An overview of how Grocery apps are growing and diversifying amidst COVID-19, new partnerships & services, and key in-app solutions.

The state of online Grocery Delivery in the US

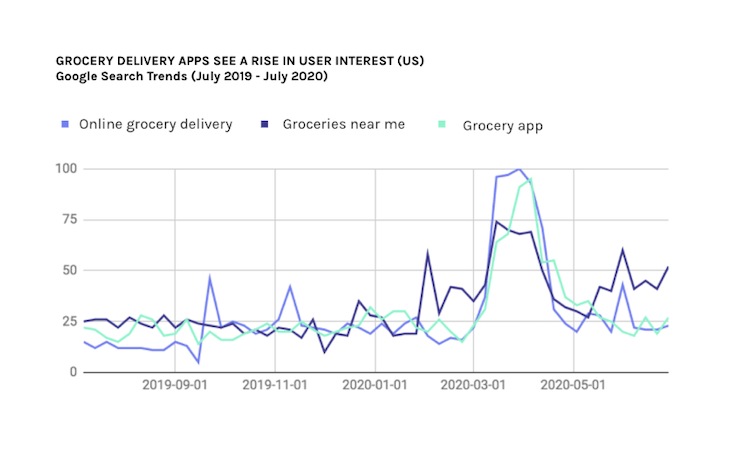

Since the lockdown and social distancing measures started, many users have dwelled on a fundamental question: [Are there] online grocery delivery services near me? 🔎. Truth is nowadays groceries are always near you.

US online Grocery sales represented $28.6B in 2019. However, in spite of experiencing an annual growth of 20% for the past four years, online purchases only made up 2.3% of all grocery sales in 20191.

Now things are starting to change 😱.

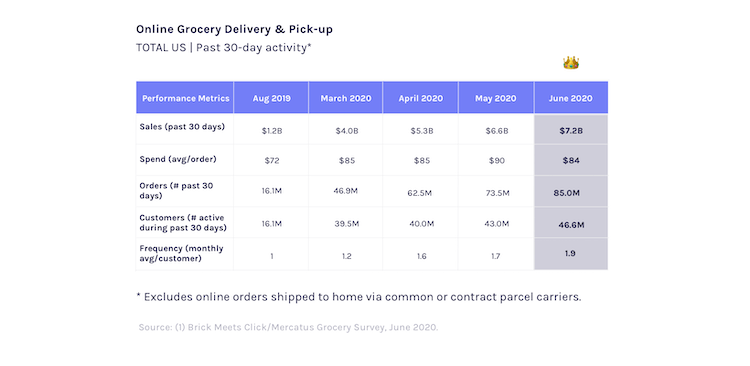

With consumers trying to limit social interaction and outings, shopping for groceries online is becoming the go-to solution for many Americans. In June 2020, a study revealed that 35% of US consumers use online grocery delivery services—that’s almost 3X more than in August 2019!2As a result, industry players in the Food and Grocery industries have been adapting to the situation in record time ⏱️.

Movers and shakers: hot partnerships in the grocery industry

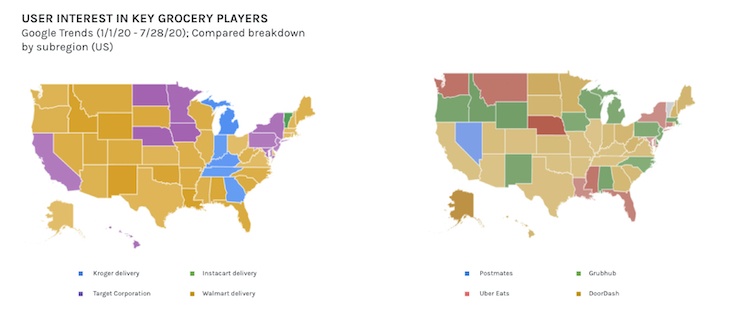

- Major retail corporations and convenience stores are partnering with Food apps to drive more reach and access mobile-first delivery solutions. For example, Walgreens has partnered with DoorDash, and Target is working together with Shipt, it’s mobile-first delivery service.

- Food apps are incorporating online Grocery Delivery. For example, Uber Eats recently integrated with Cornershop, an on-demand grocery delivery platform, to level up its Grocery Delivery solution across the Americas.

- Traditional grocery players are developing their own apps. Some supermarkets and stores have opted for developing and improving proprietary apps. Kroger launched a new app version that saw a 92% increase in digital sales, and Walmart combined its main app with its Walmart Grocery app for users to shop across departments.

Delivery services are adapting to users’ current needs

The adoption of home delivery & grocery pick-up skyrocketed, reaching 70% higher volumes than before the pandemic3.Taking into account users’ new needs, Grocery apps evolved to offer:

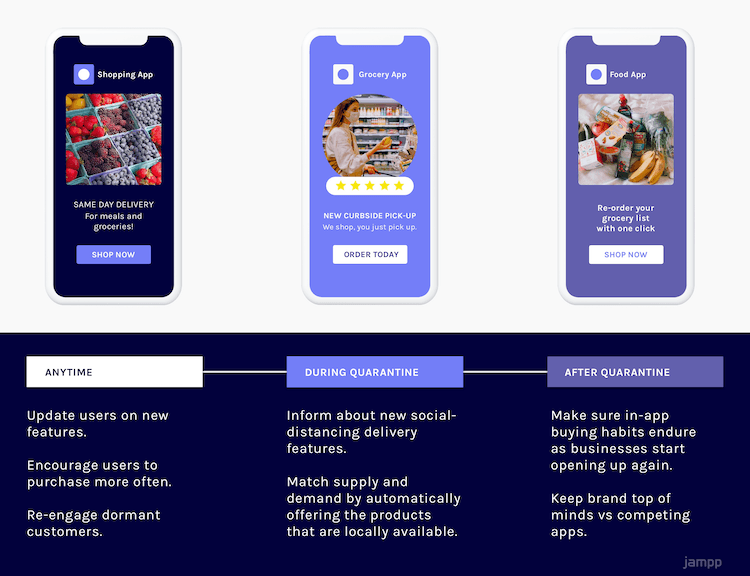

- New delivery options, including same-day, same-week, and scheduled delivery.

- Enhanced pick-up services, such as contactless in-store pick-up and curbside pick-up.

What’s the big opportunity?

In June 2020, online Grocery sales hit a record of $7.2B4. As shoppers are buying more and more often, this trend is not expected to slow down any time soon. In fact, US online grocery penetration is projected to grow from 34% in Q1 2020 to 55%-66% in 20245, bringing in more shoppers and sales.

What does this mean for app marketers?

Shoppers are becoming more familiar with Grocery delivery services, and this user behavior trend is expected to remain even after things go “back to normal”. Marketers in the Food and Grocery industries should be ready to outperform their competitors by building and maintaining a healthy-growing user base.

As a Grubhub’s shareholder letter put it last year: “Our newer diners are increasingly coming to us already having ordered on a competing online platform, and our existing diners are increasingly ordering from multiple platforms.” The same applies to in-app Grocery shopping; especially in the face of new partnerships. Users might have some preferences, but there’s no primordial go-to app for online grocery shopping.

To face high market competitiveness, any aggressive growth strategy must manage to match supply and demand, as well as contemplate App Retargeting from the beginning in order to stay top-of-mind for users.

AdTech is changing — it’s time to find out how

AI, privacy shifts, and new monetization models are transforming the app industry. Learn more about these changes and other app marketing insights in the AdTech Trends 2025 Playbook by Yango Ads.

[Download Playbook]Matching Supply & Demand 🤝

Partnerships play a key role in this, but marketing can help too. By running Geolocated Ads, marketers can easily offer local promotions and/or highlight the features available in each area. This way, they show ads only when there is enough demand, supply, and couriers, ensuring they can deliver a [great] experience for their customers.

Why App Retargeting is the right fit for Grocery Delivery apps

App Retargeting brings a variety of benefits for Grocery Delivery apps, for both quarantine and post-quarantine scenarios. Even in highly competitive verticals such as the Food industry, App Retargeting can reactivate dormant shoppers and turn users into frequent buyers, driving more sales, at a higher frequency.

While in quarantine 😷, marketers can leverage App Retargeting to inform users on new partnerships and delivery options, implement discounts that stimulate app usage, and to leverage in-app features that analyze an apps’ feed data in real-time to show ads only when products are in stock and within a specific delivery radius.

After quarantine, once industries return to their usual activities, marketers should focus on maintaining users’ new consumption habits to prevent churning or a drop in usage. In a highly competitive industry, marketers need to stay relevant among their user base at all times. After all, shoppers don’t use just one Grocery Delivery app, but a combination of the top players.

Wrapping Up

Grocery providers and Food apps in the US have evolved to meet the rise in demand for online Grocery Delivery, and these changes will shape the way people shop for groceries even once the quarantine is over.

Now is therefore the perfect time for Grocery marketers to adjust their in-app marketing efforts to this new version of online Grocery shopping, incorporating App Retargeting together with features such as Geolocated Ads.

Want to learn more?

If you’d like to learn more about how to grow your in-app Grocery Delivery service, contact us to schedule a demo.

References