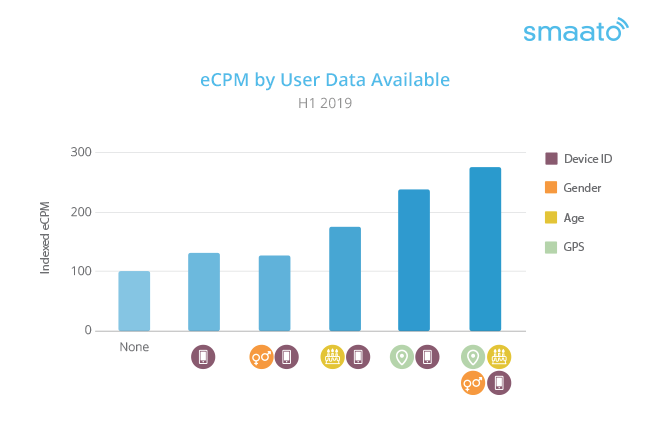

Rich user data has long been celebrated as a win for advertisers eager to increase the efficiency of their spends via more targeted campaigns and tailored creatives. However, according to a recent analysis of data from the Smaato platform for the first half of 2019, rich user data also represents a massive boon for publishers. In fact, our analysis found that apps that collect and leverage user data for better ad targeting can see their eCPMs increase by nearly three-fold.

Let’s take a look at how app publishers can leverage the wealth of available in-app data to deliver not only the best results for their advertisers, but also their own bottom lines.

Quantifying the Data Advantage

Apps that can collect user data and include it in their ad requests are earning a premium when it comes to their placements—and that premium increases with every additional layer of data that is included. For example, in the first half of 2019, ad impressions with device ID and user age data commanded eCPMs that were 27 percent higher than those without any additional data. When user gender and GPS location were added on top of that, the eCPM increased a further 117 percent.

Even on its own, device ID provides a powerful enhancement to eCPMs. A device ID is a unique string of numbers and letters that identifies an individual mobile device, and advertisers can use these IDs to track and target users and their devices. While device ID is powerful on its own, the value of this information becomes especially notable when combined with location (i.e., GPS) data.

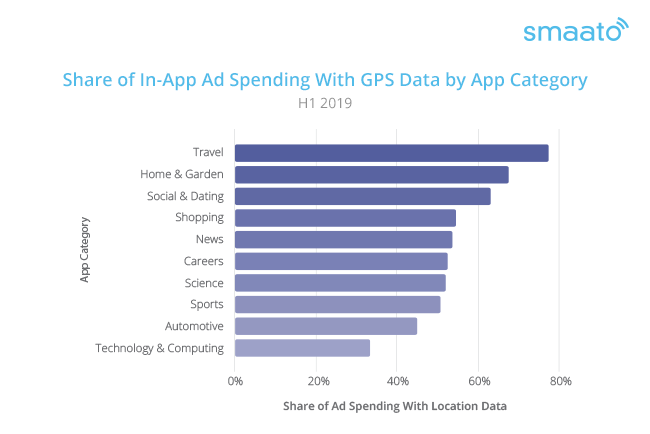

Retail advertisers are currently the biggest investors in location-based targeting, with nearly three-fourths of retail marketers employing location strategies to drive foot traffic and trigger location-based mobile advertising. Location data is key particularly for retailers with brick-and-mortar stores, as they can serve targeted ads to users within a certain proximity and segment audiences by frequency of visitation.

That said, not every app currently provides the opportunity to target ads with location data. According to our data, the travel app category had the highest share of ad spending going to impressions with GPS data (77 percent). Other top app categories include home and garden apps (68 percent) and social and dating apps (63 percent).

Apps not currently enabling location-based targeting are missing out on a notable revenue opportunity when it comes to their advertiser offerings. Of course, certain types of apps—such as those in the aforementioned categories—have an advantage in this arena because they often require access to a user’s location in order to provide their core services. Publishers that can develop their apps in a way that tailors the experience to a user’s location not only increase the value of their apps for users, but also the value of their impressions to advertisers.

Tapping into the Data Stream

Mobile apps can be a wealth of user data, so long as publishers are creating experiences that encourage users to freely share their information in exchange for in-app perks and conveniences. Done right, in-app data can be leveraged as a win-win-win scenario for users, advertisers and publishers alike.

Of course, consumers are increasingly aware of how their data is being collected and used across the digital ecosystem—especially in light of new consumer privacy laws, such as the GDPR. While some surveys of users have found that people are feeling more protective of their personal data, only a small percentage are opting out of sharing information, including their location, with the apps they use. In fact, only 15 percent of U.S. smartphone users say they are uncomfortable with letting apps track their location. The majority remain comfortable with sharing this data due to the convenience of location-based services and the benefits they receive by sharing it.

In the near future, we can expect to see new layers of data emerge that will further enable the personalization of the customer experience. For example, within the realm of location data, digital out-of-home (DOOH) is becoming more sophisticated, and we’re seeing the nascent use of geofencing to trigger personalized content for customers passing DOOH displays. In this regard, we can expect to see mobile apps, CTV apps and DOOH increasingly merge in their usage of targeting data, creating both greater opportunity and complexity.

The key to keeping user consent for data collection is to clarify what users get in return, whether that be personalized discounts or targeted advertising. The app publishers that can deliver value and clarity in exchange for user data will find their efforts richly rewarded when it comes to garnering premium eCPMs among a growing base of data-hungry advertisers.