This guide will cover the best financial app development services, how much it costs, top app development features, and how you stand to benefit from using app development companies.

Financial apps allow customers to manage and engage with their finances more than ever. In fact, global fintech app usage grew significantly in Q1 2020, which has only been further accelerated by the onset of COVID-19.

Allowing people to keep up to date and conveniently manage their finance is increasingly important.

Building and developing financial apps requires a number of must-have features to be implemented. Mobile users expect a fast, seamless experience that is both powerful and easy to use.

A good financial app needs to enable users to view their transactions, keep track of their budgets and spending, and they should be able to schedule utility payments. Informative and engaging written content, such as blog posts, is also crucial.

Don’t know where to start? We’ll cover everything you need to know about financial app development.

What is a financial app?

A financial app is a mobile app that allows users to track their monthly expenses, send money to their family and friends, and check their latest bank account balances.

Users download the app on their smartphone or tablet and can start tracking their spending, saving, and investing with ease. These mobile apps can track bill payments and keep you updated on credit score changes when they happen.

App Development Buyer's Guide

Download our App Development Buyer’s Guide to get a full list of the best service providers on the market to choose from. You will also learn about types of app developers, different app development platforms, app developer locations, app development costs, how to select the right one for your business, as well as the questions to ask any of those companies you will be evaluating.

The best apps offer personalized spending plans with real-time updates on how much users have left to spend throughout the month. Some apps use algorithms to track income, expenses, and savings goals.

The best financial app developers

Financial app developers are specialized software developers who design, create, and maintain mobile or web apps focusing on financial services and solutions.

These apps are intended to help users manage, track, and optimize their finances, as well as make financial transactions securely. Financial apps cover various services, such as budgeting, investments, payments, banking, insurance, and (personal) finance management.

We’ve listed the best financial app developers below.

1. Slashdev.io

Slashdev.io is a financial app development company that connects businesses with top-tier remote software engineers. They offer flexible freelance contracts at competitive hourly rates, enabling companies to focus on core competencies.

A personal finance management startup approached SlashDev.io to help them develop a mobile app aimed at simplifying personal finance for a broad audience. Their primary goal was to create an app that helps users track spending and manage budgets effectively, as well as offer personalized financial advice based on user behaviour and goals.

After launch, the startup saw a 40% increase in user sign-ups within the first month, driven by word-of-mouth and marketing efforts. Engagement metrics were impressive, with daily active users (known as DAU) averaging 30 minutes per session. Users particularly appreciated the real-time transaction tracking and personalized insights.

Overview

Slashdev.io was founded in 2019 by Michael Ballard and Patrich Söderström. Michael Ballard is the founder and CEO, bringing a background in software entrepreneurship and a passion for helping entrepreneurs.

Patrich Söderström co-founded the company, contributing to its mission of connecting businesses with top-tier software engineers worldwide. The company primarily works with SaaS, enterprise, and software product startups.

Services

Slashdev.io provides its customers with the following services:

- Creates financial mobile apps that boost both engagement and reach

- Offers end-to-end solutions, helping businesses design, develop, and deploy scalable apps

- Provides access to top-tier remote engineers to extend in-house teams

2. ELEKS

ELEKS offers a wide range of services to help businesses innovate, optimize operations, and drive digital growth across industries such as finance, healthcare, retail, and logistics.

Finance enterprise, Eagle, a subsidiary of BNY Mellon, needed to develop its financial portfolio management solution with enhanced functionality. ELEKS worked with the client to create a comprehensive enterprise suite for investment accounting, performance measurement and data management both quickly and efficiently.

Overview

ELEKS was founded in 1991 by Oleksiy Skrypnyk. The company started as a small software development firm in Ukraine. Since then, it has grown into a global tech solutions provider.

ELEKS has worked with prominent clients across various industries, including Hewlett-Packard (HP), Deutsche Bank, The World Health Organization (WHO), and Yelp.

Services

ELEKS provides its customers with the following services:

- Analyzes target audiences, competitors, and industry trends to shape financial app features and functionalities

- Creates visually appealing and intuitive interfaces that enhance user engagement

- Ascertains key business goals and then develops a strategic plan for the mobile app

3. Designli

Designli is a software development firm that offers a comprehensive range of services, including UX and UI design, mobile app development, web app and cross-platform development. Their approach focuses on delivering high-quality, user-friendly solutions.

Designli successfully delivered a seamless, secure, and user-friendly personal finance app for FinTrack, enabling users to manage their finances with ease. With its cross-platform availability, intuitive design, and key insights, FinTrack has become a top choice for users seeking smarter financial management tools.

Overview

Designli was founded in 2013 by Joshua Tucker and Keith Shields. The company is based in Greenville, South Carolina, and provides design and development services, particularly for custom mobile and web apps.

Services

Designli provides its customers with the following services:

- Builds financial apps that work across multiple platforms, ensuring broad accessibility and functionality

- Helps clients define their product goals, target users, and market strategies

- Offers design services to craft intuitive and visually appealing user interfaces

4. Light IT Global

Light IT Global is a financial app development company that delivers innovative web and mobile solutions for startups and enterprises. With over 18 years of experience, they have completed over 500 custom projects.

FinSync is a fintech startup dedicated to helping users gain better control of their personal finances through (advanced) mobile tools. FinSync’s mobile app, developed by the Light IT Global team, is a comprehensive, easy-to-use solution for personal finance management. By combining real-time transaction tracking, key financial insights, and secure authentication, the app provides users with all the tools they need to make better financial decisions.

Overview

Light IT Global was founded in 2006 in Ukraine. The company began as a small team of three individuals engaged in reconstructing local historic landmarks. Over time, it transitioned into a software engineering firm, expanding its services to include web and mobile development.

Light IT Global employs over 100 professionals and has completed over 500 custom client projects worldwide.

Services

Light IT Global provides its customers with the following services:

- Developing robust, secure, and scalable financial platforms that integrate with payment gateways

- Crafting intuitive and visually appealing designs that enhance the user experience and boost engagement

- Designing and building mobile apps for both iOS and Android

5. Orangesoft

Orangesoft is a mobile app and web development company that creates custom software solutions for businesses. The company serves various industries, helping clients build high-quality digital products.

Orangesoft delivered a comprehensive mobile payment solution, PayMaster, that offers a seamless user experience and robust features that ensure both convenience and security. The app saw a 30% increase in active users within the first two months of launch, as more people turned to digital payment solutions in response to increased demand for contactless payments.

Overview

Orangesoft was founded in 2011 by Dmitry Zolotukhin and Alexander Vinogradov. They established the company to provide custom software solutions, focusing on mobile app development as well as web development.

Orangesoft has worked with several key clients, including Yandex, Kaspersky Lab, Revolut, and OZON.

Services

Orangesoft provides its customers with the following services:

- Real-time banking transaction syncing and account linking for mobile apps

- Building robust back-end systems with Node.js, Python, Ruby on Rails, and other server-side tech

- Using frameworks like React Native and Flutter to develop apps that work on both iOS and Android

6. App Maisters

App Maisters specializes in mobile app development and digital solutions. The company is able to develop apps that meet the specific needs of larger organizations.

FinTechX Digital, a fintech startup, approached App Maisters to develop an all-in-one mobile app that would simplify personal finance management and investment tracking. FinTechX saw a 35% increase in user retention over three months due to the app’s user-friendly design and engaging features, which made financial management and investing easy for users of all levels.

The premium version of the app, which offered additional features such as advanced portfolio tracking and personalized investment insights, contributed to a 25% increase in revenue from subscriptions.

Overview

App Maisters was founded in 2017 by Fahim Iqbal, the current CEO. Under Iqbal’s leadership, App Maisters has grown and established itself in the app development industry, helping companies across various sectors build innovative mobile apps.

App Maisters has worked with a variety of clients, including brands such as PepsiCo, ExxonMobil, and Shell.

Services

App Maisters provides its customers with the following services:

- Develops financial app prototypes to visualize the mobile app before full-scale development begins

- Crafts intuitive, attractive, and functional app designs

- Builds apps that work across multiple platforms (iOS and Android) using frameworks such as Flutter, React Native, and Xamarin

7. NMG Technologies

NMG Technologies is an app development company that offers a wide range of services, including web and mobile app development, fintech solutions, custom software development, and digital marketing.

FinVest, a fintech startup focused on helping individuals manage their finances and investments, approached NMG Technologies to develop a mobile app that would provide users with tools to track their expenses, create budgets, and manage investment portfolios in a single platform. The FinVest app gained 25,000 active users within the first three months of launch, with high retention rates due to its user-friendly design and actionable financial insights.

Overview

NMG Technologies serves a global client base that includes startups, SMEs, and large enterprises. The company strongly emphasizes quality, timely delivery, and customer satisfaction.

Their client base spans various industries, including healthcare, finance, retail, and education.

Services

NMG Technologies provides its customers with the following services:

- Custom financial platform development using advanced tools and years of experience

- Development of native and cross-platform mobile apps for iOS and Android

- Focuses on creating user-friendly, scalable apps tailored to the client’s specific needs

Types of financial apps

Examples of financial apps, across both mobile and web apps, include the following:

- Budgeting apps

- Online banking apps

- Bookkeeping apps

- Peer-to-peer payment apps

- Financial forecasting apps

- Insurance apps

Financial app developer example

Source: Miquido

Source: Miquido

Financial forecasting apps use high-end technologies and AI to predict the risks or profits of investing. Banks and financial companies usually use these apps, while online banking apps are typically most used by the general public.

Some companies blend two or more of these models. Think carefully about which category your finished mobile app would fall under overall.

Why should I develop a financial app?

In challenging economic conditions, people need to budget and spend their money carefully, and few people want to track their expenses by going through old receipts. Yet keeping a record of personal finances is critical.

Enter the mobile financial app. Finance management apps are an excellent solution to inefficient budgeting and careless spending. Developing a fintech app is a good investment because they deliver so much value to users, particularly today.

Many finance management apps serve younger audiences and teach teenagers how to manage their personal finances. Every year, the percentage of the world’s population under 15 increases, so there’s a growing audience for the apps.

In other words, they expand financial inclusion and increase financial literacy–something that’s more important than ever.

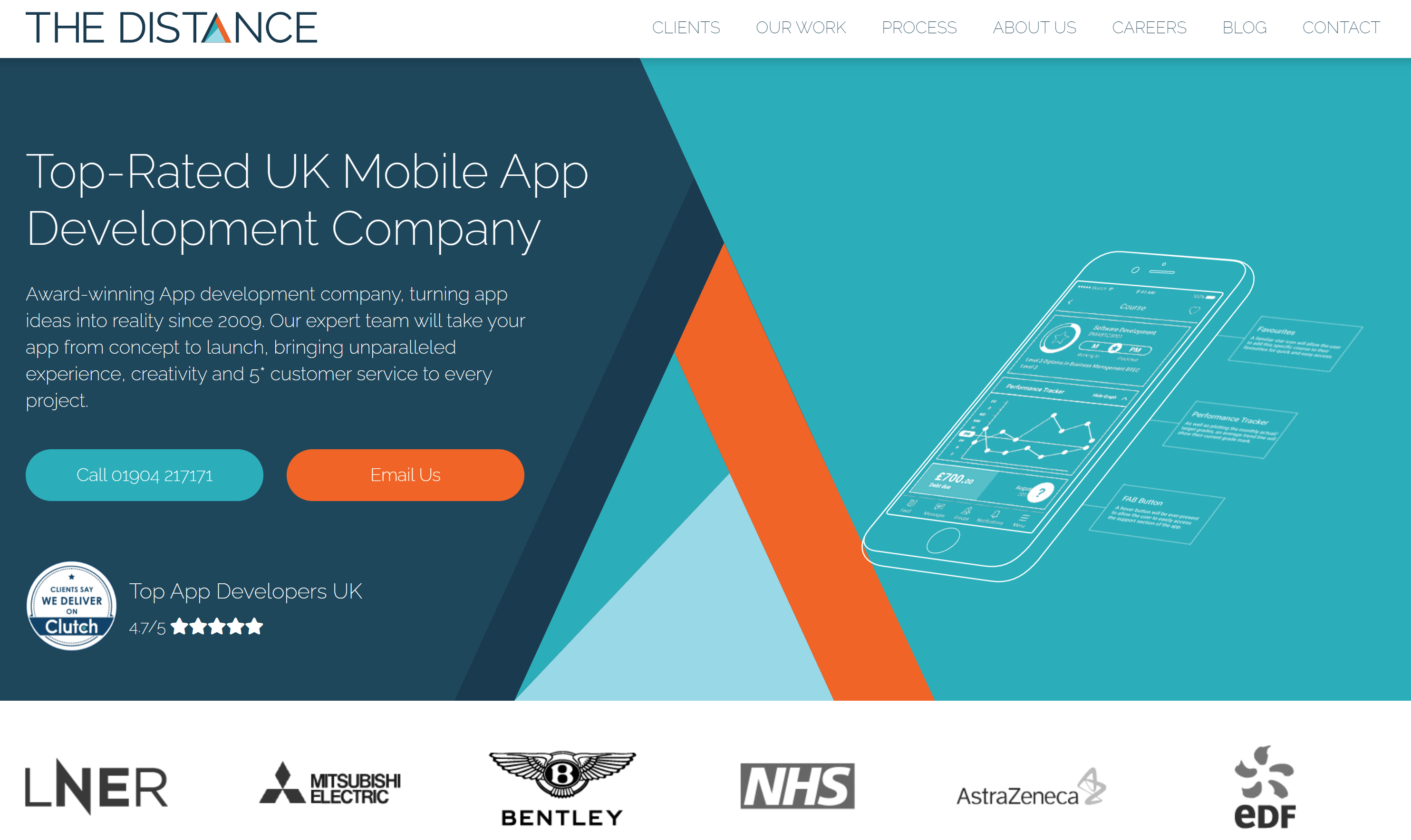

Financial app developer example

Source: The Distance

Source: The Distance

For example, 56% of millennials feel their financial goals are out of reach, and most would rather avoid thinking about or dealing with them–budgeting apps can do some real good here, preparing them for the world and helping them get a better start.

Mobile financial apps typically load faster and are more responsive than websites, providing users with a better overall experience than if they logged in on their computer or laptop. The principal value that your app offers to users is giving them the financial knowledge they desperately need.

You can also reach people directly through fintech mobile apps in ways that aren’t traditionally achievable. One-to-one marketing, through the use of push notifications, gets straight to customer eyeballs with a more engaged and available audience that you can connect with on a personal level.

What is the financial app development process?

You need to develop the best financial app possible, one that loads fast, runs smoothly, has data visualisation features, looks the part, and isn’t plagued by constant bugs and glitches.

Building a great financial app is about following a well-defined process that ensures nothing gets missed in development, from finding an outstanding marketing idea to testing and maintenance. Let’s take a look at it.

1. Identify the niche

The first step to developing a financial app is to select a suitable niche. You need to think about things like the type of app you wish to build, what it does, and which area of fintech you want to focus on overall.

You need to decide whether it’s a mobile app for managing personal finance, mobile banking, or something else that offers value.

2. Ensure legal compliance

You need to be sure you’re aware of what you’re legally allowed to do while developing a financial app.

Most countries have a set of legal requirements that you must comply with, and each will typically follow different financial safeguarding systems.

Examples include anti-money laundering, PCI DSS (Payment Card Industry Data Security Standard), and digital signature certificates; non-compliance can land you in serious trouble, so take the time to do your research and stay compliant.

3. Competitor analysis

You’ll need to analyze your competitors. While this is an important part of many industries, financial niches are highly competitive due to the potential audience you can reach and the value you can offer.

It’s important to analyze your competitors, find out the advantages you have against them, and see how long it took them to become successful.

Doing so will put you in a much better position to be able to list the features of your fintech app and set out the unique value you provide.

4. Define your must-have features

Now you need to choose the must-have features for your fintech app. You don’t need to cram your app with endless features, but you must create a robust financial solution with features that’ll make your mobile app more innovative and user-friendly.

Standard features of financial apps include the following:

- Cross-platform functionality

- Two-factor authentication

- OTP-based log-in

- Chatbot for 24/7 customer support

Lastly, shortlist all those features you can’t imagine the app would function without, as this will provide a plan to move ahead.

5. Build the right team

An experienced team of experts will allow you to create a unique financial app that goes straight to the top of the charts. Most brands alone won’t have the experience to develop a financial app without support.

Therefore, be sure to hire a team of developers or work with a reputable app development company with the relevant expertise. You need to be able to build a competent app without hassle along the way.

6. Select the correct technology stack

Selecting the correct tech stack is key for developing a fintech app as there’s a multitude of options to choose from, and there are many chances for you to go wrong with your choice.

Depending on the mobile app type and features, you’d need different technology tools for its back-end and front-end, and every app project is unique–there’s no one-size-fits-all stack for your mobile app.

Financial app developer example

Source: EvaCodes

Source: EvaCodes

A well-chosen technology stack can help you reduce development expenses; popular technologies for financial app-building include Python, C#, C++, Ruby, Java and Kotlin.

After that, your app development company will set up a model for the front-end coding of your app and will develop the API (application programming interface) as well as decide on the back-end design before moving ahead.

7. Estimate the cost

You need to consider many factors for determining the cost of your fintech solution, from the app’s features to legal compliances and maintenance costs.

It’s best to estimate before starting the app development process–you can do this by preparing your project’s scope document with a budget and timelines. Forewarned is forearmed.

8. Create an MVP

An MVP (minimum viable product) is the version of your app that serves as proof of your app’s concept and includes the minimum amount of features to be able to try it–it’s typically the most basic version of the app you’ll see.

This enables you to get early feedback on the app and minimises the risk of your idea going wrong. You’ll also be able to increase your app’s scope of improvement and reduce overall risk factors.

9. Upgrading and improving

Your financial mobile app development process shouldn’t stop after the app gets launched. Instead, keep improving and upgrading it as the feedback comes in–the process is a gradual one rather than instant.

The improvement of processes and products should be made by adopting new technologies and providing quick responses to customers’ problems–this ensures the app goes from success to success.

Financial app development best practices and features

Here are some of the key aspects to consider when developing a financial app, including best practices as well as essential and advanced features.

Data visualization

Data visualization is necessary, if not essential, for a budgeting or mobile banking app in today’s world.

Users love infographics, charts, and dashboards that attract attention and displaying data in charts and infographics makes the information more digestible. The most successful money apps all have impressive data visualization combined with user-friendly interactivity of that data.

Top-notch security and compliance

Security is particularly vital in budgeting apps since the apps have direct access to a user’s financial accounts–it’s the data most people fear losing control over, so keeping it secure is paramount.

Not only that, but a finance management app needs to comply with modern data processing and management standards such as GDPR. It’s best to build financial apps with secure cloud infrastructure and conduct penetration testing and security audits that ensure the data stays protected.

Financial app developer example

Source: App Maisters

Source: App Maisters

Smart integration with payment systems

The advantage of a budgeting app is the ability to link all your accounts together, allowing the app to cover and monitor users’ finances in one unified place. It’s one of the most expected features of any financial app.

Therefore, your app needs to support integration with various banks and payment systems, ensuring that they all work together seamlessly and without friction.

Essential features

Your financial app will also need to offer a lineup of essential features or must-have features that the app can’t function without.

The MVP is the minimum standard you can showcase your product to your target audience, and the features need to fulfil the most critical functions that users expect of financial apps.

These are the essential features your fintech app needs to have:

1. Push notifications

2. Real-time spending

3. Smart budgeting features

4. Multi-factor authentication

5. User-friendly design

6. Accounts aggregation

7. Customer service options

8. Recurring payment tracking

9. Rewards points system

10. Data visualisation

Focus on mobile app features that provide maximum value to your customers first and foremost. Gather feedback carefully, let your users tell you what features make sense to them, and then steadily implement the changes.

Financial app developer example

Source: Promatics

Source: Promatics

Advanced features

Advanced features are optional features, but they can make your fintech app offer more value to users. Advanced financial app features include the following:

1. Biometric sign-in

2. Investment tools

3. Multi-user sign-ins

4. Detailed spending categorisation

5. Peer-to-peer money transfers

6. Credit card processing

7. Digital wallet

8. Virtual accounts

9. Instant ACH

10. Voice-assisted banking

Of course, the more advanced features you add, the higher the cost of the app’s development. Keep this in mind when deciding your budget.

How much does it cost to develop a financial mobile app?

Development costs of fintech apps vary. Below are the average estimates per app category:

- Mobile banking app: $287,050 per two platforms (3529 hours)

- Lending app: $197,250 per two platforms (2254 hours)

- Insurance app: $139,300 per two platforms (1386 hours)

- Investment app: $197,250 per two platforms (2095 hours)

A developer can take anywhere from 1386 to 3529 hours to complete a financial app. Developing the app’s first version can take about three to four months.

The average cost of building a fintech app ranges from $120,000 to $300,000, but this depends on the app’s complexity–more features will result in a higher price. It’s worth contacting a financial app development company for an estimate beforehand.

How can I benefit from financial app development services?

With the demand for financial apps–not to mention the significant opportunity available–partnering with financial app creation companies allows you to create customer-friendly apps that enable users to track their purchases and keep on top of their finances.

Financial app developers are able to build highly-scalable apps, whether they’re mobile banking apps or dedicated investment apps. These development companies create beautiful apps that make use of the latest tech and trends while meeting user expectations.

Financial app developer example

Source: Indiespring

Source: Indiespring

Some of the key benefits of financial app development companies include the following:

- Reduced development and maintenance costs — The apps get designed using different frameworks, which allow developers to reuse the code for different applications.

- Improved functionality and usability — Development companies provide great functionality and usability with top-notch features as standard.

- Fast and secure — Mobile apps that can help you reach your customers anytime, with messages, offers, and new launches at your disposal.

- Improved security — Built to offer increased security for businesses and customers by using the latest encryption technology.

- Improved data management — Better data management solutions that improve business productivity while improving customer experience.

- Flexible plans — Tailor-made plans designed to fit all needs, big or small, and typically come with superior scalability for your financial app.

If you’re planning to develop a fintech app, it’s usually a good idea to get a free quote from the mobile app development experts. This is especially true if you’re a non-developer or a beginner.

Get started with the best financial app developers

To recap, the most critical reasons for having a financial app are the following:

- The apps can help customers to track their spending and investment

- Gamification features are popular and can keep users engaged

- Customers can track bill payments and can stay informed on credit score changes

- Customers are able to develop and improve their financial management skills wherever they are

- Real-time updates allow for greater control over personal finance

There are a number of app development companies that take on financial app development projects and have app developers with experience specifically catered to these apps. Here we’ve put together for you a list of the best.