There’s no doubt about it, Chinese games have found an audience in the global market. According to Business of Apps, China makes up over 31% of worldwide mobile gaming revenue. As giants like Tencent and NetEase dominate the ROI charts worldwide, Chinese gaming revenue is expected to top $39.6 billion globally by 2027.

To help Chinese game developers grasp the latest global mobile game market dynamics and trends, SocialPeta, in collaboration with Liftoff, has jointly released the report Guide to Growing Chinese Gaming Apps Overseas. This report is based on data collected by SocialPeta from January 2024 to June 2024, and Liftoff’s data on 133 billion ad impressions, 7.9 billion clicks, and 18 million installs gathered from May 1st, 2023 to June 15th, 2024.

Key findings

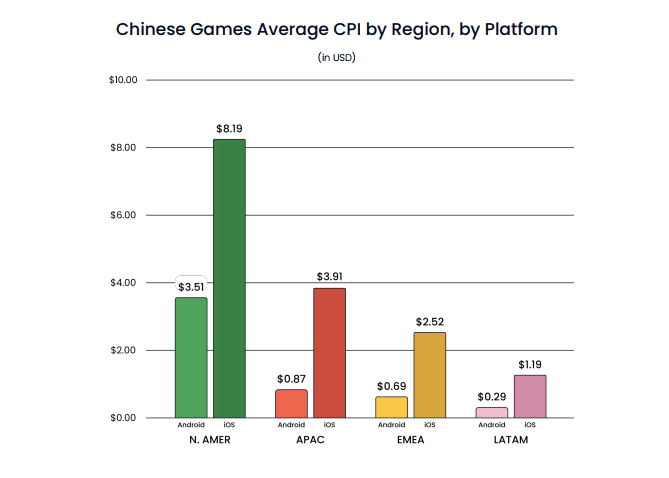

Although the CPI in the North American market is high, it is indispensable

North America is a key market for Chinese games but it’s also highly competitive. Cost-per-install (CPI) for Chinese games is 2x higher in North America than in APAC, with a CPI of $8.19 (iOS) compared to $3.91 in APAC. In EMEA, CPI on iOS is $0.69 and $2.52 on Android.

Chinese games average CPI by region, by platform

Source: Liftoff and SocialPeta

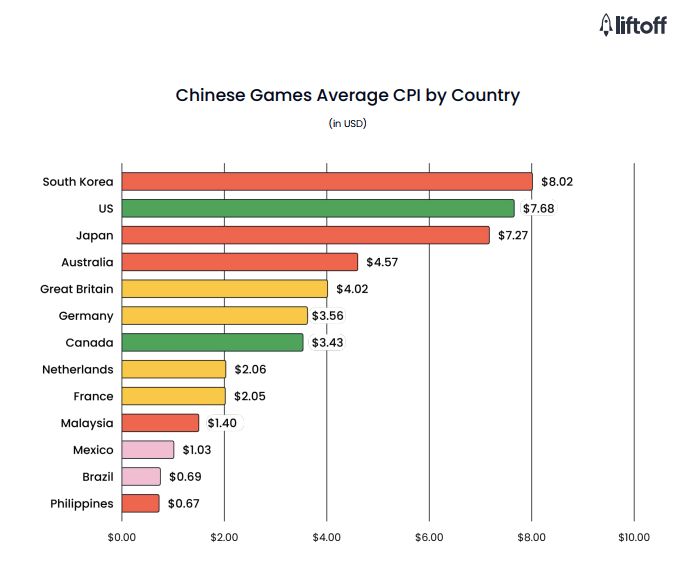

Brazil is an ideal customer acquisition market

Key countries such as Korea ($8.02), the US ($7.68), and Japan ($7.27) have the highest average CPI. The Philippines ($0.67), Brazil ($0.69), and Mexico ($1.03) have the lowest CPI. Brazil is an emerging market for Chinese games and presents a cost-effective opportunity for UA campaigns.

Chinese games average CPI by country

Source: Liftoff and SocialPeta

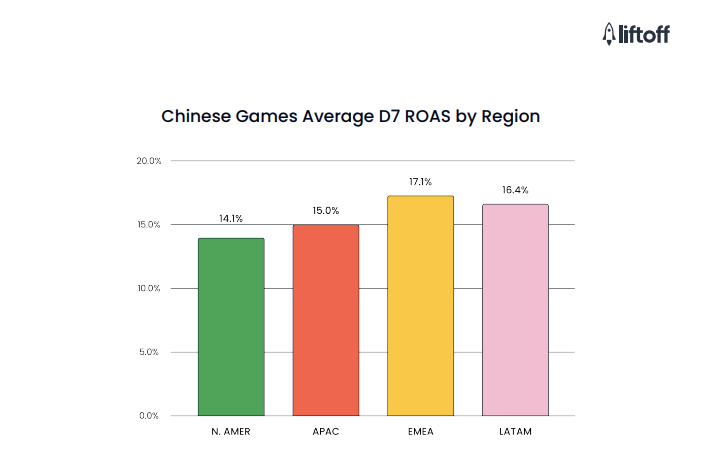

The ROAS is highest in the EMEA region

Of the four main markets, EMEA has the highest D7 return on ad spend (ROAS) for Chinese games, at 17.1%. Although North America represents a key market for Chinese games, its average ROAS is comparatively lower, likely due to stiff competition and higher costs.

Chinese games average D7 ROAS by region

Source: Liftoff and SocialPeta

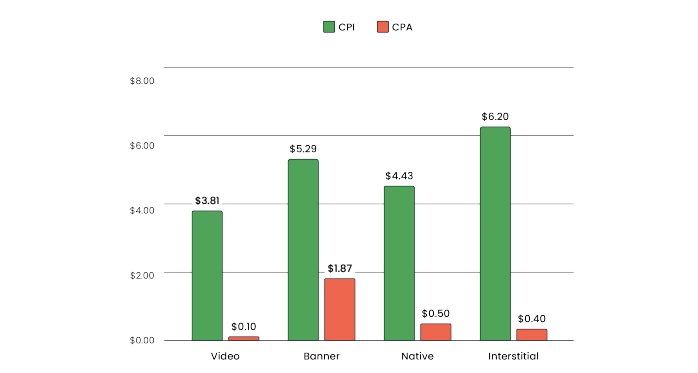

Video ads are proven to increase ROI

Video ads are the most cost-effective ad format for cost per install (CPI) and cost per action (CPA), with a CPI of $3.81. Video ads also provide the highest ROI, with a 20.9% D7 ROAS compared to native (15%), banner (12.5%), and interstitial (10.7%).

Video ads CPI and CPA

Source: Liftoff and SocialPeta

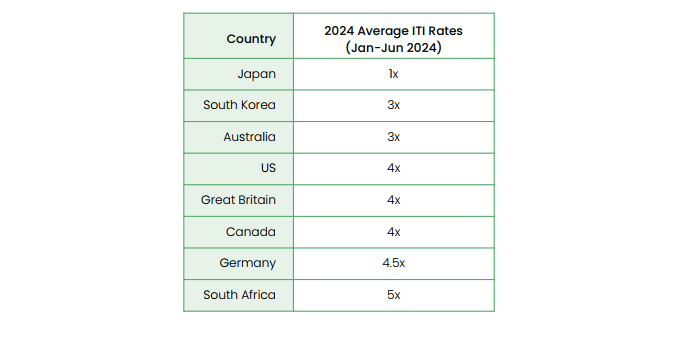

Japan proves a more challenging market to drive conversions

Japan is one of the most challenging markets to drive conversions for Chinese game mobile ads, with an impression-to-install (ITI) rate of 1x (measured Jan-June 2024), followed by Korea (3x) and Australia (3x). South Africa (5x) is one of the easiest markets to drive conversions based on ITI performance, followed by Germany (4.5x), Canada (4x), Great Britain (4x), and the US (4x).

Average ITI rates by country

Source: Liftoff and SocialPeta

Embrace AI for localization

In the past year, a new caliber of AI-based creative tools has exploded onto the scene. While the industry is still developing best practices, one of the most exciting applications for gen AI is localizing ad creatives. Here are a few tips to harness its power.

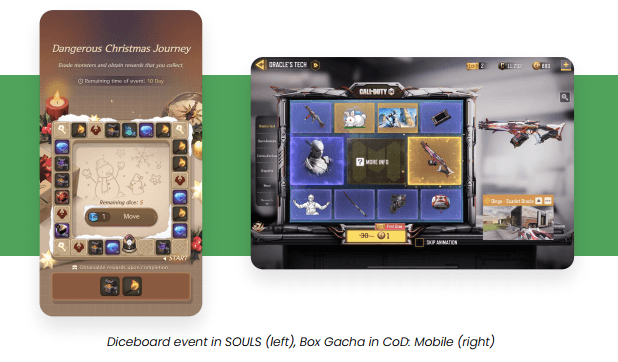

Limited-time gacha and trial characters are becoming new monetization trends

This report, through analyzing several successful mobile games, has found that popular games like Call of Duty: Mobile (CoD: Mobile) and Genshin Impact are experimenting with new monetization methods, particularly the introduction of highly popular and innovative trial characters and limited-time gacha events. These innovative forms cleverly leverage players’ fear of missing out (FOMO), significantly enhancing monetization effectiveness.

Diceboard event in SOULS (left), BOX Gache in CoD. Mobile (right)

Source: Liftoff and SocialPeta

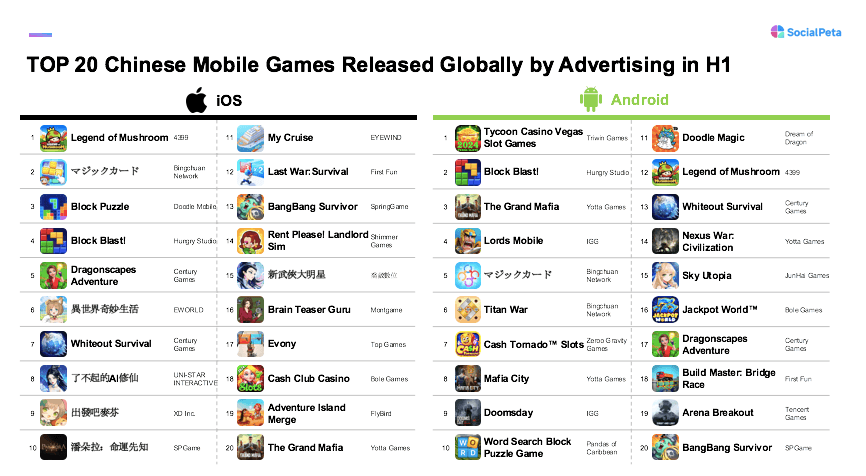

‘Mini-games’ have become the primary growth driver for Chinese game developers expanding globally

Legend of Mushroom and BangBang Survivor are prime examples. This success is largely due to the ability of Chinese developers to transform traditional, complex game mechanics into lightweight gameplay that fits fragmented time slots. This not only attracts busy adults but also makes these games popular in multiple markets worldwide.

Top 20 Chinese mobile games

Source: SocialPeta

The complete report spans 35 pages, with data up to June 2024. It covers cost and ROI and install conversion benchmarks across key regional markets, as well as insights into ad creative and localization trends. For more detailed information, please download the full report.