution is required in monetisation, notably in-app advertising (IAA). French consumers are less tolerant of mobile ads, with 40% favouring alternative approaches, exceeding the global average of 20%. Hence, tailored and considerate monetisation strategies are imperative.