As the first weeks of quarantine in Europe and social-distancing around the globe have passed, we take a look at the reactions of the AdTech industry and the impact on mobile advertising of COVID-19 that we at PubNative have been experiencing. We present to you our findings on the development of the mobile economy during the past five months.

This article was first published on Pubnative blog.

Our main takeaway from looking at the ad spend and impressions tracked in our ad exchange is that the wave of behavioral change during different phases of COVID-19 is also visible in ad spend based on the different app categories and countries. Let’s take a look at the data in-depth.

The development of ad spend since November 2019 at PubNative

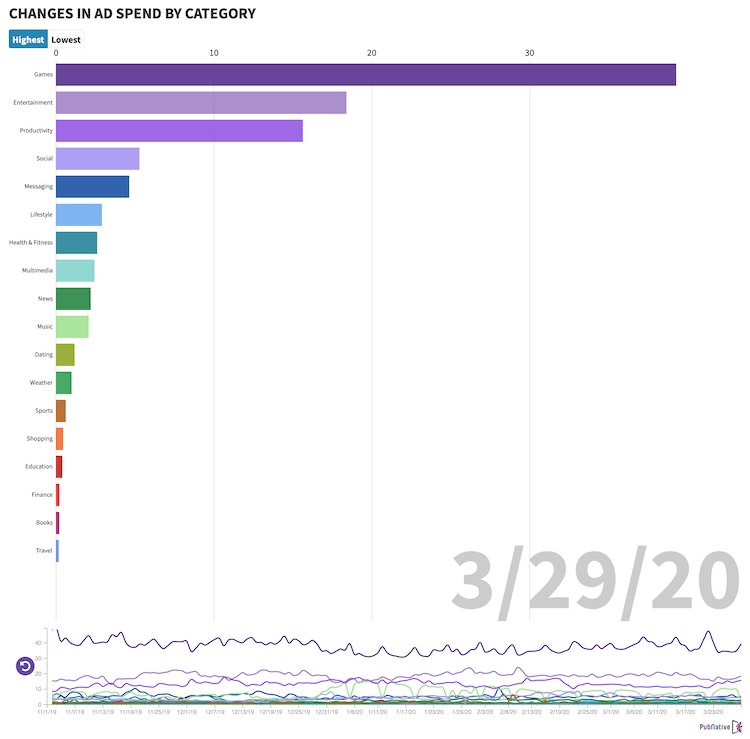

There has been a notable development in ad spend per app category since November of last year.

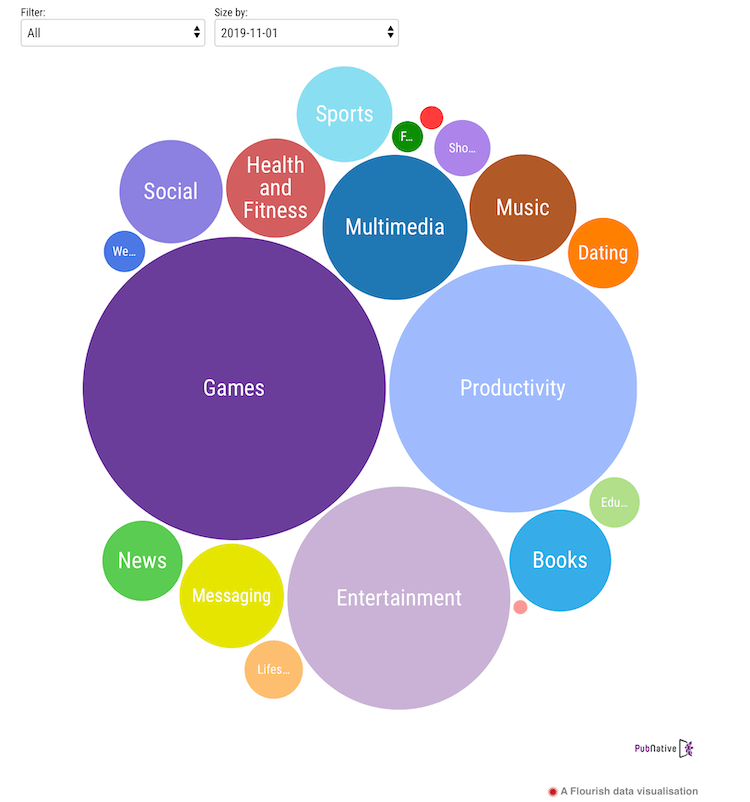

If you look at the animated distribution of ad spend per app category, you will see that overall, the Games category remains dominant in the market from Q4 2019 to Q1 2020. However, over time, the Productivity and Entertainment categories were closing in, continuously switching places on ranks 2 and 3.

Growing app Categories

High growth during the past few weeks can be witnessed in the categories of Lifestyle and Health & Fitness. Overall, ad spend also increased in the News, Multimedia and Music categories. Social and Messaging started to compete on ranks 5 and 6 beginning in the middle of January 2020.

Declining app categories

The biggest losses can be seen in the Travel, Books, and Finance categories. At the end of January, the Dating category dropped to the bottom of the list but made a recent recovery.

Changes in ad spend over time by app category & country

Exploring categories by country

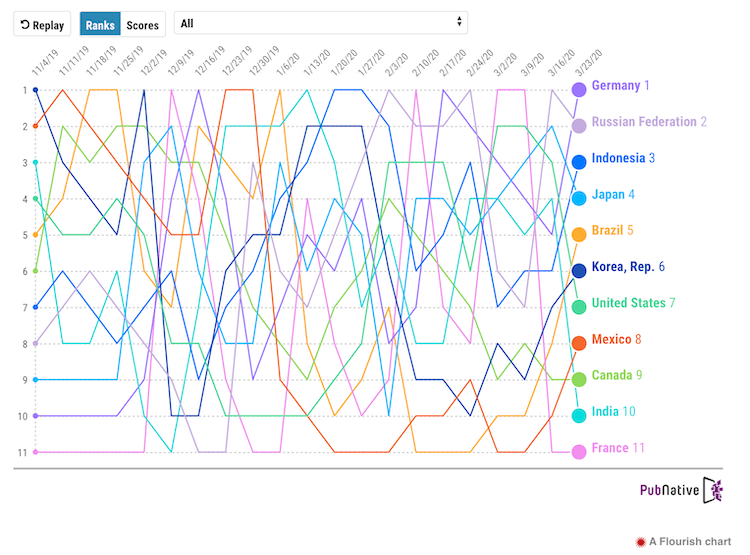

Looking at categories by country, you will notice that with the outbreak of COVID-19 in Asia in December and January, Productivity apps ranked first. In Korea, Productivity apps have been replaced by Lifestyle and Health & Fitness categories in March. In Japan, Games outran productivity apps in February.

In Europe, Games remained one of the strongest categories throughout almost two quarters. Only in France, Productivity apps outranked Games while COVID-19 cases rose in February. However, in March, the dominant categories once again were Games and Entertainment.

In Germany, Entertainment apps rose to and remained on rank 2 throughout January while Productivity stayed put on rank 3. In France, News and Shopping apps ranked high over the past few months, while Books dropped down to the last ranks. The biggest losses in Germany were attributed to Weather apps.

One of the noteworthy changes in categories is the emergence of the Gambling category in France in March.

In North and South America, News apps became more important in the past two months. The gaming segment still remains steady on top of the table, closely followed by Entertainment.

Changes in ad spend over time by country

When you look at the distribution of ad spend per country over time, you will notice a peak in spending in France around March 2nd, closely followed by a drop in ad spend as of March 16th, when the country went on a nationwide lockdown.

In comparison, Germany’s overall ad spend is increasing again since public restrictions have been put into place on March 16th.

In Korea and Japan, ad spend has remained at the same level throughout the past three months with even a slight increase over the past few months.

Market expectations from the buy side

According to the IAB’s report on Coronavirus ad spend impact, even though a quarter of all buy-side decision-makers are cutting all ad spend for Q1 and Q2 and almost 50% of all respondents are adjusting their budgets, less negative impact on digital spend is expected than on traditional spend for the first half of 2020.

Even though we see a decline in ad spend in Q1, the IAB sees a shift towards more mission-based and cause-related marketing. Also, the respondents expect that spending will take off again in May or June.

When it comes to programmatic advertising, the respondents of IAB’s impact report disclosed that 29% of companies plan on increasing their programmatic spendings, while only 18% plan on decreasing their budget, with 52% of programmatic budget remaining without a change.

All of the insights visualized are based on data from PubNative. We hope that these insights have given you an overview of the recent industry developments.

If you have any further questions, get in touch.