Tech giant Apple made this week announced a series of upcoming tax changes that will impact apps, in-app purchases, and subscriptions. These changes are set to take effect from May 31. Let’s take a closer look.

App Store tax changes

In a blog post, the iPhone-maker highlighted that developers on the App Store will see modifications in their proceeds from the sale of apps, in-app purchases, and auto-renewable subscriptions, all in accordance with newly implemented tax adjustments. Prices won’t be affected.

The changes are as follows:

- Ghana: Increase of the VAT rate from 12.5% to 15%.

- Lithuania: Reduction of the VAT rate from 21% to 9% for eligible e‑books and audiobooks.

- Moldova: Reduction of the VAT rate from 20% to 0% for eligible e‑books and periodicals.

- Spain: Digital services tax of 3%.

Apple also revealed that it will now withhold taxes for all sales made in Brazil. This decision is in response to the new tax regulations introduced in the country. As part of its role in administering the collection and remittance of taxes, Apple will handle these responsibilities on a monthly basis.

Ultimate App Growth Guide 2025

Boost your app’s success with the Ultimate App Growth Guide! 🚀 Expert insights, proven strategies & must-know tips. Download now!

Master app growthAccessing your tax information

Source: Apple

Developers will be able to access information about the amount of tax deducted from their earnings starting in June 2023, with the May earnings report. It’s important to note that developers based in Brazil are not affected by this change.

Why is Apple updating its tax regulations?

Apple regularly updates the proceeds received by iOS developers in specific markets. That’s because of evolving tax regulations across the globe.

The most recent update happened in January, which had an impact on App Store prices in various countries, including the UK and South Africa.

These adjustments demonstrate Apple’s commitment to aligning with local tax regulations and ensuring compliance with the changing legal landscape.

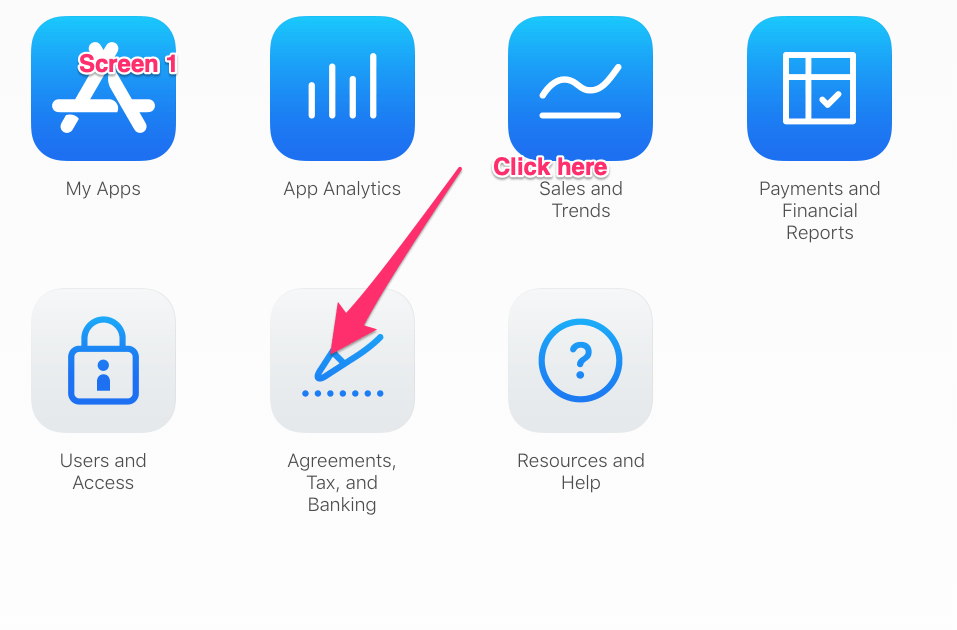

Once the latest changes have taken effect, Apple will provide iOS developers with the opportunity to update their prices through the Pricing and Availability section of My Apps in App Store Connect. With a selection of over 900 price points, developers can adjust their app pricing to align with the revised tax regulations and market conditions.

Key takeaways

- Apple unveiled a series of upcoming tax changes that will affect apps, in-app purchases, and subscriptions on the App Store

- The modifications in developers’ proceeds will be in line with newly implemented tax adjustments and will not impact app prices

- Apple will now withhold taxes for all sales made in Brazil due to the country’s new tax regulations