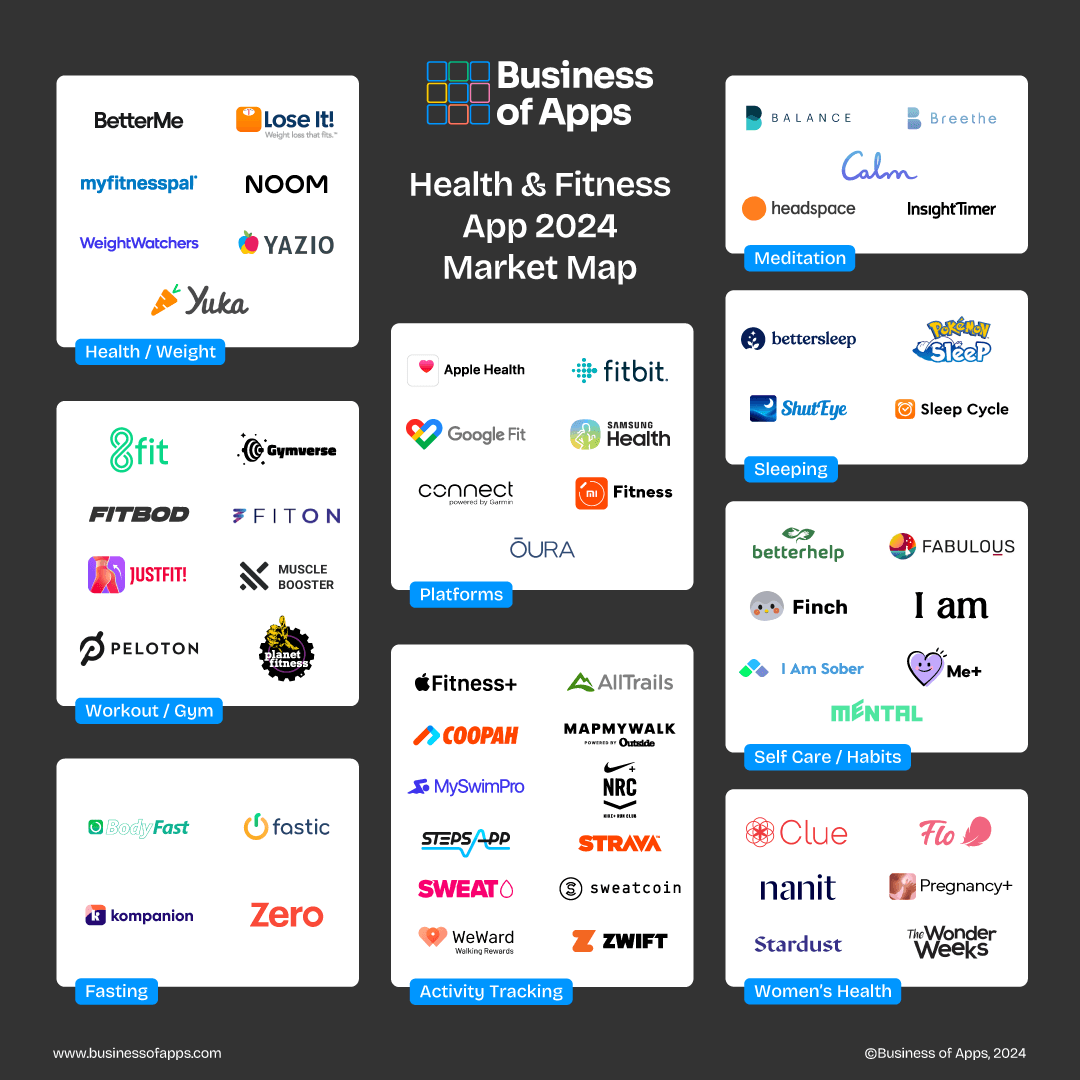

The health and fitness app sector is a burgeoning market, which generated $4.4 billion revenue in 2023 according to our Health & Fitness App report. Over 600 million people access these apps, and use them as primary resources for losing weight, gaining muscle and maintaining a healthy lifestyle. Anchored by the three key pillars—health, fitness, and wellness—this vibrant market branches into a multitude of subsectors, all of which are detailed in our comprehensive market map.

Platforms

Starting with all-in-one platforms like Apple Health, Google Fit, and Samsung Health, these apps leverage sensors on connected devices to track a wide range of health metrics. While some are primarily tied to mobile devices, others are linked to specific hardware, such as Fitbit’s fitness trackers and Oura’s smart ring.

Activity Tracking

Tracking fitness is a key way to maintain commitment, especially when a social element is involved, as offered by platforms like Strava, AllTrails, and Nike Run Club. For users seeking more guidance, services such as Apple Fitness+, Coopah, and MySwimPro deliver personalized training plans to help users stay on track and improve. Another effective way to sustain momentum is through rewarded exercise, with apps like Sweatcoin and WeWard offering coins that can be spent in their marketplaces.

Health and Weight

Similarly for health and weight loss, daily tracking has been shown to reduce calorie intake and support more effective weight loss. Apps like MyFitnessPal, Lose It!, and Yazio provide extensive food databases to help accurately track calories. For a more guided approach, programs such as Noom, WeightWatchers, and BetterMe offer personalized plans, including regular check-ins and fitness routines.

Fasting

A breakout from typical weight loss programs, fasting involves a set period of time not eating. Many participants follow a 16/8 intermittent fasting schedule, although there are several iterations of the schedule. Fasting apps such as Fastic and Zero help users track fasting periods, provide health recommendations, and encourage consistency with reward streaks.

Workout and Gym

For those concerned with muscle growth, there are plenty of apps that offer personalized workout plans. Options like 8fit, FitOn and JustFit cater to home workouts without equipment, while Muscle Booster, Gymverse and Fitbod provide varied workout routines to practice in a gym or with home equipment.

Women’s Health

This subsector is split into three primary categories: period tracking, pregnancy and babies. Flo and Clue are the key apps in this section, both also provide pregnancy tracking tools. Nanit and the Wonder Weeks have many tools available for baby tracking and insights.

Meditation

Over the past five years, the wellness segment has been the fastest-growing part of the health and fitness market, with Calm and Headspace leading the way. These meditation apps offer guided meditations, stories, music, and coaching, helping millions reduce stress, improve sleep, and enhance their overall mental well-being.

Sleeping

As the wellness app market expanded, developers created apps specifically designed to address sleep issues. Sleep Cycle and ShutEye are two of the most prominent in this category, offering insights into users’ sleep patterns and provide strategies to enhance overall sleep quality.

Self Care and Habits

Another segment of wellness is self-care, which can take several forms. Finch, Fabulous, and Me+ are some of the top daily habit and routine planners, while apps like Mental combine fitness with therapy.