Your churn rate is the percentage of customers which stop doing business with your company in a given period. If you don’t know how to calculate churn rate, you’ll never know exactly how many customers you’re losing on a monthly or yearly basis.

This makes it harder to understand the revenue impact of lost customers. Plus, you’ll struggle to identify exactly why customers end their relationship with you, and what steps you should put in place to retain them.

Not sure how to calculate the churn rate (or not sure why you should?). Read on to learn the formula for churn rate, how to apply it to your business initiatives, and how you can use churn rate to your advantage.

What is the customer churn rate?

Customer churn rate, also known as customer attrition rate, refers to the percentage of customers who stop making purchases from your company within a given period. If you use a subscription-based model, for example, customer churn rate is the percentage of subscribers who discontinue their subscription within a specific period.

Free to use image sourced from Pixabay

While there are lots of different types of churn, let’s take a quick look at the four main types.

1. Voluntary churn

Voluntary churn occurs when a customer makes an active, conscious decision to stop using your app or product. Common reasons for voluntary churn include things like:

- The customer no longer has the financial means to continue their subscription.

- The customer is dissatisfied with your app or product.

- A competitor lured them in with a more attractive offer.

- Your product or app no longer meets their needs or desires.

Unless a customer directly complains, you’ll need to do some thorough investigation to figure out the reason behind their decision to leave. Conducting customer satisfaction and NPS surveys at the point of cancellation can bring light to flaws in your app, product, or overall customer experience.

2. Involuntary churn

Involuntary churn occurs when a customer leaves your company due to technical or admin issues. Most involuntary churn happens at the point of transaction due to for reasons such as:

- Out-of-date billing and payment details (e.g. expired bank cards).

- Insufficient funds in the customer’s account.

- Suspected fraud.

- Accidental cancellations or failed renewals.

Free to use image sourced from Unsplash

To avoid involuntary churn, consider using automated recurring billing solutions that warn customers about expired cards and remind them of upcoming payments and subscription renewals. Refine your contact management strategy so that all of your contacts are organized and up-to-date, which reduces reducing the risk of error.

🕒 Mobile Speed Matters: Stop Losing Customers 📉

Discover mobile benchmarks, top conversion killers, and expert fixes. Learn how to keep users engaged and drive revenue on mobile!

Download now3. Revenue churn

Revenue churn is concerned with the revenue lost from customers who stop using your products. Along with the revenue lost from canceled subscriptions, it takes into account the financial impact of downgraded subscription tiers.

When a customer downgrades from a high-cost tier plan to a cheaper alternative, it has a direct impact on bottom-line revenue. Understanding why the customer decided to downgrade can tell you a lot about the value of your offering. For example, a surge in downgrades suggests that your premium price packages aren’t delivering enough value to justify the increased cost.

Without a subscription revenue optimization strategy, even upgrades can result in revenue churn. For example, it might cost more resources to support premium users — and that creates , creating revenue loss.

4. Reactive churn

Reactive churn is the one type of churn in which the customer’s decision to leave is exclusively triggered by a failure made by your company. It typically occurs due to negative customer experiences, such as:

- Lengthy customer service wait times.

- Inadequate issue resolution.

- A lack of personalization at touchpoints in the customer journey.

- Poor omnichannel experiences.

- Unaddressed feedback or complaints.

Of all the different churn types, reactive churn is the most likely to result in consistently high churn rates and long-term damage to your reputation and revenue.

Improving the customer experience — particularly at customer service touchpoints — increases customer satisfaction and reduces reactive churn. Implementing a VoIP phone service can improve customer service experiences by providing you with remote flexibility and as well as advanced features like call routing and integrations.

What is a “normal” customer churn rate?

A churn rate of 0% is every business owner’s dream — but it’s a pretty unachievable goal. So, what is a realistic churn rate?

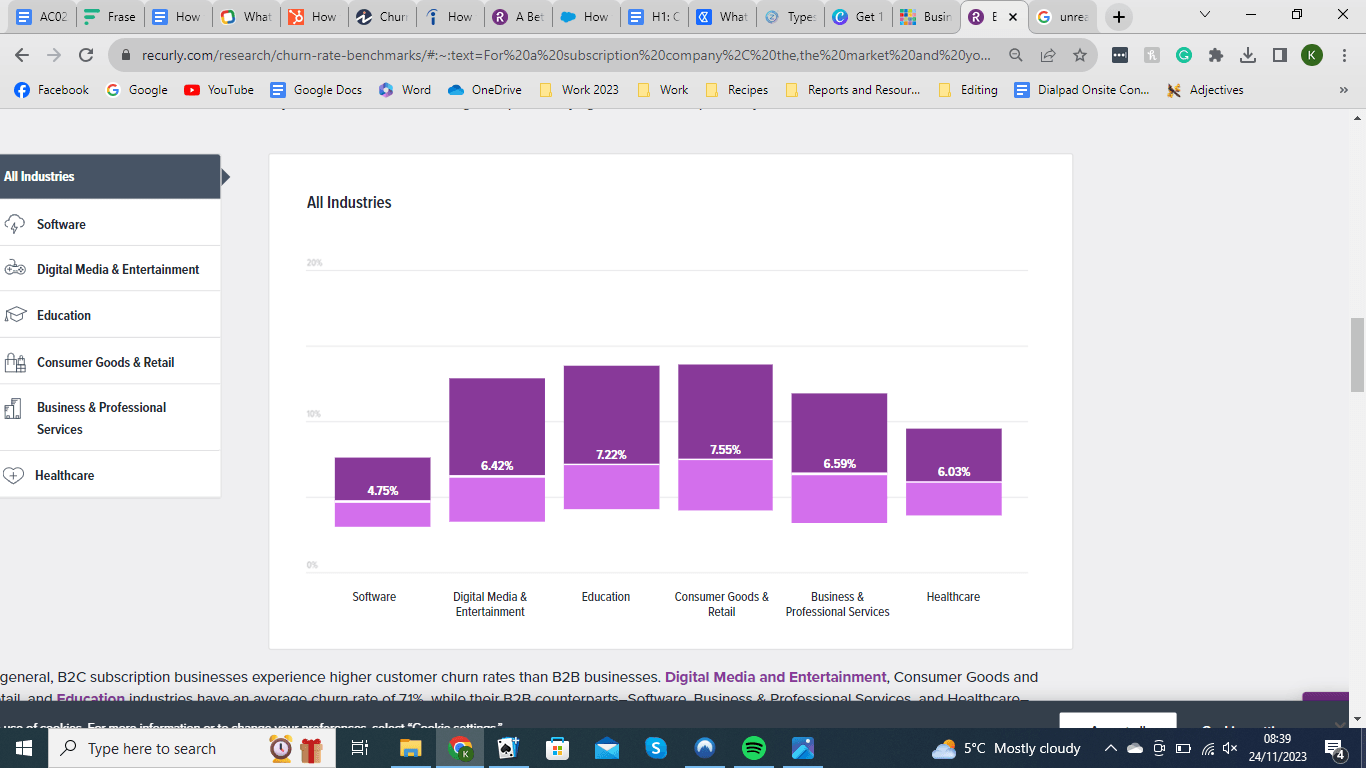

Strictly speaking, the lower your churn rate, the better. Research from Recurly puts the average churn rate across industries at 5.57%. B2B businesses typically have a lower churn rate (averaging 4.91%), while B2C churn rates are higher (, at around 6.77%). Here’s a breakdown across industries to help you see how you compare:.

Churn Rate Across Industries

Image sourced from recurly.com

Why customer churn is so important

When it comes to customers, one thing is for certain: you win some, you lose some. It’s inevitable. So, why measure customer churn at all?

Aside from simply making you aware that you’re losing customers, high churn rates can highlight critical flaws at vital points in the customer journey. From lead generation and marketing to customer retention and loyalty, churn rates can inform you of the effectiveness — or ineffectiveness — of key strategies.

In turn, you can better gauge customer satisfaction levels … not to mention, as well as long-term financial stability and performance.

Let’s take a look at three metrics that are critical to your churn rate analysis:.

1. Customer Lifetime Value (CLTV)

CLTV measures the estimated revenue generated by a single customer over the course of a single customer’s entire relationship with your business.

CLTV has a correlational relationship with churn rate. The higher your churn rate is, the lower your CLTV. So, a high churn rate indicates that customers are spending less time with your company, in turn reducing the revenue generated by them.

But you can also use CLTV to reduce churn. CLTV strategies use historical data to identify high-value customers and target them with personalized campaigns, exceptional customer service, and loyalty rewards. These activities retain customers who are projected to be high-value, lowering churn rates and increasing revenue.

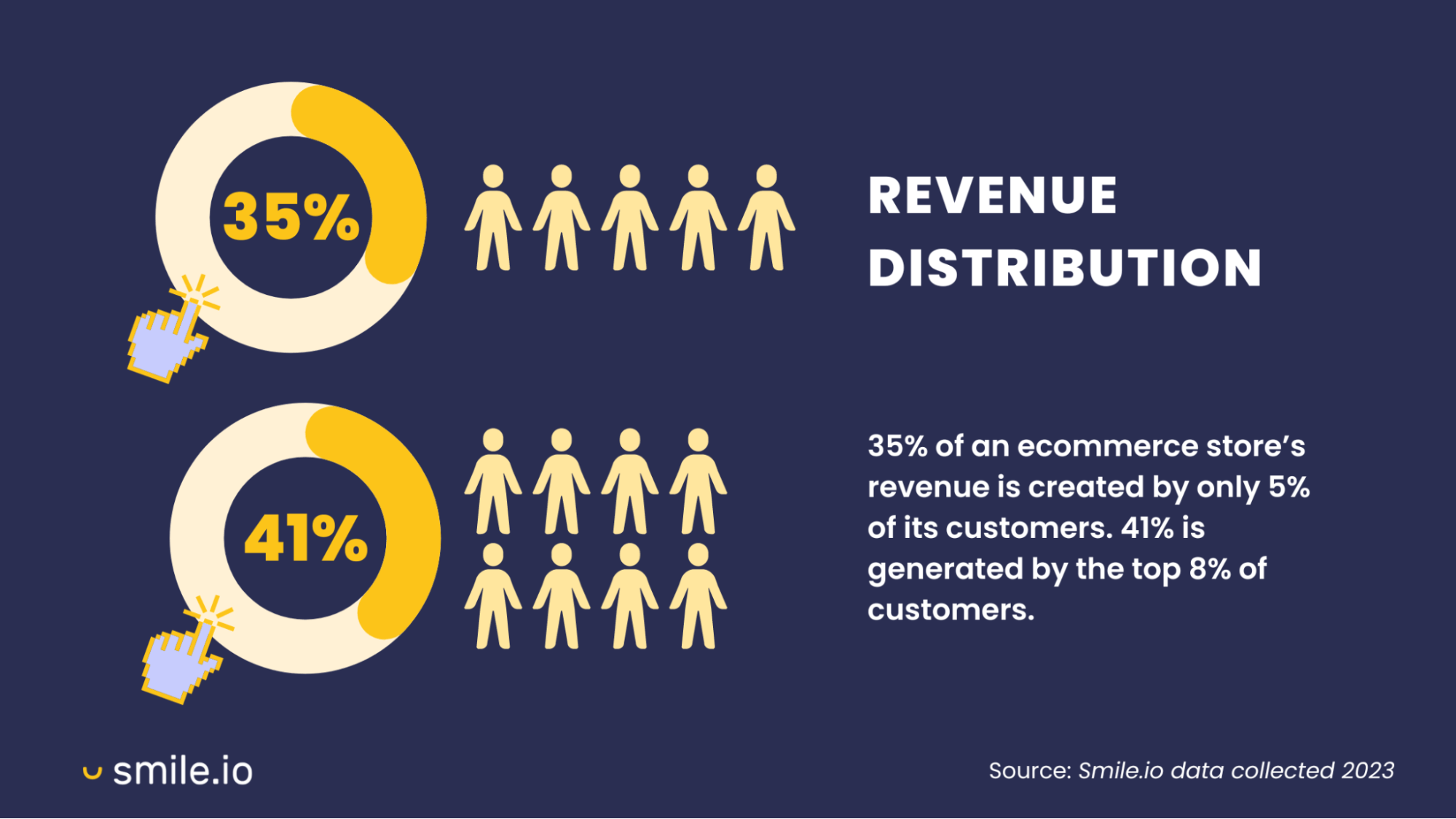

It’s estimated that 35% of an ecommerce store’s revenue is generated by just 5% of the entire customer base. So, it pays to invest in customer loyalty.

Revenue Generated

Image sourced from smile.io

2. Customer acquisition cost (CAC)

Customer Acquisition Cost (CAC) measures the amount of money you spend on acquiring a new customer. This includes advertising, marketing, and labor expenses. It also includes outreach, such as making an outbound voice call to a customer.

The relationship between churn rate and CAC is significant because high churn rates will skyrocket CAC. Remember, selling to a new customer is more expensive than selling to an existing customer. So, if your churn rates are climbing, chances are your CAC is following suit as you struggle to recoup the cost of lost customers by spending more on acquisition.

With a careful eye on churn rate and CAC, you can optimize your spending to make sure you’re not blowing your budget on acquisition.

3. Monthly Recurring Revenue (MRR)

Monthly recurring revenue (MRR) is a vital metric for companies using subscription-based business models. It projects the predictable revenue gained from recurring monthly subscriptions. Churn MRR measures the revenue lost due to customers either canceling or downgrading their subscriptions.

To truly determine the bottom-line impact of cancellations, you need to refer to your churn MRR to establish not just how many customers leave, but the value lost from these customers.

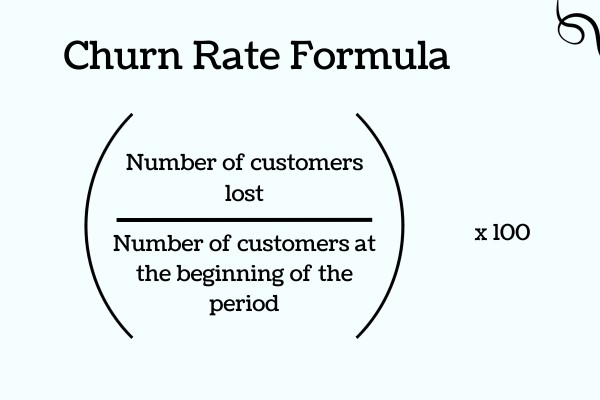

Churn rate formula

To calculate your churn rate, you can follow this simple formula:

(Number of customers lost ÷ Total customers at the beginning of the time period) x 100.

So, if you had 20 customers at the beginning of the specified time period and lost 10 customers by the end, you’d calculatedo (10 ÷ 20) x 100, which will give you a 50% churn rate.

Churn Rate Formula

Image created by writer

How to calculate churn rate

Using the formula above, let’s break down how to calculate your churn rate.

1. Choose a time period to track your churn rate

This will usually be monthly, quarterly, or annually. Monthly churn rates are perfect for illuminating short-term trends, while quarterly churn rates uncover seasonal trends. Annual churn rates provide the deepest insights into your customer retention strategy and paint, painting the most reliable picture of your long-term customer loyalty and attrition.

2. Establish your total number of customers at the beginning of your chosen time period

Once you’ve picked a time frame, identify how many subscribers you have at the start. For this example, let’s say that you want to track your monthly churn rate. On the first of the month, you have 500 subscribers.

3. Determine how many customers you lost at the end of the time period.

Now it’s time to work out how many customers churned. Calculate the difference between the total number of customers you had at the start of the month and the total number of customers you have left at the end of the month.

For example So, if you started the month with 500 subscribers and ended with 400, you’ve lost a total of 100 subscribers.

4. Use the churn rate formula

Using the example above, you’d divide the number of lost customers (100) by the number of customers you started with (500). This equals 0.2. Now, multiply this total by 100. 0.2 divided by 100 is 20. So, your churn rate would be 20%.

Wrapping up

Now that you know how to calculate churn rate, it’s time to use it to your advantage. Churn rate insights validate the effectiveness of your current customer retention strategy and unlock opportunities for improvement and growth.

KSo, keep an active eye on customer churn and strive to sustain low churn rates by identifying why churn happens and how you can prevent it.