The role of an affiliate manager is important, and CPA networks should invest enough time and effort in adopting affiliate management and performance tracking in their working environments.

A common mistake is to underestimate this role and think that being an affiliate manager is a piece of cake. Managing offers in the tracking system, communicating with supply partners over email and Skype, and sorting out incoming requests seem to be the main tasks an affiliate AM is on during the work day.

In fact, this role is much bigger and involves more activity. In this article we’d like to bring you closer to all the specifics of the affiliate manager role. After 5 years of working with app advertisers, performance networks and agencies we have refined and polished a series of insights that will help you better understand the role and adopt it in your affiliate marketing business.

To begin with, let’s recall what Affiliate Manager is in general.

What is an affiliate manager?

In digital advertising, an affiliate is a business intermediary that connects an advertiser (“ad buyer”) with one or more publishers (“ad sellers”) to promote a product or service on a performance basis and get paid a reasonable commission in return. It can be an self employed marketer or consultant, but more often a company that buys traffic from publishers and resells it to advertisers through a network of affiliates. This company is called an affiliate network.

An affiliate manager is an employee whose primary role is to retain and grow affiliate accounts of a CPA network. This job is about “nurturing” a portfolio of existing affiliates and taking a proactive approach to improving campaign performance and solving incoming requests.

Simply put, an affiliate manager is a liaison between a CPA network and its publishers and affiliates.

The role is about reaching out to affiliates, managing their accounts in the tracking system, targeting problems before they even happen, and helping optimize ad campaigns. It’s about knowing affiliates’ business needs and stepping into their shoes to increase traffic volumes and reduce churn.

Supply partners an affiliate manager deals with

Generally speaking, there are four types of supply partners an affiliate manager deals with on a daily basis:

- Networks, or business intermediaries that participate in various affiliate programs and campaigns and re-sell traffic from publishers (websites and mobile apps) to advertisers (brands, agencies, developers). Networks often work with each other and run cross-promotional deals at scale, allowing affiliate marketing to be a good channel for publishers to monetize inventory, and for advertisers to target and reach new audiences.

- Affiliates, or self-employed marketers and contractors that act either on their own behalf or on behalf of a CPA network to do the job. Actually, an independent affiliate uses the same tools and methods of affiliate marketing as networks do to advertise client’s programs and run CPA offers.

- Publishers, or those businesses/individuals who own websites or mobile applications where ads are actually placed. An affiliate manager can work with a number of website/app publishers to buy traffic and pay on a CPA performance basis.

- RTB media buyers. In-house media buying is usually delegated to a group of 2-5 people who have enough competencies to effectively buy CPM or CPC traffic on RTB-powered ad platforms or DPSs like Google Adwords, Facebook Ads, Nexage, Applovin, Revmob, others.

Media buyers work in close cooperation with affiliate managers to agree on campaign setup and goals. Their primary task is to buy and optimize CPM/CPC traffic for desired CPA.

Affiliate manager’s skills

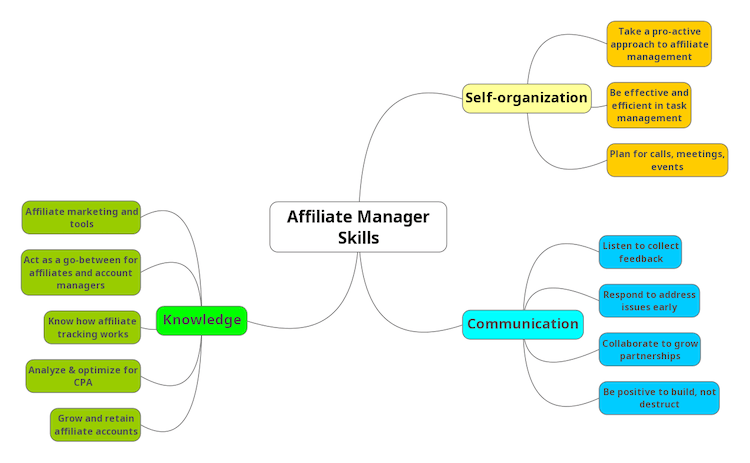

A blend of Communication, Knowledge and Self-organization skills is required to successfully fulfill an affiliate manager role. These attributes are detrimental to forging strategically viable relationships with affiliates, networks, publishers and media buyers. Let’s break through these essential skills in detail.

Communication. We wouldn’t surprise you that an affiliate manager should possess excellent interpersonal skills. Speaking and interacting with people all day long should be a pleasure for this employee; otherwise he wouldn’t be persuasive enough to listen, respond, collaborate, and express a positive attitude towards supply partners.

Knowledge. A successful affiliate manager should be confident of what traffic is and and how to get it. As this person takes on a go-between business role, his strong competency determines the success of relationships with traffic suppliers. He should be technically savvy to manage assets (like offers, tracking URLs, postbacks, click logs, etc.) in the tracking system and help affiliates optimize for CPAs. Also, having in-depth knowledge of affiliate marketing and tools is absolutely crucial.

Self-organization. Since the role connects the company and its affiliates, this employee should be well organized to handle requests for both sides. A typical day for an affiliate manager involves putting together ad campaigns and offers for publishers, communicating with account managers and business development staff, gathering and handling complaints, concerns and feedback, making teleconference calls, taking meetings. A number of these and other tasks indicate that it is a pro-active position that requires proper self-organization at work.

4 essentials of affiliate management

Affiliate management is a standalone business process of building long-term relationships with traffic supply partners – affiliates, publishers, networks, media buyers. This process is set to move all interactions with traffic suppliers forward in order to maximize the value of those interactions and reduce risk of failure. You can see it in action when a new publisher joins your network (you review their application, complete s2s integration, approve first offers, etc.), or when existing affiliate accounts are managed for retention, high volumes of traffic, fast payouts etc.

Affiliate management is a company-wide, long-term perspective, not an immediate technique. It is a network’s commitment for their affiliates and publishers to build strategic and supportive partnerships with them. Here, the role of affiliate managers is to ensure smooth buying and delivery of traffic from suppliers to advertisers through a performance tracking system like Evertrack. Below are four steps to help you manage affiliate accounts in your network.

Onboarding new affiliates

When somebody joins your CPA network as an affiliate, you first need to assign an account manager who will support the onboarding procedure and provide necessary assistance and guidance for the new affiliate.

At this step, new affiliates learn about your network, the terms of cooperation, payment schedules, billing procedures, what offers at what payouts are available for approval. The affiliate manager helps new supply partners feel welcomed into the network and gets everything ready to start buying their traffic.

Here are 4 essentials of the onboarding procedure to pay attention to:

- Allow access to your network’s affiliate dashboard

- Make an intro call with the new affiliate to get to know each other better and learn about their traffic (what offers they like to run, what volumes they do, how they optimize, whether they can run banner, video, rewarded, social ads etc.)

- Provide necessary legal and tech documentation including Insertion Order (if applicable for your network) and API guides

- Enable server-2-server tracking over API if applicable

A basic KPI for an affiliate manager at the boarding procedure is to generate $1,000 in 30 days after a new affiliate has joined your network.

Prioritize affiliate accounts

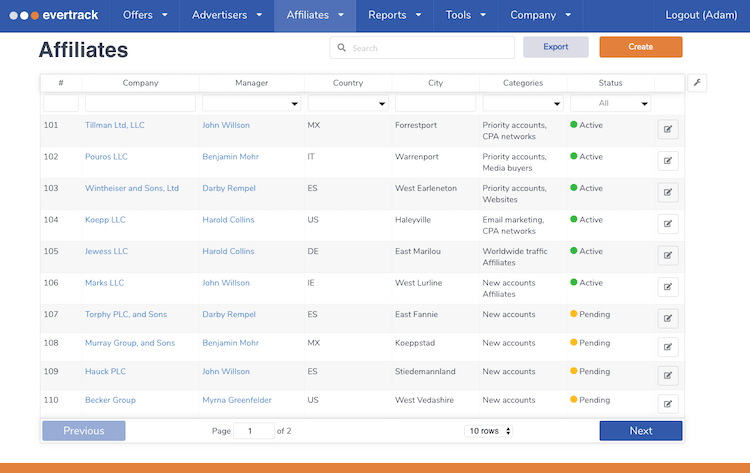

Dozens of affiliates and publishers can sell traffic for your CPA network, but it doesn’t mean that they all bring the same value. A careful identification of your key affiliate accounts will help you focus on top-converting sources that demonstrate sufficient volumes and quality.

You need to create clear guidelines for affiliate managers about how to prioritize their publisher partners. Keep track of affiliate performance and measure every traffic source for conversion rates, KPI compliance, volumes, CPA (how much you pay per attributed action).

Affiliate managers should communicate top affiliates their special status and what preferences they receive – for example early payments, dedicated caps, high payouts, bonuses. Just be sure to follow through on your promise; otherwise a failure to meet your commitment will break your network of CPA affiliates.

Start small with 5-10 affiliate accounts that have been demonstrating high performance with your CPA offers over the last 5-6 months. Keep your list small, don’t add too many affiliate because your priority should be set for quality of traffic rather than quantity.

Choose and train affiliate managers carefully

As it’s been mentioned earlier, Affiliate Manager is a challenging role that requires a person to be savvy, quick and communicative. Candidates must be carefully chosen and trained.

It’s not always a good idea to assign anybody in your company to the role because this role requires a candidate to be stress-resistant and use a proactive strategy for better understanding an affiliate’s needs and goals and encouraging the success of that affiliate.

The journey of a future affiliate manager usually begins with a customer service role in any company to provide assistance and advice to people before, during and after they acquire digital products or services. Then this employee can perform an account manager role with the focus on customer retention and recurring purchases.

An ideal candidate could be a person with at least 1 year experience in lead generation or business development. A business development manager has similar duties (except for affiliate management) and must possess similar skills in order to be successful. So, an option could be re-assigning a business development manager to the role of an affiliate manager in your network.

Another option is to re-assign an advertiser account manager to the affiliate manager role. Advertiser account managers carry out the same duties working with demand partners – direct advertisers, agencies, networks.

It usually takes 3-4 months to train an employee for the basics of affiliate management and ad tracking. Assign an experienced affiliate manager to training new employees.

Track affiliate performance

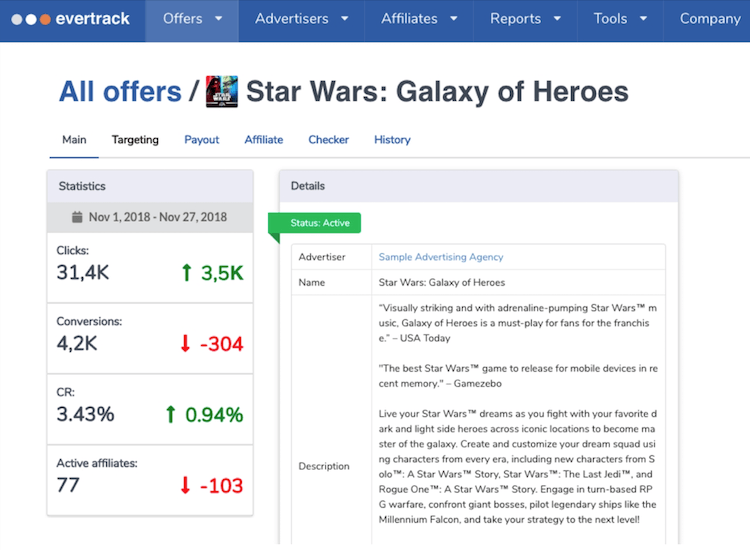

In today’s affiliate marketing space, there are many software solutions available that allow CPA networks to track offers and affiliates against a series of performance metrics.

For example, we suggest that in Evertrack you start with a few basic metrics such as

- CPA (cost per action or an amount of money you pay an affiliate for every attributed action)

- CR (conversion rate, usually the ratio between installs and clicks)

- Margin (an amount of profit generated per affiliate per offer)

Use these and other metrics that best characterize the performance of affiliate accounts in your CPA network. Outline what actions affiliate managers can take for improving affiliate performance.

Affiliate Manager’s DOs

Build a lasting relationship with your affiliates. Work hard at sustaining healthy strategic cooperation, instead of always pushing affiliates towards your tactical deliverables. This will pave the way for a sustainable traffic supply chain in your network and you’ll be less likely to have a hard time finding new supply partners.

Dig deeper into the demands of your publishers, in addition to what their goals and expectations are. Think about financial (high and fast payouts, bonuses) and non-financial incentives – this way you’ll have a better understanding and context for what they want to accomplish. Ultimately you will gain more strategic guidance that will help you progress affiliate partnerships.

Be committed and honest. Fulfill your commitments as an advertising/demand partner of your affiliates in a timely manner and to the full extent. Pay bills on time, share regular feedback, motivate with exclusive and direct offers, give special CPA rates and dedicated caps. If you’re unable to meet a commitment, be proactive in communicating that. Adopt honesty as your best approach to affiliate management. And never erode your credibility with dishonesty.

Be a good listener to analyze and understand an affiliate’s interests and needs. This will help you deliver better value to your affiliates and give them a good reason to keep coming back to you and running your offers. You don’t want them to forget why they’re selling traffic to you or what true value your network adds to their affiliate marketing business.

Affiliate Manager’s DON’Ts

Don’t make affiliates wait on you; otherwise you are deemed to see them go to other networks. So, be punctual for Skype calls and be consistent and proactive with your communication.

Come clean and don’t fake answers. It’s okay to say, “I don’t know, but I can definitely find out for you,” when a client asks you a question. It sucks not knowing the answer to a client’s question, but you can create sticky situations by not owning up to it.

Don’t rely on email as the only communication channel. Email is efficient, but you won’t get your message across just using this channel. Use messenger apps (Skype, Whatsapp, Viber) and social apps (Facebook, Linkedin, Twitter) to communicate with your affiliates and publishers on mobile at any time.

If you see an email conversation going down the wrong path, or you just notice that something’s wrong with an ongoing campaign, use your favorite messenger to have a direct conversation with your affiliate and get their instant replies. Most affiliates prefer speaking directly over Skype or Whatsapp, rather than just email.

Don’t turn affiliate post-payments into a disaster. Affiliates don’t like late payments and late numbers confirmations. Remember that even a slight delay in payment damages your network’s reputations. Your affiliates won’t run your offers if you reject conversions without justification (detailed reports).

It’s an industry standard that CPA networks post-pay their affiliates. It can be a net-15, -30, or -45 payment basis – an affiliate gets paid a commission in 15, 30 or 45 calendar days following the billing month. Always be strict with net payment schedules and justify invoice deductions if any happens.