The rise of OTT and CTV is something we’ve been talking about all year, and in 2022, this trend is poised for even more explosive growth.

Did You Know?

OTT stands for over the top, and is used to describe video that streams over the internet, instead of via satellite or coax cables. OTT encompasses CTV, too.

CTV, or connected TV, simply refers to any TV that can stream content via the internet, whether a Smart TV with built-in internet, or a connected device like a PlayStation or Roku.

What contributed to the rise of this channel, and why is it so critical for publishers and marketers?

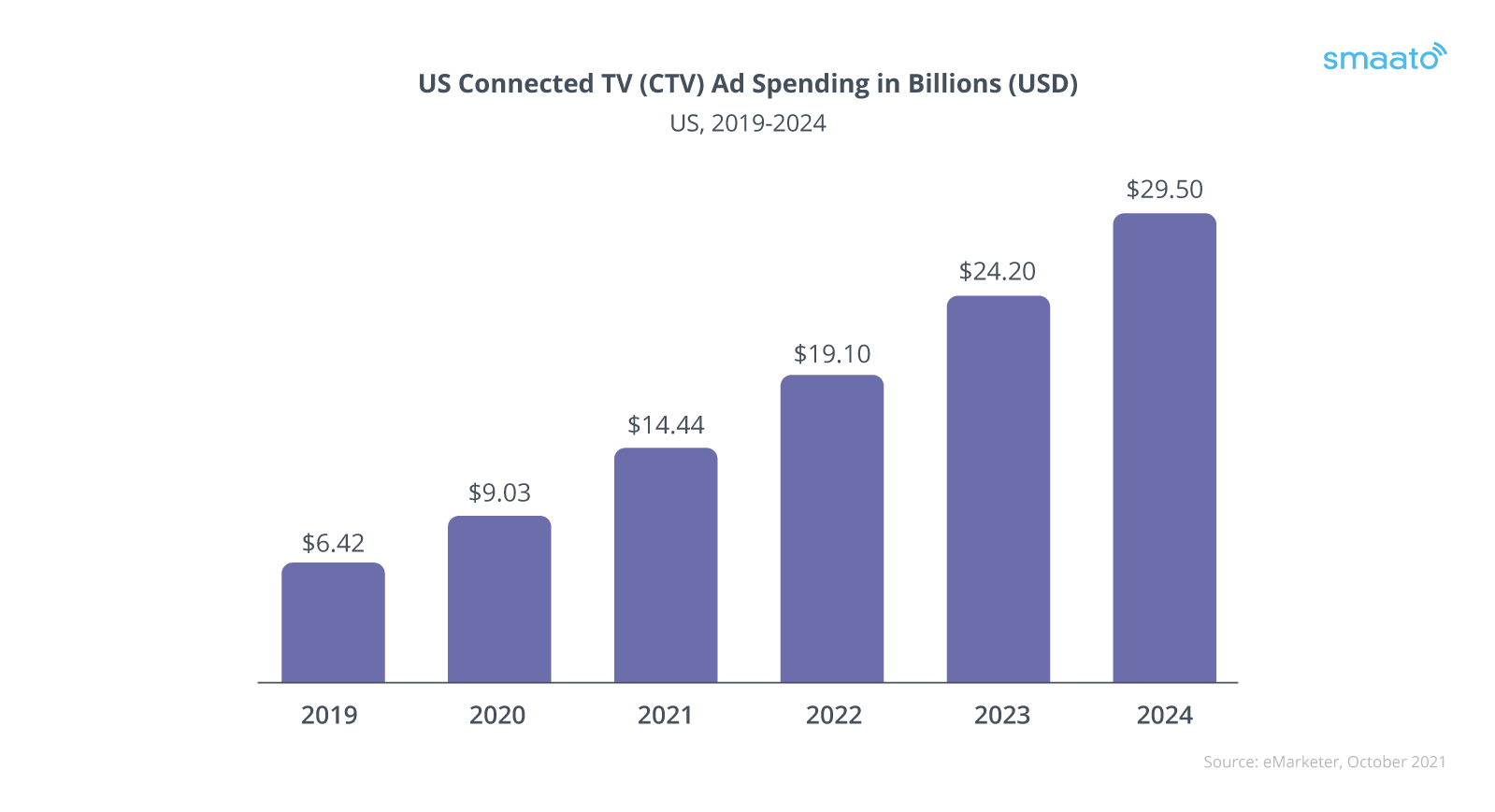

Over the years, there have been many innovations in how television and video content has been delivered to viewers around the world. From radio signal to satellite to cable, delivery mechanisms (and quality!) have been steadily evolving. Over-the-top, or OTT, is the latest innovation: delivering content via internet transmission rather than by cable or satellite. It’s the newest delivery mechanism, and it’s been steadily chipping away at Linear TV’s lead for years. In the US alone, CTV ad spend is projected to reach nearly 30 billion dollars by 2024. And by 2022, CTV ad spend will capture double its percent of total media ad spend from 2019.

US Connected TV (CTV) Ad Spending in Billions (USD)

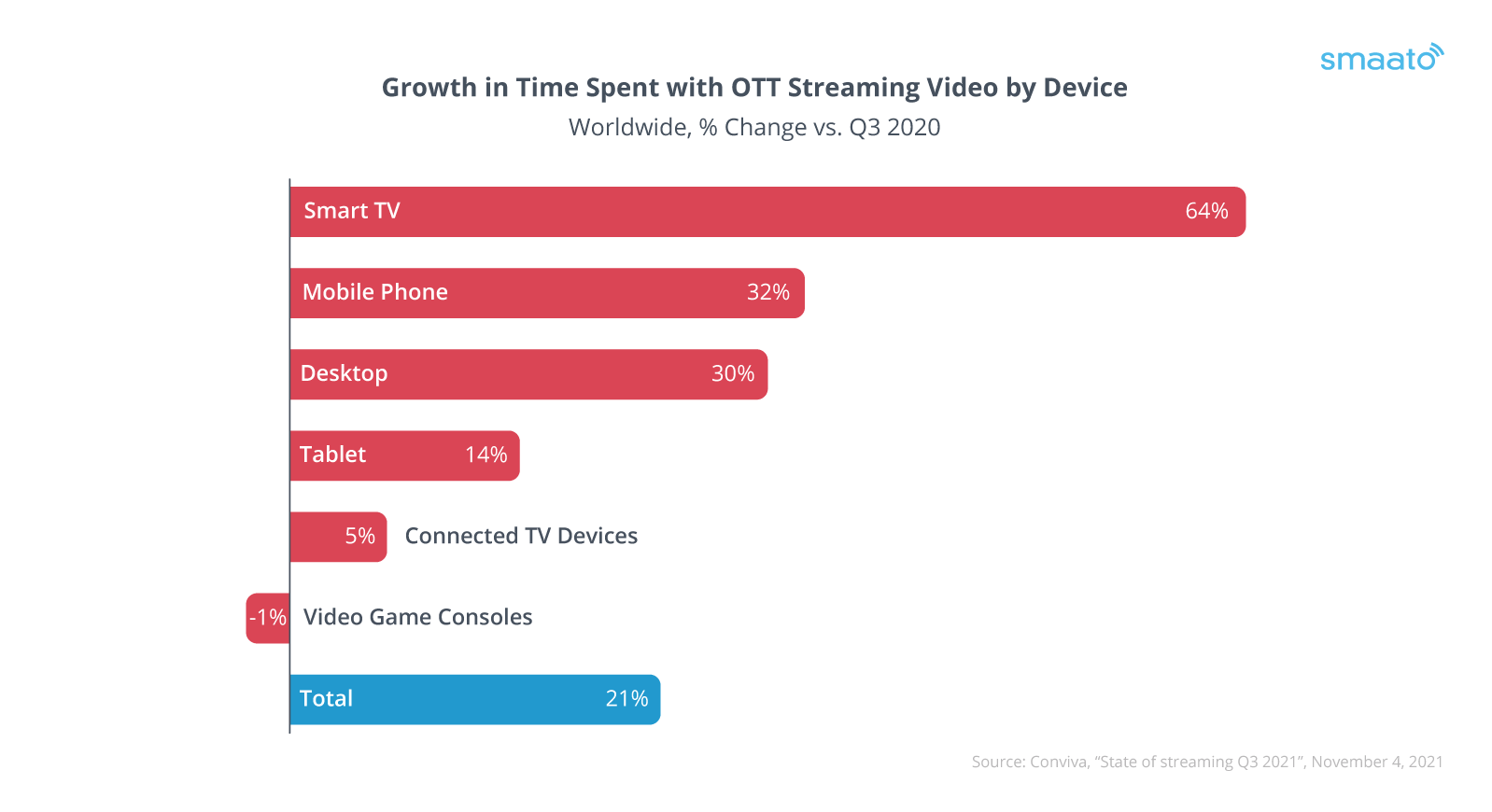

So what makes this trendy, exactly? The events of 2019 to now have greatly accelerated the reliance on OTT, while connected devices (basically, televisions that are internet-enabled, either directly like a Smart TV, or indirectly via a connected device like a Roku or gaming console) are becoming more attainable and more affordable. With limited in-person activities available, shutdowns, lockdowns, quarantines, and even sick days, digital video entertainment has helped fill a gap for people all over the world. Unsurprisingly, time spent streaming grew steadily YOY from 2020 to 2021.

Growth in Time Spent with OTT Streaming Video by Device

The explosion of content streaming platforms is another big contributor both to time spent with OTT and to OTT’s success. Why should viewers pay for cable when they’re already juggling subscriptions for some combination of Netflix, Hulu, Amazon Prime, Apple TV+, Disney Plus, HBO Max, Peacock, and more? Why not spend more time watching, when there is so much quality content to consume?

According to a recent report by Insider Intelligence, in many countries, the number of internet users streaming video now surpasses the number of viewers watching Broadcast live TV.

Did you know?

Roughly ⅔ of all Americans are CTV (connected TV) device users. Americans spend more than 80 minutes each day with subscription OTT content.

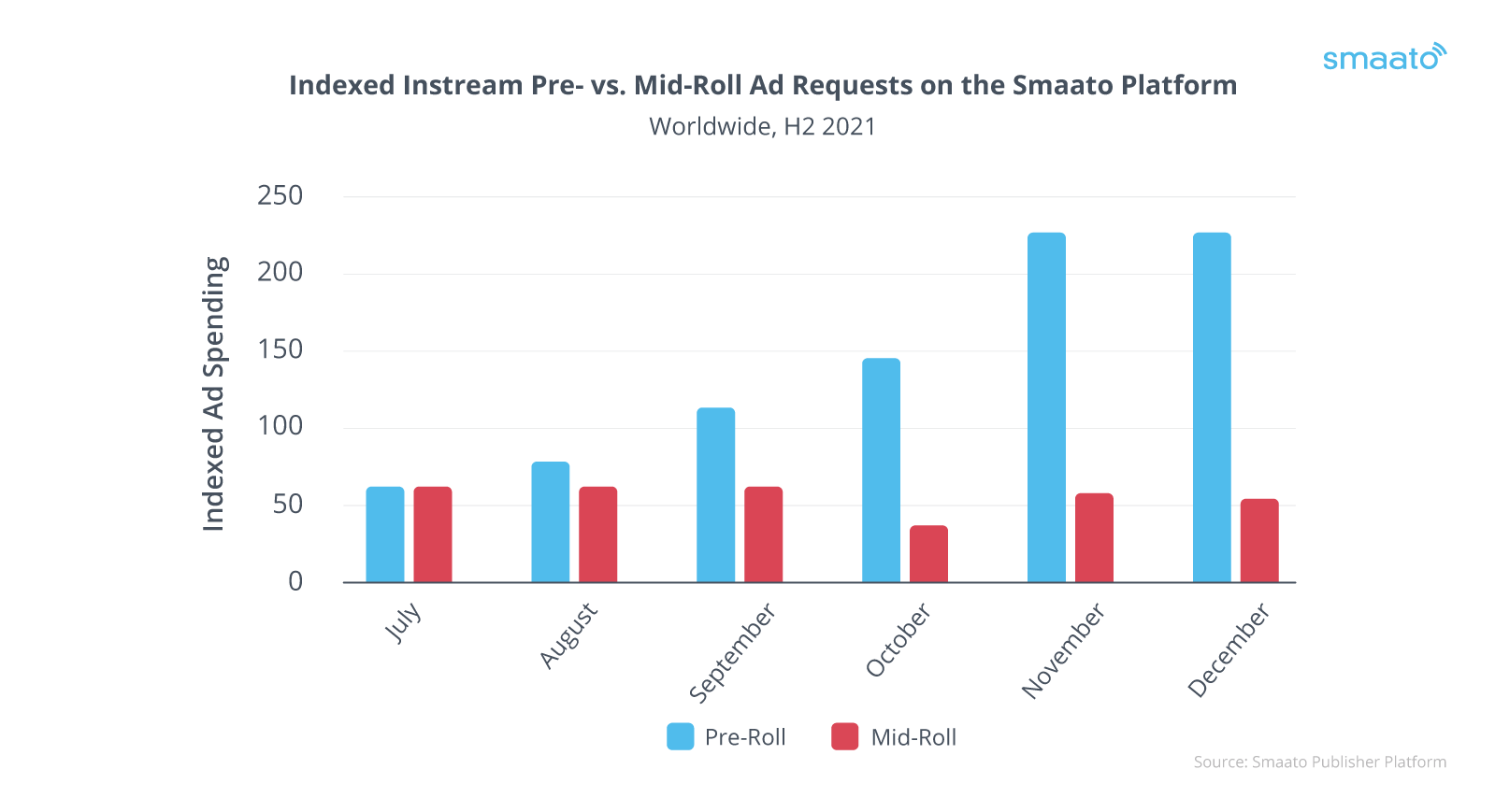

Early in 2021, we launched our robust OTT/CTV Advertising Platform at Smaato, and immediately our publishers and marketers began to see results. On the Smaato Platform, we see the majority of ad requests coming from pre-roll content. Pre-roll is a popular spot because, like splash ads, these advertisements reach viewers while they’re fresh, before they start watching.

Indexed Instream Pre- vs. Mid-roll Ad Requests on the Smaato Platform

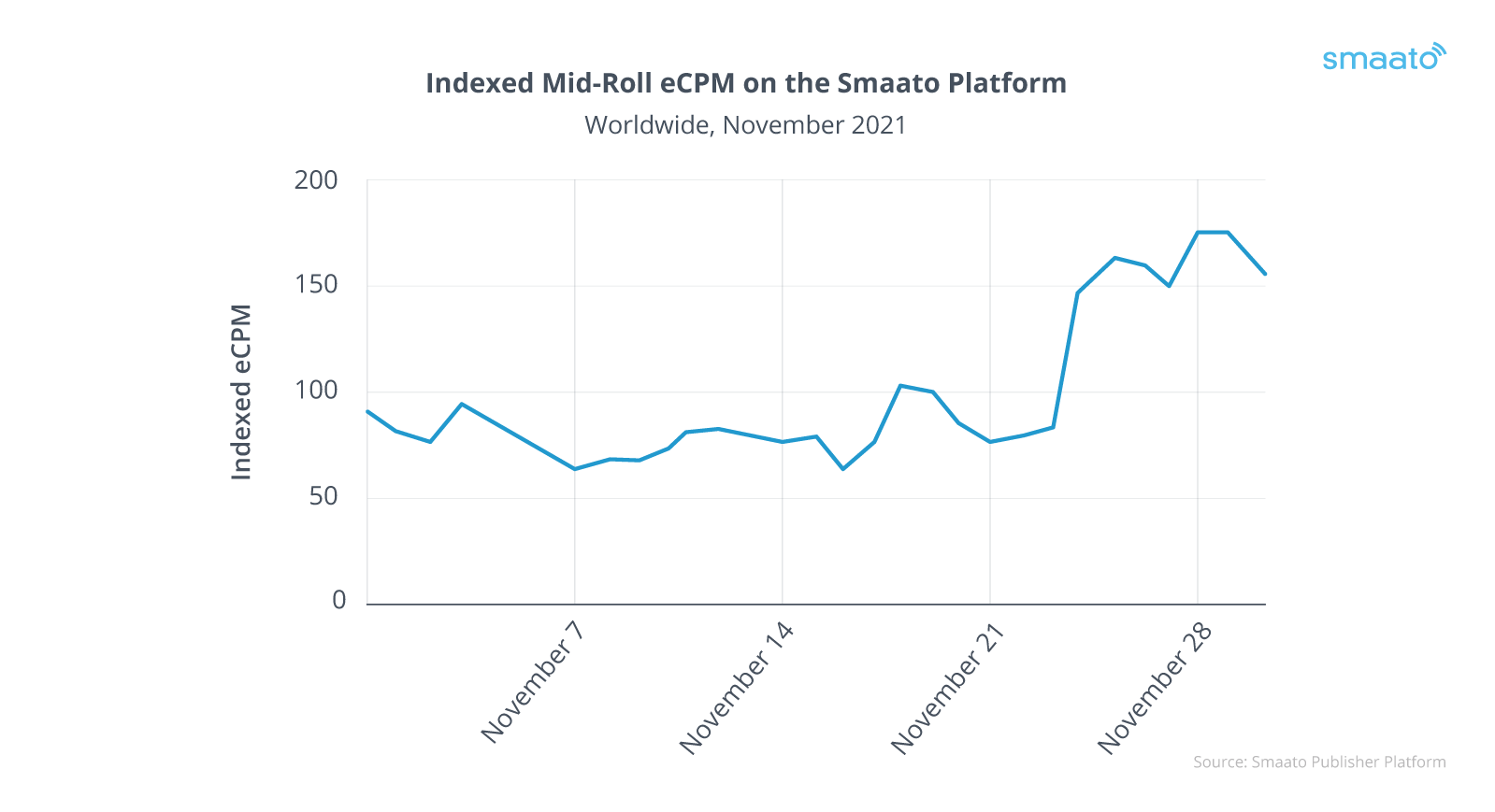

Mid-roll ad requests are lower than pre-roll, but still outpace post-roll placements. Of note, mid-roll performance enjoyed a big spike around Black Friday and Cyber Monday. This may be correlated to an increase in competition for ads to reach early holiday shoppers.

Indexed Mid-Roll eCPM on the Smaato Platform

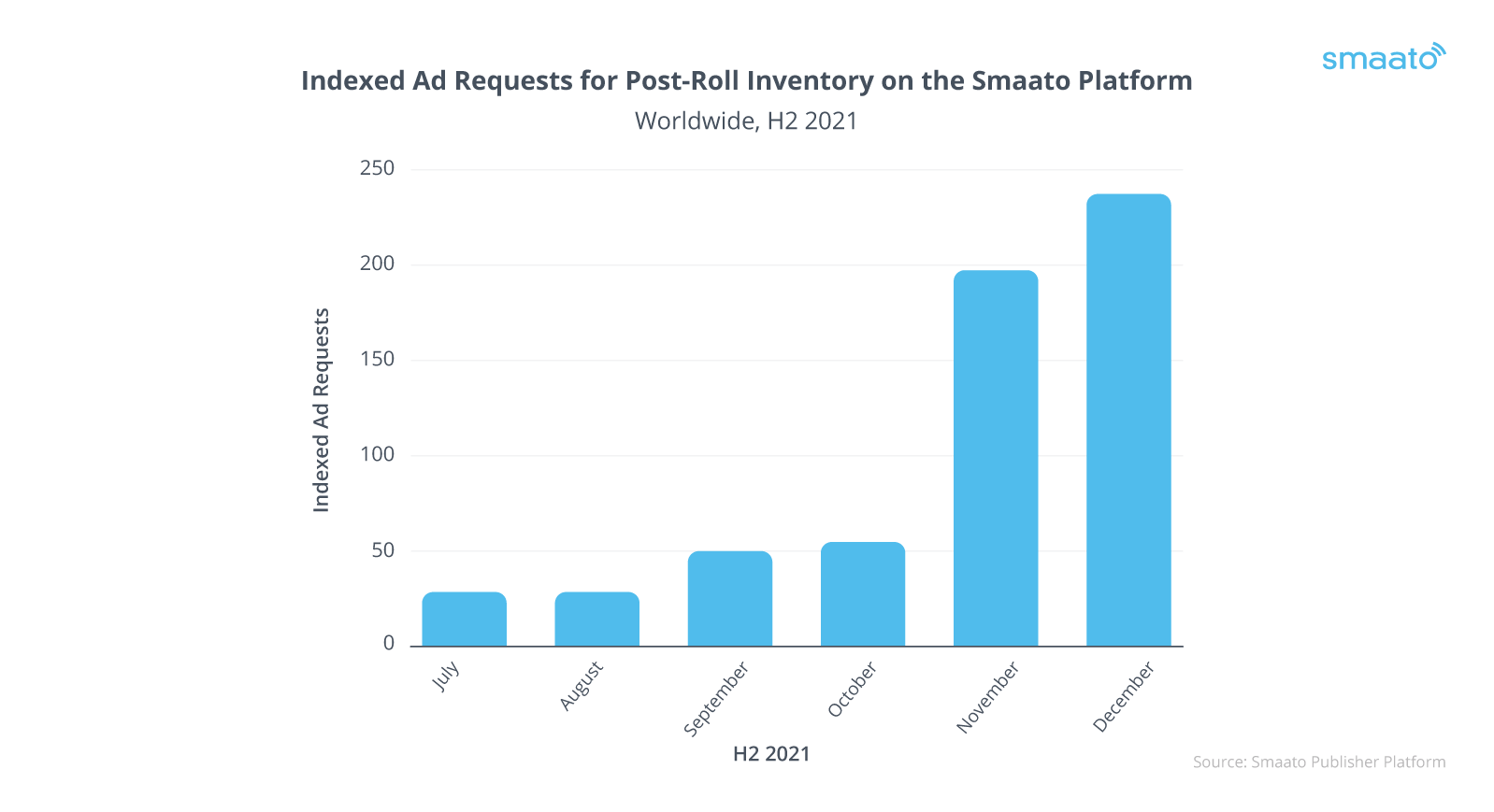

Post-roll requests are negligible compared to pre- and mid-roll ad requests, which may be attributed to a belief in viewer attention waning at the end of the program. Post-roll performance has, however, ramped up towards the end of 2021, and eCPMs, while lower than mid- and pre-roll eCPMs, are comparable.

Indexed Ad Requests for Post-Roll Inventory on the Smaato Platform

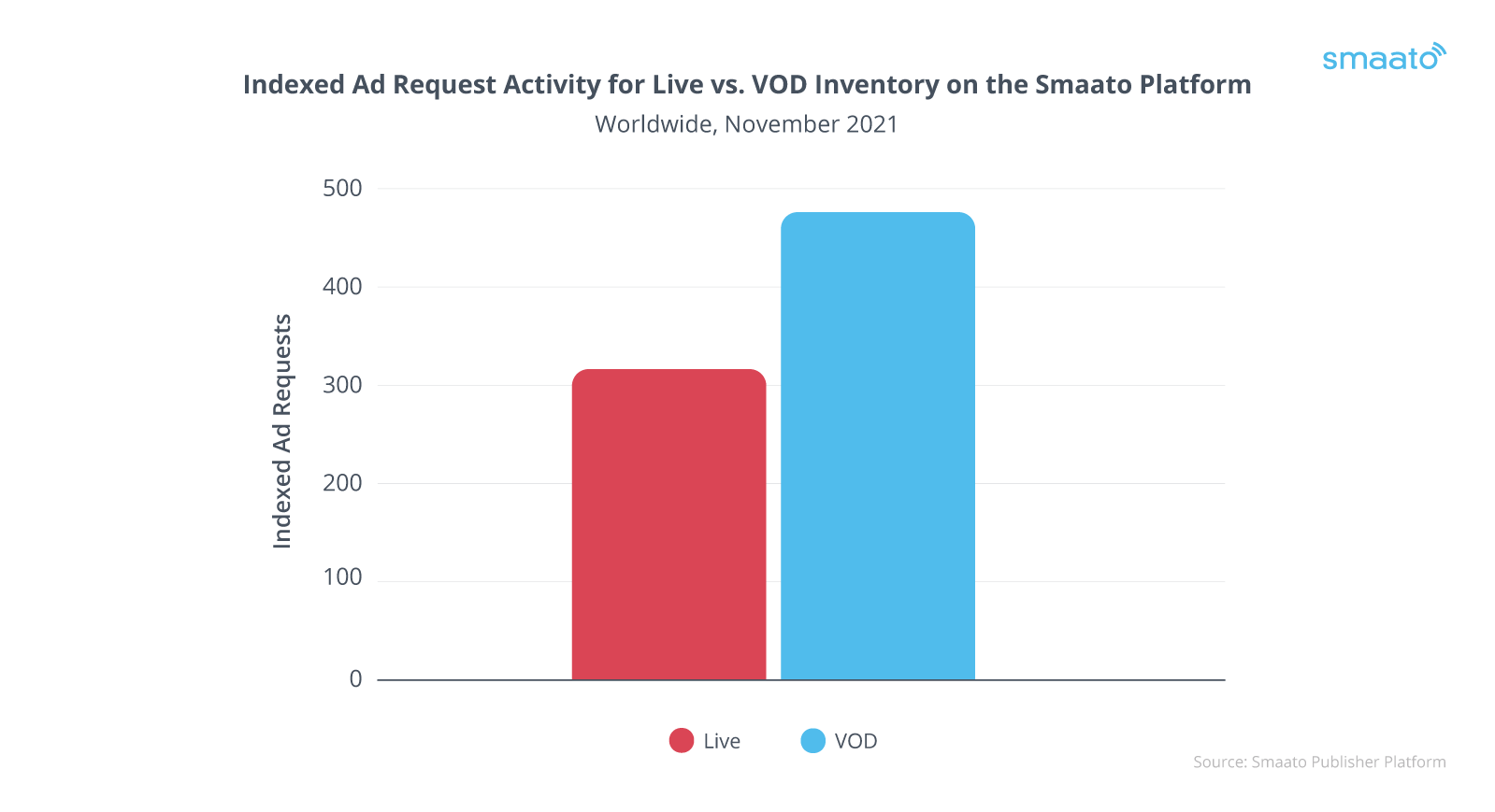

We also see stronger ad requests for VOD inventory vs. Live inventory on the Smaato platform, though we expect that as our OTT/CTV platform grows and additional publishers start monetizing this way, that Live requests will grow, too:

Indexed Ad Request Activity for Live vs. VOD Inventory on the Smaato Platform

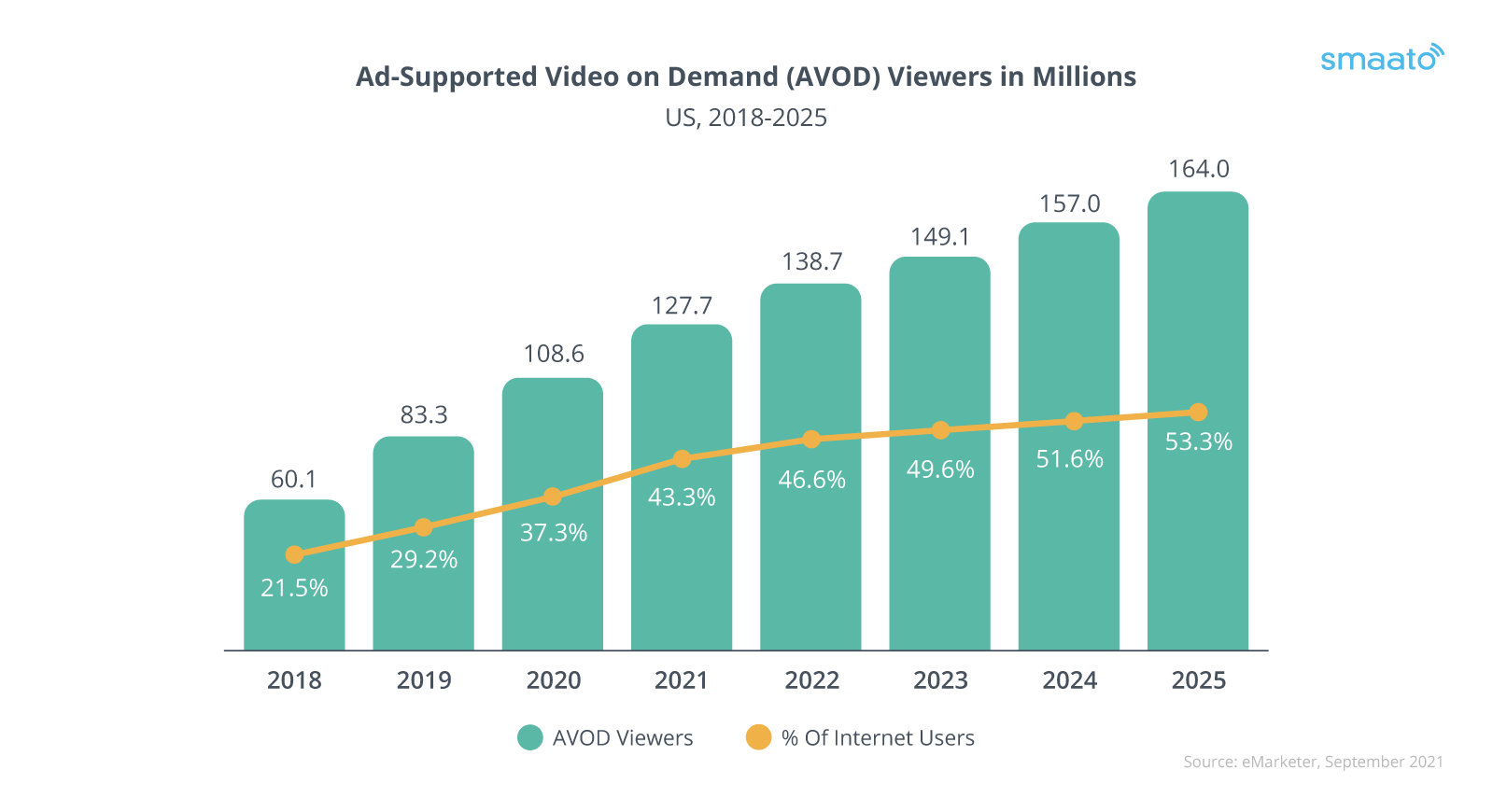

OTT and CTV are major frontiers for publishers and advertisers alike. Ad-Supported Video on Demand (AVOD) viewers are on the rise, and we expect the AVOD market to keep expanding as more major players launch their streaming services.

Ad-Supported Video on Demand (AVOD) Viewers in Millions

As the diversity of content choice continues to expand, viewers will favor ad-supported content over paid subscriptions, further bolstering its popularity and solidifying the AVOD’s future as a strong monetization opportunity for publishers, and necessary channel for marketers.

Challenges and opportunities with OTT and CTV advertising

Of course, OTT and CTV come with their fair share of challenges. Among them, getting stakeholders to invest in OTT/CTV monetization and advertising strategies, reaching the right audiences, and increased server-side ad insertion ad fraud. Luckily, there are ways to tackle each challenge to take full advantage of OTT and CTV opportunities.

Gaining organizational buy-in

As with any new format, getting buy-in can be a challenge. Internal knowledge gaps and new-format hesitancy can exacerbate this challenge. It may be easier said than done, but educating stakeholders on the benefits of OTT and CTV advertising is a great first step. Ad-supported OTT and CTV helps give content to viewers without subscription fees.

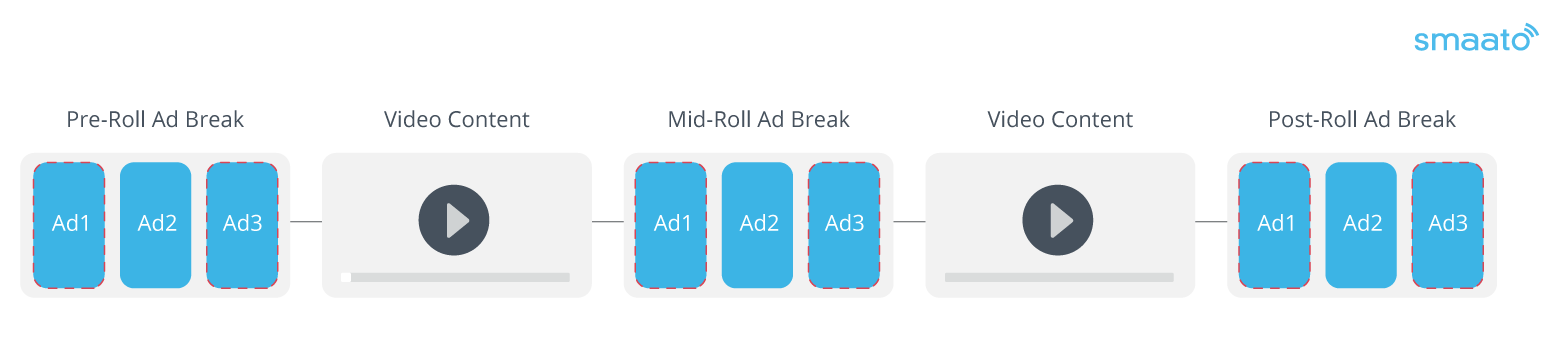

For publishers, this offers a scalable revenue opportunity by creating more advertising opportunities (including pre-, mid-, and post-roll ad breaks, or “pods,” with multiple ad slots per ad pod) that don’t cap out with a single monthly price.

For marketers, the evolution from linear to OTT/CTV may be a more natural progression, but concerns about ad fraud (more on that below) can make some advertisers and marketers wary. Luckily, selecting an OTT platform that includes in-house server-side ad insertion (SSAI) can eliminate this risk, making it easier to reassure stakeholders.

Eliminating server-side ad insertion (or dynamic ad insertion) fraud

One of the biggest challenges with OTT and CTV is that it is highly susceptible to ad fraud, which happens when publishers use a third party SSAI/DAI service that sits between the publisher and the ad server. Fraudsters trick ad servers into delivering real ads by pretending to stitch ads in on behalf of real, reputable publishers. When the bad actors receive the ads, they confirm that they were “viewed,” so they can pocket the marketer’s money without ever delivering the ad content to the end user.

We built our platform to eliminate this risk completely. All of our server-side ad insertion is completed in house. There is no opportunity for malicious activity. Plus, publishers don’t have to pay a third-party vendor. Viewers also get a better experience, since we’re able to deliver ads with less latency.

Reaching the Right Audience

Evolving privacy laws are changing how marketers and advertisers traditionally targeted users based on personal identifiers. OTT and CTV inventory offers a unique opportunity to reach audiences based on context clues that can deliver positive user experiences without compromising viewer privacy.

For example, SSAI makes it easy to match publisher content with advertising messages. Since ads are stitched into predetermined content, relevant ads can be paired with the publisher’s content. At Smaato, we also recommend that marketers and advertisers check out a bid request’s content object. Our publishers specify things like title, content ID, genre, rating, category, and more. Equipped with this information, demand partners can make more informed bids, and better deliver contextually-relevant ads to engaged viewers. There’s other information that can help, too: for example, if a viewer is streaming their show on an Xbox, chances are that ads that resonate with gamers will resonate with them, too.

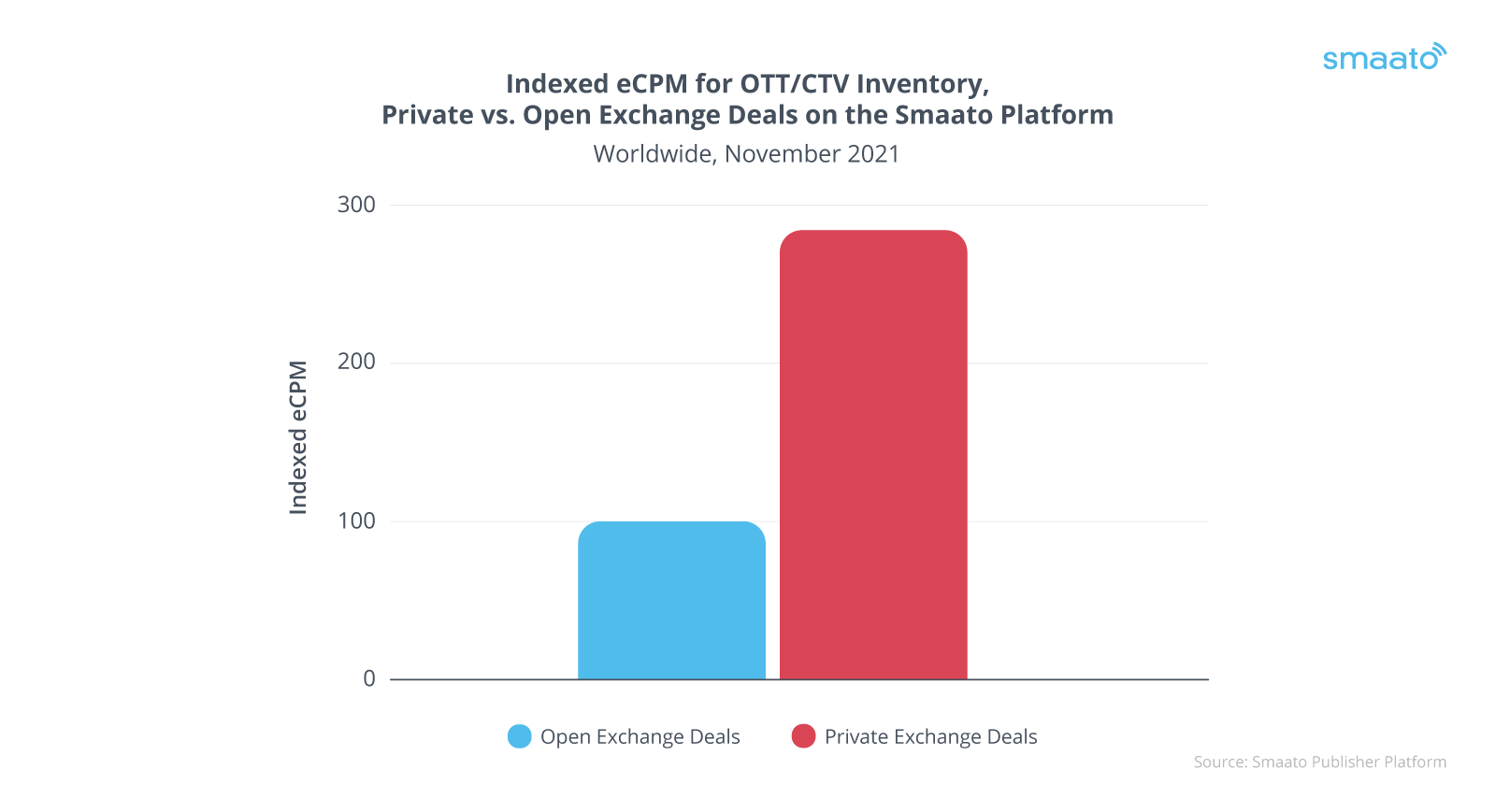

Finally, private exchange deals (deals in which one publisher invites a select group of marketers to participate in a private auction) also help deliver contextually relevant advertisements without overstepping viewer privacy. We’ll dive into more details on the benefits of private exchange later on. As a result, private exchange deals can command more of a premium, which boosts publisher performance, and which advertisers are more than willing to pay.

On the Smaato platform, we see eCPMs for private exchange deals that are more than double those of open exchange deals when it comes to OTT/CTV inventory:

Indexed eCPM for OTT/CTV Inventory, Private vs. Open Exchange Deals on the Smaato Platform

Making the most of ad breaks

One of the features we’re most excited about with Smaato’s OTT and CTV Advertising Platform is Ad Podding.

Ad Podding

Source: Smaato

Ad Pods essentially recreate a traditional commercial break using VAST video ads. In a given pod, each ad is referred to as a “slot.” There are many key advantages to ad podding. For publishers, the main advantage is that it offers unprecedented control over their inventory, and allows publishers to better monetize their ad breaks. For marketers, ad podding comes with additional contextual targeting opportunities, while also offering greater opportunities to appear in a given ad break.

Did you know?

Creative Deduplication: No identical ads will run in the same pod.

Competitor Separation: No two ads from the same IAB category will run in the same pod.

Smaato offers both to ensure ad breaks are as effective as possible.

Of course, not all slots are considered equal. Our platform allows publishers to determine individual floor prices for each slot and pod. Publishers also get complete control over where the ad breaks fall for video on demand (VOD) content. They can select percentage completion or customized intervals, or even specific time stamps to ensure a seamless transition between cinematic moments and ad breaks.

A key challenge with ad podding is that some platforms are not able to monetize multiple slots per pod, meaning that each ad pod could only have a single ad. Other platforms may have trouble accurately splicing pods for bidding, making it more difficult to map where each slot should go in a final pod to best maximize revenue.

But what about bidding? How can marketers and advertisers bid: by slot, or by pod?

Per-slot bidding is more common in the industry. In this instance, marketers bid on the individual commercial spot level. This can maximize ad revenue for publishers for each commercial in a given ad pod. Some will be higher than others, and some slots may not fill at all.

There is another option, though it is harder to find. Per-pod bidding is a way to maximize ad performance revenue for an entire commercial break. Demand partners compete to buy impressions as a pod in addition to individual impressions. Publishers can send a bid request with multiple impression opportunities for each pod in a given viewing session.

Why could this be better? It’s simple. Per-pod bidding takes revenue per minute into consideration.

For example, in an ad pod with four slots, per-slot bidding would involve sending four separate requests to DSPs and marketers. With per-pod bidding, publishers can bundle all four slots into a single request, giving marketers an opportunity to bid on some or all of them. This helps reduce Queries per Second (QSP), which in turn reduces costs. This makes programmatic bidding more efficient and cost effective.

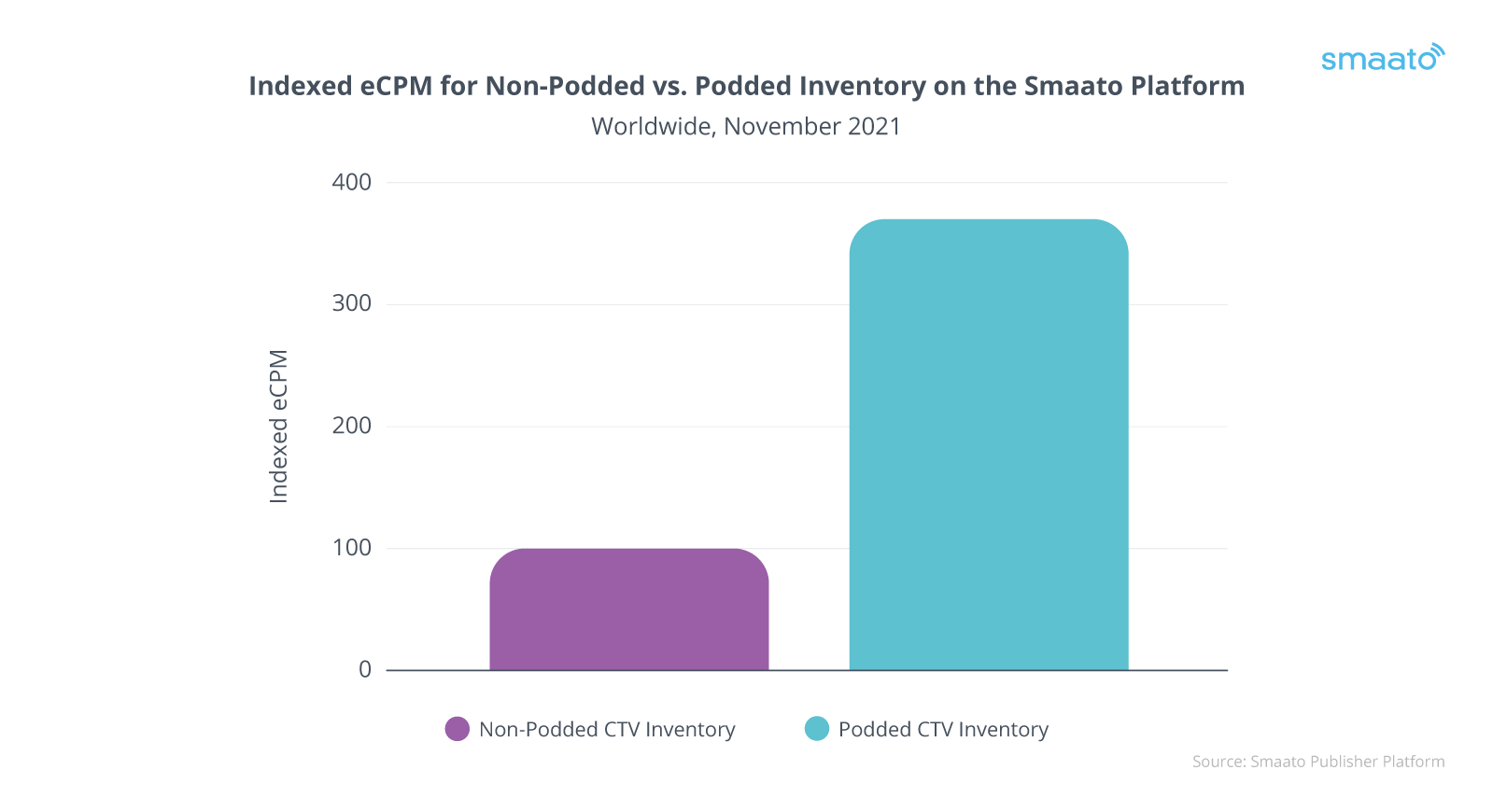

We offer both per-slot and per-pod bidding on the Smaato platform, and so far have seen that per-pod bidding helps generate higher revenue for publishers.

In November, for example, eCPMs for podded inventory were more than triple those of non-podded inventory:

Indexed eCPM for Non-Podded vs. Podded Inventory on the Smaato Platform

Conclusion

The OTT opportunity continues to grow for publishers and marketers alike. As the landscape shifts to a cord-free world, we are excited to support our partners in delivering relevant, positive viewer experiences to audiences around the world. Ready to learn more about all things OTT and CTV? This article is an excerpt from our 2022 Global Digital Advertising Trends report. To learn more about the growing OTT/CTV trend, and many others, check it out.

To learn more about the many benefits of OTT and CTV advertising, check out our complimentary OTT/CTV Advertising eBook.