As digital advertising moves away from device IDs and welcomes a new era of privacy-conscious practices, two prominent players have taken the stage to redefine ad campaigns on iOS and Android. Enter Apple SKAdNetwork and Google Privacy Sandbox, two privacy-centric solutions that, while fundamentally aligned, chart divergent paths in revolutionizing Ad Tech.

As an in-app DSP built with a north star of adapting to device ID-less advertising, Dataseat (now part of Verve Group) has a unique view of how both of these technologies are impacting app advertisers now–and what we expect to see in the near future.

Differences and similarities

SKAdNetwork (SKAN) and Privacy Sandbox both seek to remove dependence on device identifiers for tracking users across sites and apps.

But while SKAN is solely focused on measurement, Privacy Sandbox goes well beyond this with technologies that can also benefit targeting–in the absence of device IDs–based on user behaviors.

This is the most crucial difference between the two technologies: while Apple’s SKAN gives advertisers a privacy-safe method to measure campaign success, it currently offers nothing to help them drive campaign success in the first place–putting the onus entirely on the advertiser and their partners.

As a result, advertisers have a much greater challenge to overcome for their iOS apps in 2024 vs on Android.

Contextual targeting has emerged as the new way of powering iOS performance. Yet it goes without saying that comparing Behavioral to Contextual targeting is not an apples-to-apples situation. This is because while both seek to find the target audience, the Behavioral approach does this with generally stronger and more reliable signals which track users across sites and apps.

Only Android campaigns will benefit from Behavioral targeting within the constraints of the new SKAN and Privacy Sandbox standards. Since Google is fundamentally powered by advertising, it is no surprise it is keen on showing that privacy-preserving advertising and behavioral targeting can co-exist. Accordingly, Google Privacy Sandbox promises to offer advertisers a plethora of behavioral data to use when choosing who to show their ads to.

For user acquisition, Privacy Sandbox’s Topics API shares signals about user actions and interests to help advertisers find relevant audiences. On the re-engagement side, the Protected Audience API offers audience targeting–helping advertisers find specific users of their own apps in the crowd.

Your playbook for the new app ecosystem [webinar]

The app stores have been cracked open. Savvy teams are already capitalizing by implementing App2Web and Web2App strategies. Join Paddle’s Lucas Lovell to discover smarter billing tactics.

Register nowTimelines and status

SKAN is live and has been widely used by app developers since 2021. According to Apple, it must be used from Spring 2024 for any developers wishing to track their ad campaigns. After this, prevention of fingerprinting is expected to be enforced.

Privacy Sandbox, on the other hand, is currently still mostly in the proposal phase and working towards beta testing. Google is partnering with Ad Tech leaders to validate the system before rolling it out more widely, so we can expect varying timelines for various different features, with the Topics API most likely launching first.

There is little data on how Privacy Sandbox impacts campaigns in the wild yet. But we should expect it to be closer to the status quo vs SKAN because of the interest-based targeting it permits.

The privacy vs performance dilemma

One question is whether Google’s approach can succeed in achieving both their privacy goals and campaign performance goals at once: is good ad personalisation possible within the realms of increased privacy? Ironically, the more behavioral targeting capabilities that Google manages to include in Privacy Sandbox, the less it may succeed on the privacy side.

Mixed consumer reactions to the Topics API rollout have highlighted that the path to striking the right balance will not be entirely straightforward. Not only does Privacy Sandbox need to offer the right technical solution but it also needs the right marketing to help consumers understand that this is net-positive for their web and app browsing experience.

Compounding this dilemma is the fact that the more comprehensive Privacy Sandbox becomes as a solution, the more network traffic, processing and filesystem space it will take up–will average consumers be capable of understanding that this is a positive thing, or will it be labeled as bloatware?

At Dataseat, we agree with Google that there is room for personalization within privacy-preserving advertising. However, we do not see any signs that this will be addressed on iOS any time soon. The next version of SKAdNetwork will apparently support re-engagement, but this most likely only refers to measurement of campaigns–not targeting.

What would it take for Apple to invest in helping their developers target relevant users? The strongest drivers here would be revenue opportunities and consumer attitudes. Improving advertising performance does not directly benefit Apple unless it can use this to promote its own advertising tech. Though this idea was popular in the Ad Tech community after ATT was announced, there has been little to back it up since–beyond the expansion of Apple Search Ads.

Meanwhile, Android may be in a strong position to take more marketing dollars from iOS for advertisers preferring an easier ride to achieving ROAS goals. Starting from 2021, when Android ad spend soared up 8-21% and dropped on Apple within just two weeks of the iOS 14.5 release, Android has been getting an increasingly bigger piece of the ad budget pie. Q2 2022 data reported that 54% of ad revenue was generated by Android applications while iOS applications generated 46%.

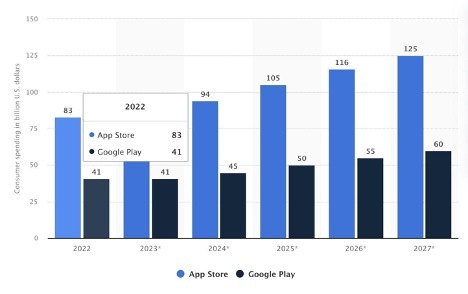

But the fact remains that iOS continues to generate the most in-app revenue (with 83 billion consumer spend on iOS vs 41 billion on Android in 2022 as per Statista). Achieving ROAS goals on iOS is getting harder, but no less important.

Mobile app consumer spending worldwide from 2022 to 2027, by store

Source: Statista

This is not to say that achieving ROAS goals on Android with Privacy Sandbox is also a done deal: ad platforms will need to make major changes to adapt to the new paradigm which effectively flips targeting logic on its head. Those built with privacy in mind from the beginning are in a stronger position to do this.

What’s in store for 2024?

Investing in contextual targeting is the best path for iOS. With the upcoming restrictions on fingerprinting expected in Spring 2024, solving this for iOS is more urgent than ever.

Google is likely to make it easier for advertisers to target efficiently on Android when compared to iOS, but there are a lot of unknowns on how this will look in the wild–and how long it will take.

The industry anticipates privacy measures on Android later in 2024-2025. For advertisers, it makes sense to become familiar with Sandbox and to work with Ad Tech partners which are investing in Sandbox already, so that they have an upper hand with all the collected campaign learnings when privacy is fully on.