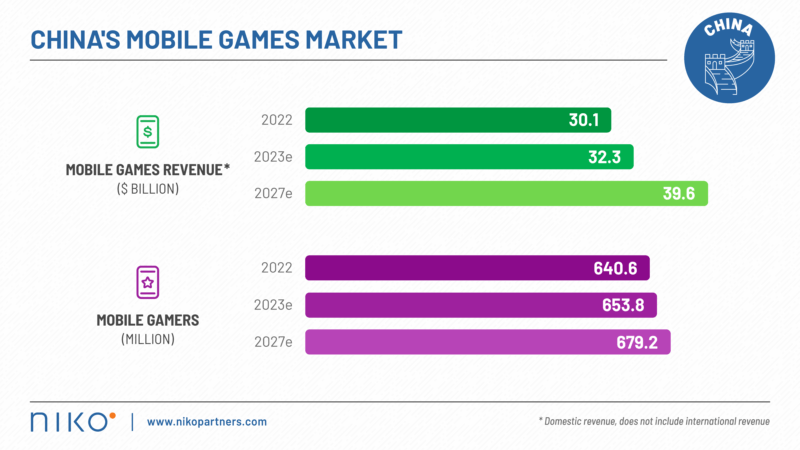

China retains its unrivalled position as the dominant force in the global mobile gaming industry, capturing a staggering 31.7% share of the worldwide mobile games revenue, all generated domestically. That’s according to the latest research from video games market research firm Niko Partners.

China leads in revenues

China is expected to reach $57 billion in gaming revenues by 2027. That figure includes mobile, PC and console games. Game companies in the country now account for 47% of mobile gaming revenues and 39% of PC revenues globally.

“Chinese game companies are growing internationally, and they are making bold investments at higher rates than ever,” said Lisa Hanson, CEO and founder of Niko Partners. “PC games revenue generated overseas by Chinese owned companies rose by 22% in 2022 and is expected to grow by a 13.8% CAGR through 2027 – which is higher than the domestic growth rate by a significant margin. You must get to know Chinese developers and publishers both in the domestic market and abroad if you are serious about the global games industry.”

China mobile gaming revenues projected to grow

Source: Niko Partners

Gamers on the rise

Despite a declining population, the country is projected to reach a whopping 730 million gamers. In terms of revenue distribution, mobile games account for 66%, PC games for 31%, and console games for 3%.

Context-aware tech: The secret to 81% more conversions

Learn how leading apps are using context-aware technology to deliver perfectly-timed offers, reduce churn & transform passive users into loyal fans.

Learn moreIn 2022, Tencent and NetEase dominated the domestic PC and mobile games revenue, capturing a combined market share of 61%.

However, their dominance weakened compared to 2021 due to underperformance of existing titles and a lack of new game launches. This suggests that other competitors are gaining ground.

In Q1 of 2023, both companies reported positive earnings, with Tencent’s domestic game revenue growing by 10.9% year-on-year and NetEase’s total games revenue increasing by 7.6% year-on-year.

Interestingly, 42.8% of active gaming and esports content viewers in China make in-game purchases every month, compared to only 2.2% of gamers who do not watch esports or gaming content. Furthermore, gamers who engage in live streaming tend to spend, on average, 70% more per month than those who do not.

“China’s market can be tough for domestic and foreign companies, but the country remains the #1 market globally for games revenue and the number of gamers, and cannot be ignored,” stated Lisa Hanson, CEO and founder of Niko Partners. “Game companies are successful in China, both through officially approved releases on app stores and unlicensed releases through platforms such as Steam International. If we consider games published through Steam in China as if Steam were a single entity, the revenue generated from the platform would make surpass all other publishers in the country except for Tencent and NetEase.”

Key takeaways

- China accounts for 31.7% of worldwide mobile games revenue

- China is projected to achieve $57 billion in gaming revenues by 2027

- China is expected to have a massive 730 million gamers, with mobile games accounting for 66% of revenue