Netflix has been Apple’s favorite for years and has made good money off of this relationship. However, since the beginning of this year, Netflix lost its place in the App Store’s list of featured apps and rank in their Top Grossing list as well. Apple didn’t fare well either, losing millions of dollars in commissions. Who won the battle? Let’s sort it out below.

This article was originally published on AppFollow’s blog.

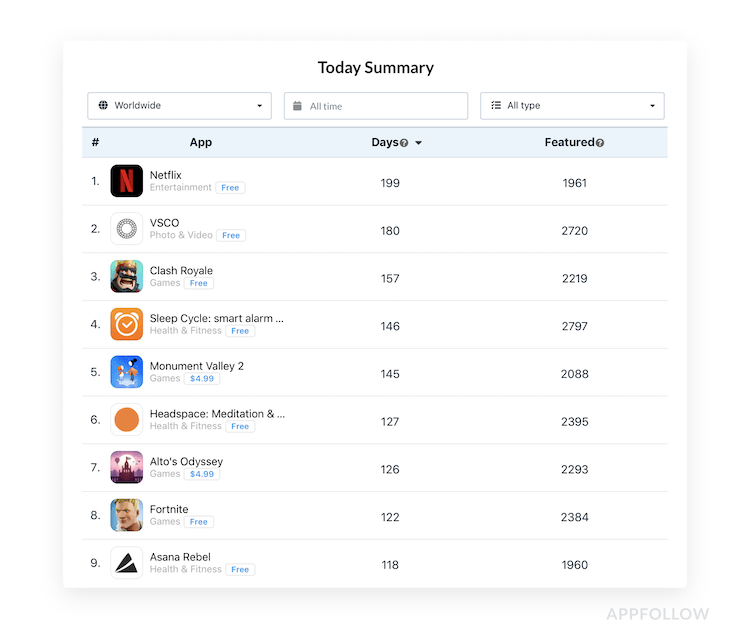

The most mentioned app in the App Store

Apple has been singling out Netflix since the list of featured apps first appeared in iOS 11. As everyone knows, Apple editors are picky about who to feature. But with the ability to receive 30% commission from a popular app, why not make it even more popular? As a result: in 2018, the Netflix iOS app appeared 99 days out of 365 in collections from different countries for a total of 1961 times.

By the end of 2018, Netflix became the most mentioned app in the App Store. (Source)

According to the stats, being featured helped Netflix earn $1.5B in 2018, and Apple received a justified third of these earnings as commission.

Everything changed in January of this year. Netflix decided to save on Apple’s commission and began to transfer new users to subscriptions fees on the web instead of in-app purchases. According to our calculations, this change in Netflix’s strategy has caused Apple to lose at least $ 3.7–5.5M for Q1 2019. For all of 2019, these losses could reach $ 44–67M.

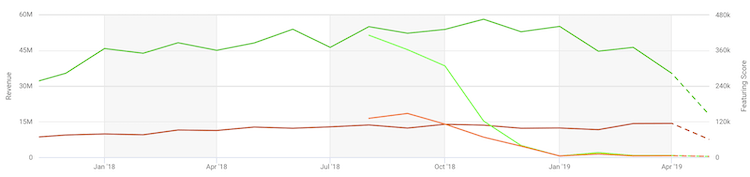

No longer listed in the featuring list (since February 24th), Netflix’s revenues have decreased. (Source)

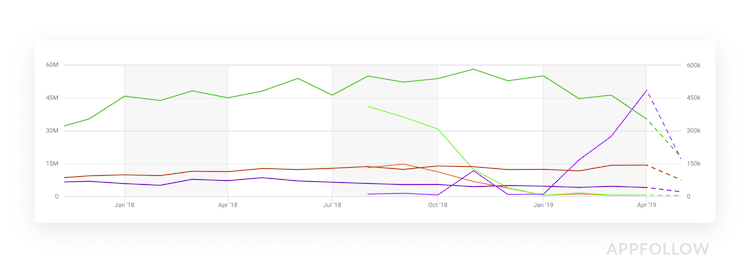

The number of mentions of Netflix in the iPhone featuring (depicted in the chart in light green) drops sharply in the autumn. Revenues (depicted in green) have fallen gradually since the beginning of 2019, in-app purchases were redirected to subscription fees on the web.

Then, on March 25th, Tim Cook announced Apple TV Plus, which is supported by HBO, Showtime, and others, but notably not by Netflix. A month later, Netflix removed support for the popular app, AirPlay. They cited Apple support for new devices (Samsung, LG, and Sony will start working with AirPlay in 2019) as the cause.

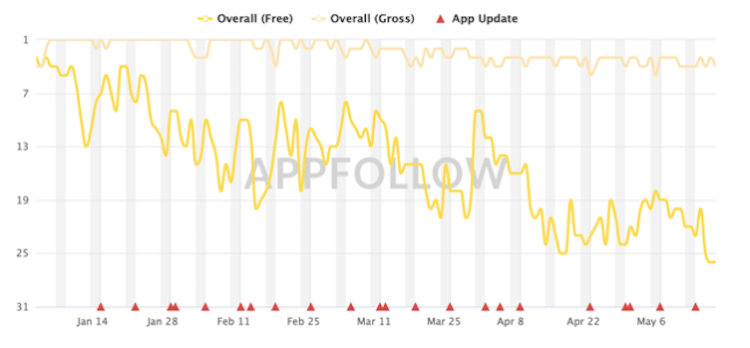

Even though, Netflix still ranks #1 in the Entertainment category, without regular mentions in Featuring, the app has lost its position in both Top Grossing and Free. Netflix revenues (depicted here in yellow) fell shortly after the official announcement of the new streaming service from Apple. (Source)

Maximize App Growth with #1 App Store Optimization Company

Expand app store reach, increase downloads, boost engagement, lower acquisition costs & achieve higher user LTV with our leading ASO services & technology

Contact Us TodayDid Netflix benefit from this battle with Apple?

Spoiler: yes.

One of the indicators of a company’s success is an assessment of its share value. In January 2019, the first month after canceling payments through the App Store, Netflix shares on the New York NASDAQ rose 22% from $276 to $337.

Does this mean investors saw greater value in Netflix?

There are 2 important points here:

- These values are less than the historical maximum in July 2018, when the price reached $418. Therefore, this is not about continuing growth, but the fluctuation of the stock price within the local interval.

- In December, the fall of the stock price (which continued from a peak in July) stopped. It’s quite possible that this news indicated improvement for Netflix’s investors. But, more likely, news about the company’s Q4 financial results and Q1 2019 plans played a greater role.

Now on to Netflix’s reports on Q1 2019 results:

According to Netflix reporting, the company earned about $4.5B in Q1 2019, 22% more than in Q1 2018. This is less than the growth for Q4 2018, which was 27%. The growth rate fell by 5 percentage points for the quarter. Could this be at least partly caused by the conflict with Apple? Let’s puzzle it out.

At the beginning of 2018, quarterly growth was at 40% and then slowed down to 27%, (that is, about a third). It is more logical to attribute this slowdown to the saturation of the market and the exhaustion of light growth opportunities. Fortunately for us, Netflix provides an opportunity to look deeper at the statistics of the number of paid subscribers in its reporting, including a breakdown of the US / the rest of the world. And here is where the fun begins.

In the local market in 2018, the number of Netflix paid subscribers increased by 10.7%, from $53 to $58.5 million; and for the 1st quarter of 2019 another 3% increase to $ 60.2M, which in annual terms is 12%. Compared with 2018, the growth of the 1st quarter of 2019 was higher! And what about the average bill? Did Netflix lower prices to remain competitive without the support of Apple?

But even by the most modest estimates, the average bill rose by at least 10 cents to $11.5 (Netflix has not yet disclosed the exact data, but the numbers are expected to be higher). According to the tariff, this average bill means that the average paid subscriber in the USA watches video on 4 screens at the same time, which is suitable for the average family. With a population of approximately 330M and about 128M households, we can estimate that half of the American households use Netflix.

Of course, the other half remains for an opportunity for growth, but, most likely, the easiest opportunities for growth have already been exhausted.

Looking at not only the continuation of growth but also its acceleration in Q1 2019 it’s clear that the conflict didn’t have much impact on Netflix’s performance.

In the 2018 international market, paid subscriptions increased by 40%, from ~ $58 M to $81M, and in Q1 2019 to $88.6M, which is + 10% for the quarter and + 40% in annual terms! The average bill is also at the same level.

If the revenue growth forecast for Q2’19 comes true (4% more than growth in Q1’19), we can assume that for the service as a whole, growth will continue at just as fast pace as before.

What about Google Play?

While Apple and Netflix tried to sort this out, the latter became a frequent guest in the Google Play collections: the number of mentions has increased 10 times since January 2019. However, it does not affect Netflix’s revenue.

The number of mentions of Netflix (shown here in purple) has increased dramatically since January 2019. (Source)

Read more research like this on AppFollow’s blog.