Japan’s mobile market is a dynamic and innovative powerhouse, characterized by its mobile-first approach, app-centric behavior, and tech-savvy consumer base. The market reached approximately $103.6 billion in revenue in 2022, according to GlobalData. This highlights the immense potential for businesses to tap into this market and leverage the country’s tech-savvy population.

In this article, we will dig deeper into the various facets of Japan’s mobile market—first, its demographic traits and preferred mobile OS, then we will explore key consumer behaviors, as well as market dynamics that have contributed to the market’s remarkable growth and success. By understanding the unique characteristics of the Japanese mobile landscape, businesses can unlock immense opportunities and navigate this dynamic market with confidence.

Number of users

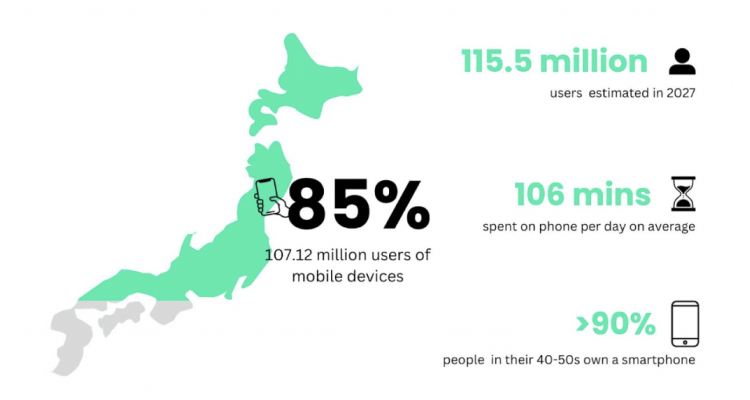

Japan boasts a significant number of smartphone users, contributing to its thriving mobile market. According to a summary report about Japan’s mobile economy, mobile device usage time in Japan tripled in the last decade, coming close to 106 minutes per day, per person.

As of 2022, there were approximately 107.12 million smartphone users in Japan, representing a substantial portion of the population (85%). This high adoption rate underscores the country’s mobile-centric culture and the widespread integration of smartphones into daily life.

This number is projected to reach over 94% of the population, or 115.5 million users, by 2027. Over 90% of Japanese adults in their fifties also use smartphones, and nearly all of those in their teens through their forties do so with or without computers.

Japan in numbers

Source: Statista Report on Japan Average Mobile Time and Share of Population to Smartphones

Purpose of using mobile

According to data.ai, the 35-44 age group spent the most time on mobile apps in Japan in 2020, followed closely by the 25-34 age group. Women and men use mobile apps at similar rates in Japan, with perhaps a slight skew towards male users.

Smartphones serve diverse purposes for Japanese users, reflecting their reliance on mobile devices for various activities. The main purposes of smartphone usage can be categorized into several key areas:

- Communication and social networking: Smartphones are integral to communication in Japan, with individuals using messaging apps, social media platforms, and email services to stay connected with family, friends, and colleagues. Popular apps like LINE, X (formerly Twitter), and Instagram facilitate these interactions.

- Mobile apps for practical activities: Mobile apps play a crucial role in the daily lives of Japanese smartphone users. They rely on apps for various practical activities such as banking, shopping, transportation, food delivery, and travel planning. Popular apps like Rakuten, Amazon, Yahoo Japan, and Google Maps cater to these needs.

- Entertainment and media consumption: Smartphones serve as portable entertainment hubs, enabling users to enjoy a wide range of media content. From streaming videos and music to playing games and reading e-books, Japanese smartphone users engage in various forms of entertainment through dedicated apps and services.

- Educational purposes: Smartphones are also used as an educational tool in Japan, with studies suggesting Japanese students’ high regard for smartphones and mobile apps for learning purposes.

- Internet browsing and information access: Japanese smartphone users heavily rely on their devices to access the internet, search for information, and browse websites. From news articles and weather updates to research and entertainment, smartphones provide convenient access to a wealth of online content.

Purpose of using mobile in Japan

Source: aix

iOS vs. Android

Japan’s mobile operating system market is dominated by two major players: iOS and Android. According to MMD (in Japanese), a mobile marketing data labo, as of 2021 May, iOS had a market share of around 44.1% in Japan, while Google Play had a market share of approximately 51.5% Other platforms, such as Windows and KaiOS, held a very small share of the market.

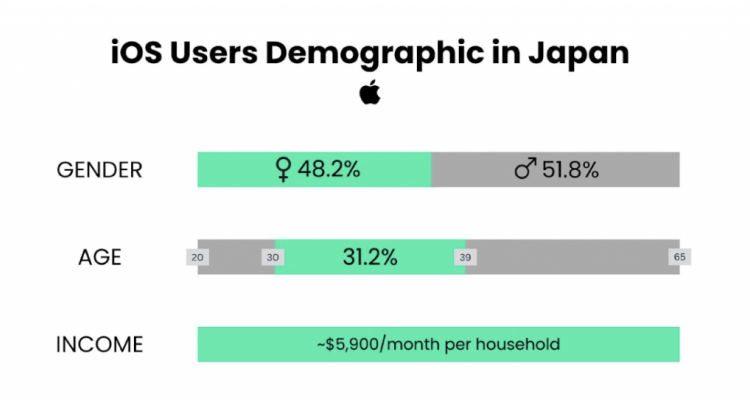

Demographic split of iOS users in Japan

- Gender: In Japan, the gender split of iOS users is roughly equal, with slightly more male users than female users. According to a survey conducted by MMD Labo in 2020, 51.8% of iOS users in Japan were male, while 48.2% were female.

- Age: iOS users in Japan tend to be younger than Android users. According to the same survey by MMD Labo, the majority of iOS users in Japan were between the ages of 20 and 39, with the highest percentage of users (31.2%) in the 30-39 age range.

- Income: iOS users in Japan tend to have higher incomes than Android users. According to a survey by GfK in 2020, the average monthly household income of iOS users in Japan was 645,000 yen (approximately $5,900), compared to 485,000 yen (approximately $4,430) for Android users.

Demographic split of iOS users in Japan

Source: aix

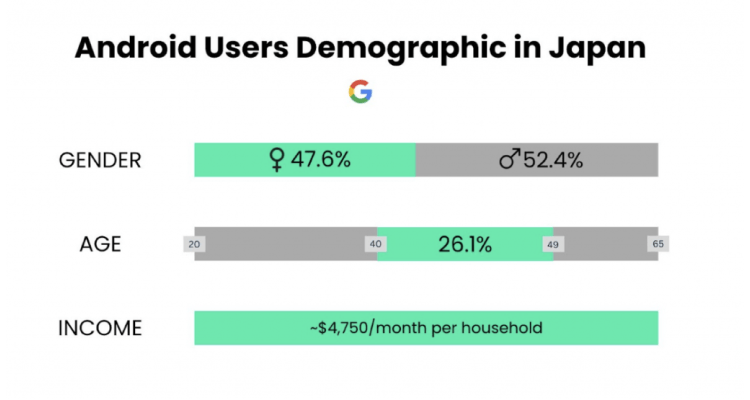

Demographic split of Android users in Japan

- Gender: The gender split among Android users in Japan is relatively balanced, with a slightly higher percentage of male users. According to a survey conducted by MMD Labo in 2020, approximately 52.4% of Android users in Japan were male, while 47.6% were female.

- Age: Android users in Japan encompass a wide range of age groups. According to the same survey by MMD Labo, the largest segment of Android users fell into the 40-49 age range, accounting for 26.1% of the user base. However, Android users are present across all age groups, with significant representation from younger demographics as well.

- Income: Android users in Japan show a diverse range of income levels. According to the aforementioned survey by GfK in 2020, the average monthly household income of Android users in Japan was 520,000 yen (approximately $4,750).

Demographic split of Android users in Japan

Source: aix

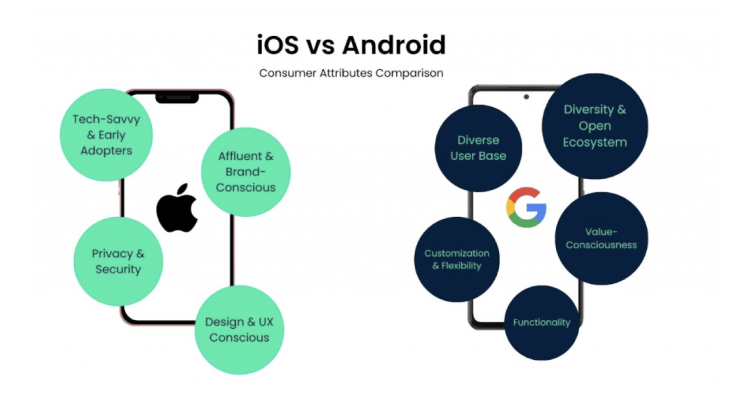

iOS consumers characteristics

iOS consumers in Japan possess certain distinct characteristics that contribute to their preferences and behaviors within the mobile market. Here are some key characteristics of iOS consumers in Japan:

- Tech-savvy and early adopters: iOS consumers in Japan are known for being tech-savvy and early adopters of new technologies. They eagerly embrace the latest iPhone models, operating system updates, and innovative features introduced by Apple. This tech-savviness drives their interest in exploring new apps and services to enhance their digital experiences.

- Design and user experience-conscious: iOS consumers in Japan appreciate the sleek design and user-friendly interface of Apple products. They value the seamless integration between Apple devices and services, which creates a cohesive and intuitive user experience. The aesthetic appeal and attention to detail in Apple’s hardware and software design resonate well with this consumer segment.

- High engagement with mobile apps: iOS consumers in Japan are highly engaged with mobile apps. They actively seek out and download a wide range of applications from the App Store to cater to their various needs and interests. From social networking and entertainment to productivity and lifestyle, iOS users in Japan embrace the app-centric nature of their devices.

- Emphasis on privacy and security: iOS consumers in Japan prioritize privacy and data security. They trust Apple’s strong stance on protecting user privacy and appreciate the robust security features embedded in iOS devices. This emphasis on privacy aligns with the broader cultural value placed on personal data protection in Japan.

- Affluent and brand-conscious: iOS consumers in Japan tend to have higher income levels compared to the average population. They are often brand-conscious and willing to invest in premium devices and services that offer quality, reliability, and a prestigious image. The exclusivity and perceived status associated with Apple products appeal to this consumer segment.

Android consumers characteristics

Android consumers in Japan possess certain distinctive characteristics that shape their preferences and behaviors within the mobile market. Here are some key characteristics of Android consumers in Japan:

- Diverse user base: Android consumers in Japan represent a diverse user base, encompassing various age groups, income levels, and lifestyles. Android devices cater to a wide range of price points, making them accessible to a broad demographic in Japan.

- Customization and flexibility: Android consumers in Japan appreciate the customization and flexibility offered by the Android operating system. They enjoy the ability to personalize their device’s appearance, choose from a wide array of apps and widgets, and customize settings according to their preferences.

- Value-consciousness: Android consumers in Japan tend to be value-conscious and seek devices that offer a balance between features and affordability. They often consider factors such as specifications, pricing, and value for money when making purchasing decisions.

- Embracing local brands: While global brands like Samsung, Google, and Sony have a significant presence in the Android market in Japan, consumers also show a willingness to embrace local brands. Manufacturers such as Sharp, Fujitsu, and Panasonic offer Android devices tailored to the preferences and needs of Japanese consumers.

- App diversity and open ecosystem: Android consumers in Japan enjoy the vast app selection available on the Google Play Store. They take advantage of a wide range of apps that cater to various interests, including social media, gaming, productivity, entertainment, and local services. The open ecosystem of Android allows for greater app diversity and experimentation.

- Emphasis on functionality: Android consumers in Japan often prioritize functionality and practicality. They appreciate devices that offer a wide range of features, expandable storage options, and compatibility with various third-party accessories.

- Strong local support and communities: Android consumers in Japan benefit from strong local support networks and online communities. They actively engage in forums, social media groups, and online communities to share tips, troubleshoot issues, and discuss new Android-related developments.

It’s important to note that these characteristics are general observations and may not apply to every Android consumer in Japan. Individual preferences and behaviors can vary within this diverse consumer segment.

Interestingly, the market study report on mobile OS by the Japan Fair Trade Commission highlights a “lock-in effect” where consumers largely stick to whichever operating system they are currently using, preferring not to switch even if there were a hypothetical price increase; for users, “various costs are incurred in switching between Android and iOS” anyway.

iOS vs. Android consumers characteristics in Japan

Source: aix

Future vision

In addition to gaming, the mobile app market in Japan is poised for significant growth in the health and wellness sector. With an increasing emphasis on personal well-being, there will be a surge in mobile apps that cater to fitness tracking, mental health management, and overall wellness. These apps will leverage sensors, artificial intelligence, and data analytics to provide personalized recommendations, track progress, and offer valuable insights to users. The vision is to empower individuals to lead healthier lifestyles through mobile apps that seamlessly integrate into their daily routines.

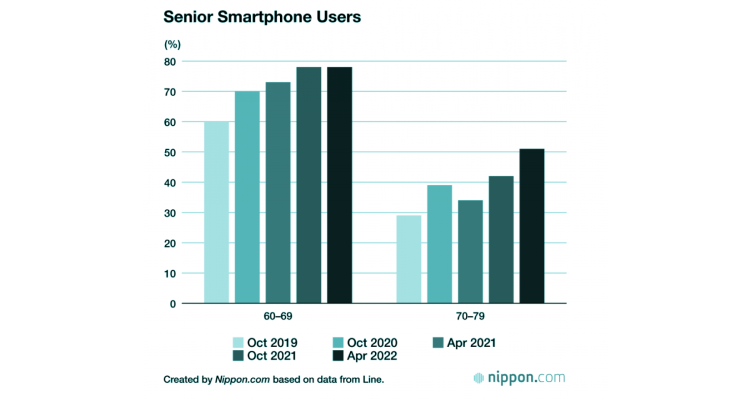

Furthermore, as Japan has an ageing population, there is a growing opportunity for mobile apps to cater to the specific needs of seniors. Future mobile apps may focus on enhancing accessibility, providing healthcare monitoring solutions, and facilitating social connections for the elderly. By addressing the unique challenges faced by older generations, mobile apps can contribute to improving the quality of life and promoting inclusivity.

Senior smartphone users

Source: Nippon

Overall, the Japanese mobile market embodies a vibrant and evolving landscape, characterized by technological advancements, changing consumer preferences, and a constant drive for innovation. As the mobile market continues to thrive, it will remain a key player in shaping the digital landscape of Japan’s future. Businesses will need to stay agile and embrace evolving trends and technologies to leverage the full potential of Japan’s mobile market.

If you want to take a deeper dive into the Japanese mobile market, visit the ASO index.