Tracking progress has always been necessary for fitness fanatics, but the internet and mobile apps made these services available to everyone.

MyFitnessPal was one of the first to provide tracking services for fitness and health, with user generated meals, items and workouts. Strava, AllTrails and Komoot added refined tracking through GPS and route planning, which let users explore routes and challenge friends on times.

The introduction of the iPhone led to the creation of Fitbit and other fitness accessories, using sensors to better track steps, distance and heart-rate. Apple and other brands have added more health and fitness tracking in recent years, marketing their watches as all-in-one fitness solutions.

Master Mobile Media Buying Design Secrets! 📱🚀

Ready to skyrocket your campaign results? Grab your free guide packed with design strategies for better ad performance.

Learn MoreThe market for fitness has split between trackers and their accompanying apps and agnostic fitness platforms. These fitness platforms use a mixture of AI and human interactions to provide personal training services at scale.

Peloton may be seen as the cumulation of the personalized and premium fitness sector. The company sells a treadmill and bike with a price tag in the thousands, while also offering a subscription to its fitness classes and personalized workout routines.

While Peloton has been successful, most fitness apps still offer their services for free through ads or opt-in premium services. Leap Fitness has launched several free apps which target specific types of people, such as those who want to a six pack or who don’t have any gym equipment at home.

Often, health and fitness sectors are combined, and include wellness and Covid apps. This sector profile only includes statistics directly related to fitness, however a few of the fitness apps covered do also offer health in the form of calorie counters and nutritional information.

We have collected data and statistics on the fitness app industry. Read on below to find out more. If you want to learn more about the fitness app industry, check out our sector report.

Key Fitness App Statistics

- Fitness apps generated $3.98 billion revenue in 2024, a 11.1% increase on the year prior

- Peloton generated the most revenue of all fitness apps through its Peloton App+

- 345 million people used fitness apps in 2024

- Fitness apps were downloaded 850 million times in 2024

Health & Fitness App Report 2025

Want to learn more about the health & fitness app industry? In our Health & Fitness App report, we cover financials, usage, downloads, and demographics by age and gender, alongside market share, engagement, and benchmarks.

Top Fitness Apps

| Title | Description | |

|---|---|---|

| https://www.businessofapps.com/data/fitbit-statistics/ | Fitbit | Recently acquired by Google to be part of the company's hardware division. Known for its popular fitness trackers |

| https://www.businessofapps.com/data/myfitnesspal-statistics/ | MyFitnessPal | One of the most popular calorie trackers, with a huge database of food products |

| https://www.businessofapps.com/data/strava-statistics/ | Strava | A popular fitness app with the cycling community with a competitive King of the Hill mode |

| https://www.businessofapps.com/data/peloton-statistics/ | Peloton | Seller of expensive cardio equipment and exercise livestreams that can be followed along at home |

| https://www.alltrails.com/mobile | AllTrails | Another route planning app used for outdoor activities such as hiking, climbing and snow sports |

| https://fitonapp.com/ | FitOn | A fitness app which prides itself on offering free workout and meditation sessions |

| https://betterme.world/ | BetterMe | An all-in-one health, fitness and wellness app that acts as a virtual health coach |

| https://www.sweat.com/ | Sweat | A fitness app built for women, which has a large library of female trainers and workouts |

| https://us.zwift.com/ | Zwift | A massively multiplayer online cycling game that lets you explore virtual worlds at home |

| https://leap.app/ | Leap Fitness | Publisher of the most popular free fitness apps on iOS and Google Play |

| https://sweatco.in/ | Sweatcoin | An app that rewards users for walking with sweatcoins, which can be exchanged for real-world goods |

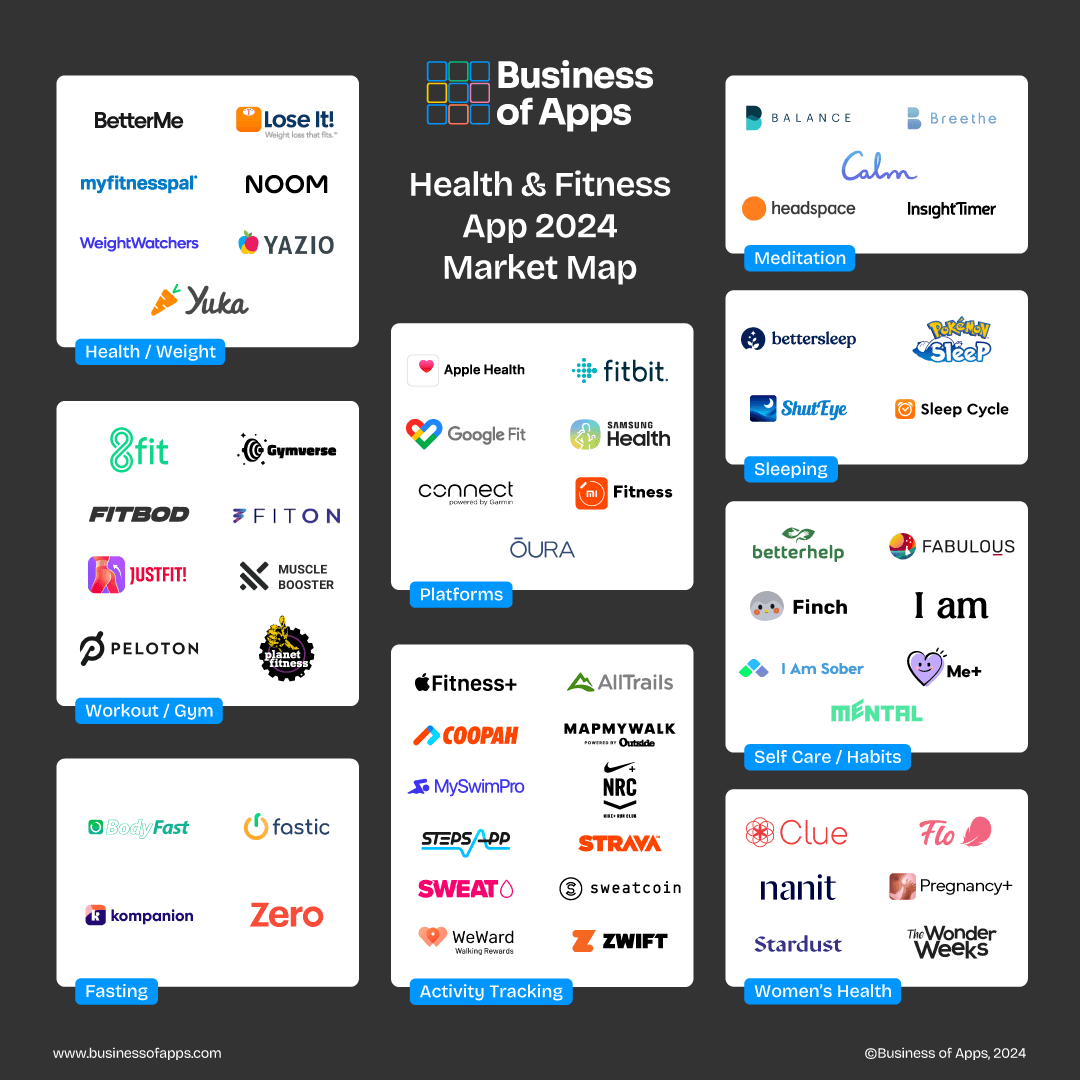

Health & Fitness App Market Landscape

Fitness apps are part of a wider ecosystem of the health and fitness category. For fitness, platforms play a key role in tracking various metrics; activity tracking apps are available for targeted activities and exercise. There are also apps available for following gym and exercise workouts, with coaching available for additional fees. You can download this market map as a PDF, which includes a landscape version.

Fitness App Revenue

Revenue increased in 2024 even as usage and downloads declined, with more users sticking to their subscriptions.

Fitness app market size 2016 to 2024 ($bn)

Fitness Revenue by App

Peloton is way ahead of other players in fitness subscription revenue, but Apple has made strong gains in the past two years with its Fitness app.

Fitness revenue by app 2024 ($mm)

Fitness App Users

The fitness app industry saw a surge in usage during the pandemic, but has seen usage fall since.

Fitness app users 2015 to 2024 (mm)

Fitness App Market Share

Apple Fitness is the most popular fitness app on the market, as the premier fitness app on the Apple Watch.

Fitness app market share 2024 (%)

Fitness App Downloads

Fitness apps were downloaded 850 million times in 2024, another year of slight decline.

Fitness app downloads 2016 to 2024 (mm)

More Health & Fitness App Data

- Health App Revenue and Usage Statistics (2025)

- Strava Revenue and Usage Statistics (2025)

- Health & Fitness App Benchmarks (2025)

- Flo Revenue and Usage Statistics (2025)

- Headspace Revenue and Usage Statistics (2025)

- Wellness App Revenue and Usage Statistics (2025)

- Calm Revenue and Usage Statistics (2024)

- Sweatcoin Revenue and Usage Statistics (2025)

- MyFitnessPal Revenue and Usage Statistics (2025)

- Peloton Revenue and Usage Statistics (2025)