In today’s rapidly growing global mobile gaming market, casual and puzzle games have shown their unique appeal and significant commercial potential. Casual games, with their simple mechanics and accessibility, attract a wide range of gamers. Meanwhile, puzzle games, known for their challenging puzzles and brain-training elements, have become popular among fans of intellectual games.

Match-3, elimination, parkour, instant games… The classic gameplay and broad appeal of these styles have resulted in frequent hits within these two major genres.

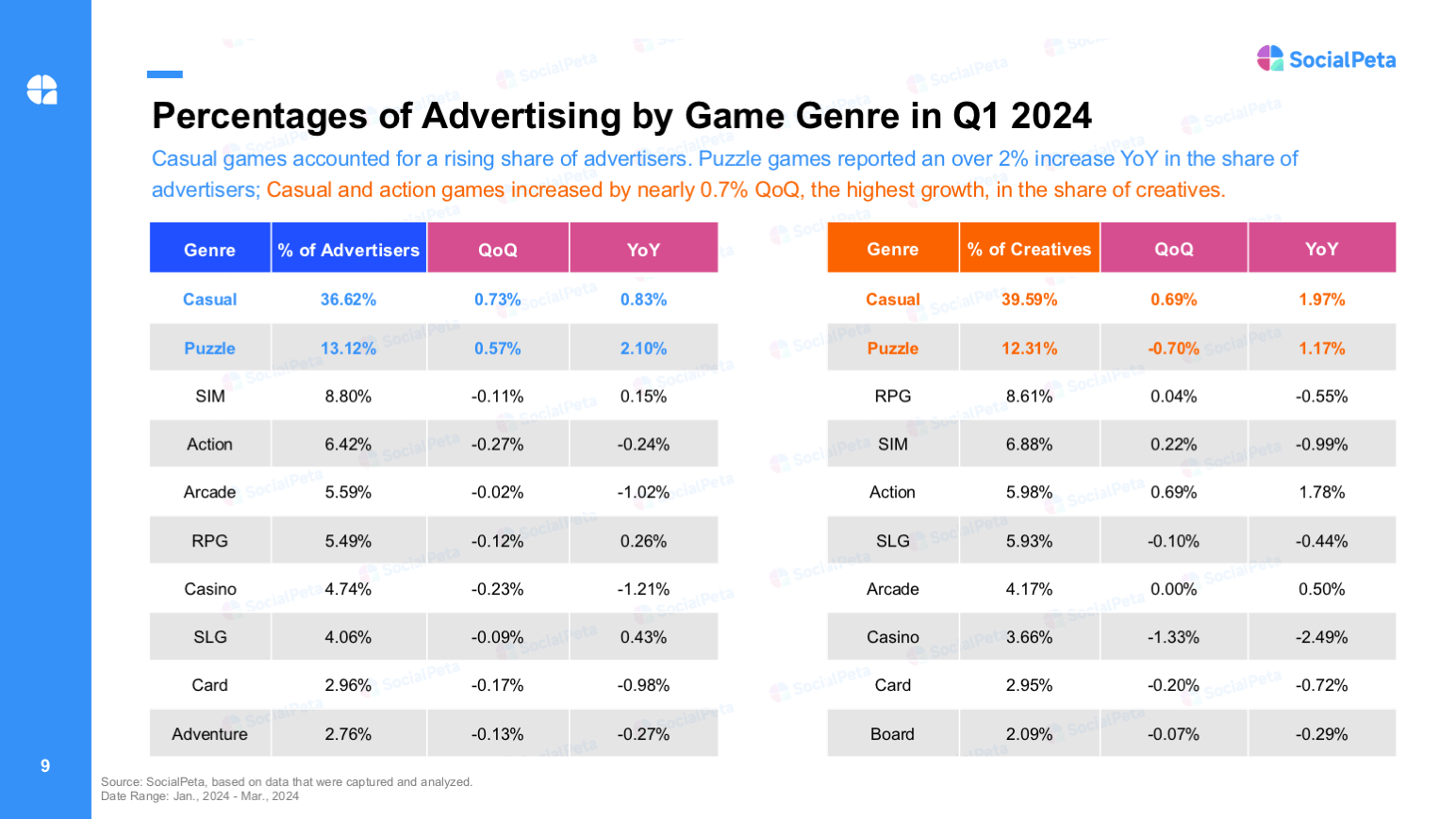

Casual and puzzle games represent the two largest genres in terms of quantity and marketing within the mobile gaming sector. In Q1 2024, casual game advertisers accounted for 36.62% of the market, a year-over-year increase of 0.83%. Casual game creatives made up 39.59% of the market, an increase of 1.97% compared to the same period last year.

Puzzle games are the second-largest genre, with advertisers and creative volumes accounting for 13.12% and 12.31%, respectively. The share of puzzle game advertisers grew by 2.1% from the previous year, marking the largest increase among all genres.

Percentage of advertising by game genre in Q1 2024

Source: SocialPeta

Furthermore, many mid-to-hardcore products have shifted their gameplay positioning and acquisition strategies towards the casual market to comply with increasingly stringent privacy policies in app stores.

A prime example from 2023 is the explosive trend of “mini-game” marketing. Additionally, the gameplay of many hit puzzle games has served as a blueprint for mini-game acquisition strategies. Many classic, high-quality puzzle mechanics have become the driving engines for hits in the instant games category.

To this end, SocialPeta has partnered with the globally renowned casual game publisher Supersonic from Unity to release the report Marketing Insights into Global Casual & Puzzle Games for Q1 2024.

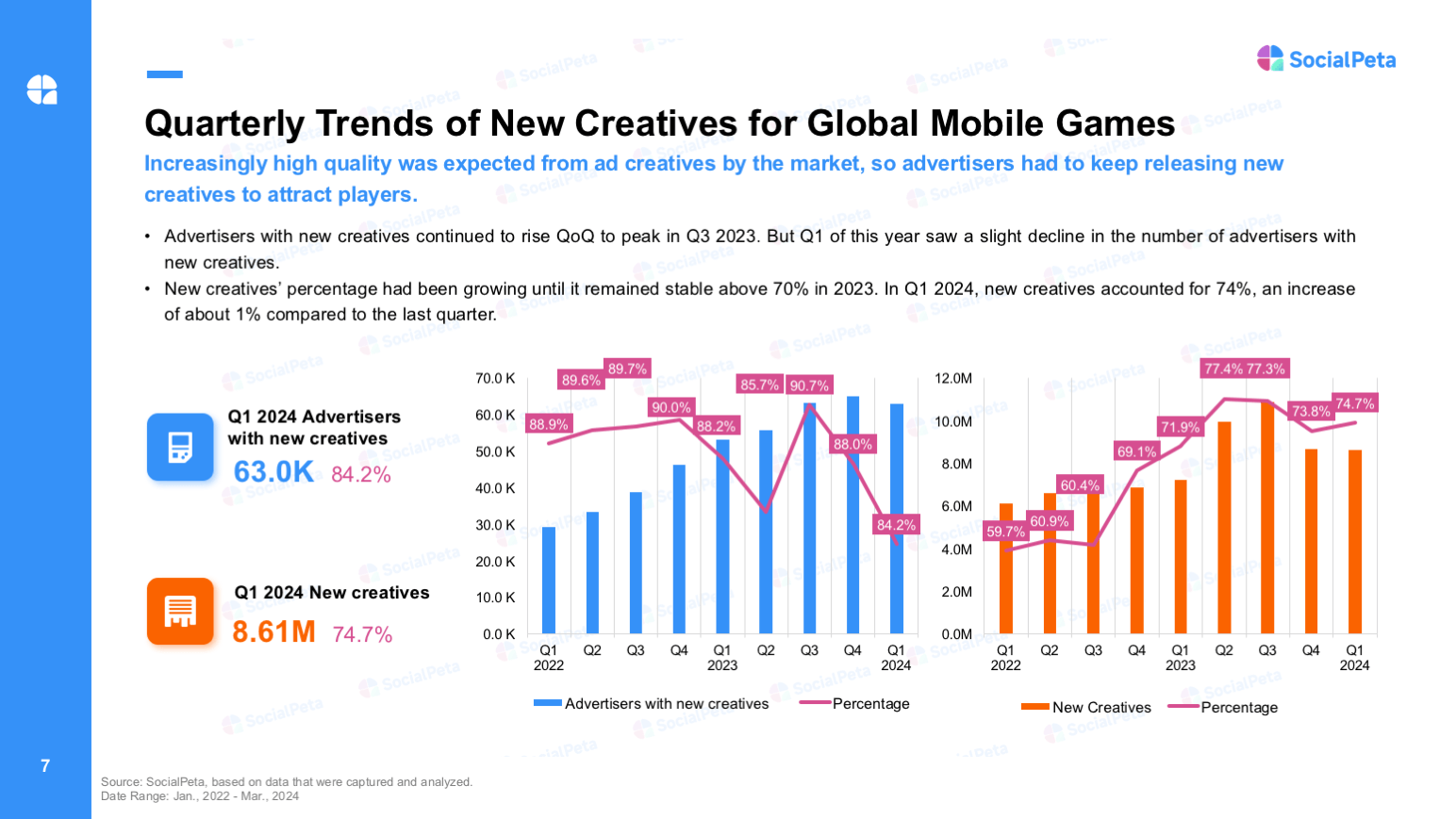

Mobile game advertisers release an average of 109 creatives per month, with new creatives making up 74.7% of the total each quarter.

This report provides a detailed analysis of global mobile gaming marketing trends for Q1 2024. The number of mobile game advertisers per month continues to show a clear growth trend, with an average of over 51,000 advertisers each month in Q1 2024, a 28.9% increase year-over-year. The average number of creatives per advertiser was 109 per month, reflecting an 18% decrease.

However, the overall trend indicates that the intensity of creative deployment is stabilizing, with the average monthly creatives per advertiser in Q2 2024 expected to be between 110 and 120.

Advertising trends in global mobile games

Source: SocialPeta

Although the average intensity of advertising has slowed, advertisers’ pursuit of new and innovative creative ideas remains strong. In Q1 2024, over 63,000 mobile game advertisers released new creatives, accounting for 84.2% of the total.

We captured more than 8.6 million new creatives during Q1, representing 74.7% of the total, an increase of 2.8% compared to the same period last year and approximately a 1% increase from Q4 2023.

Quarterly trends of new creatives for global mobile games

Source: SocialPeta

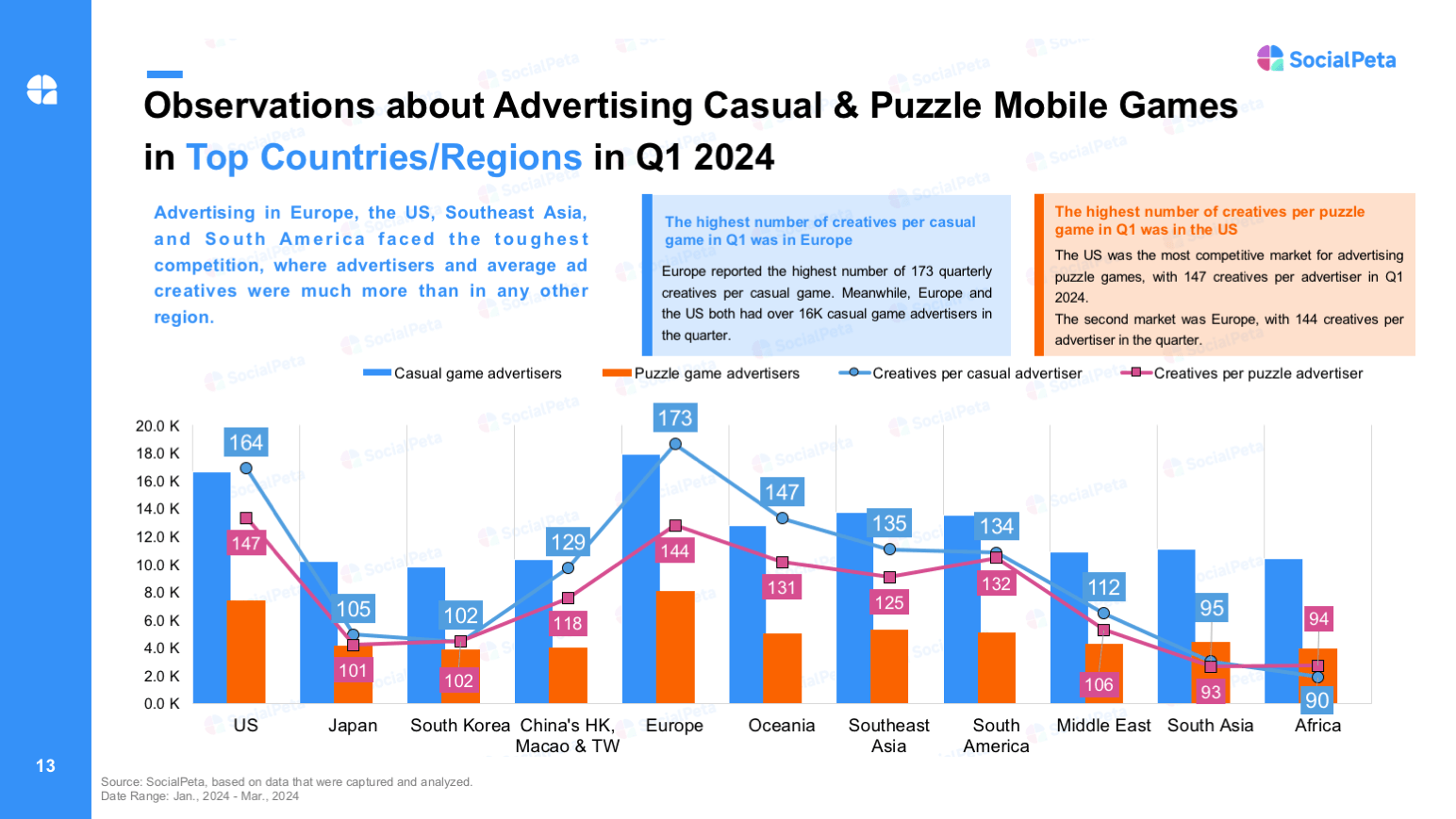

The primary marketing battleground remains in Europe and America.

Based on observations of advertising for casual and puzzle mobile games in top countries/regions in Q1 2024, the market remains primarily concentrated in Europe and America. Europe had the highest number of casual advertisers, with nearly 18,000 advertisers during this period. Furthermore, Europe is the most competitive region for casual games, with an average of 173 creative pieces per advertiser in Q1.

The US market was the most competitive for puzzle games, with an average of 147 creatives per advertiser in Q1, followed closely by the European market with an average of 144 creatives per advertiser.

Additionally, the markets in Oceania, South America, and Southeast Asia also showed significant competition in the casual and puzzle genres. Notably, in South America, the average number of creative pieces per advertiser exceeded 130 during the quarter.

Casual and puzzle games in Q4 2024

Source: SocialPeta

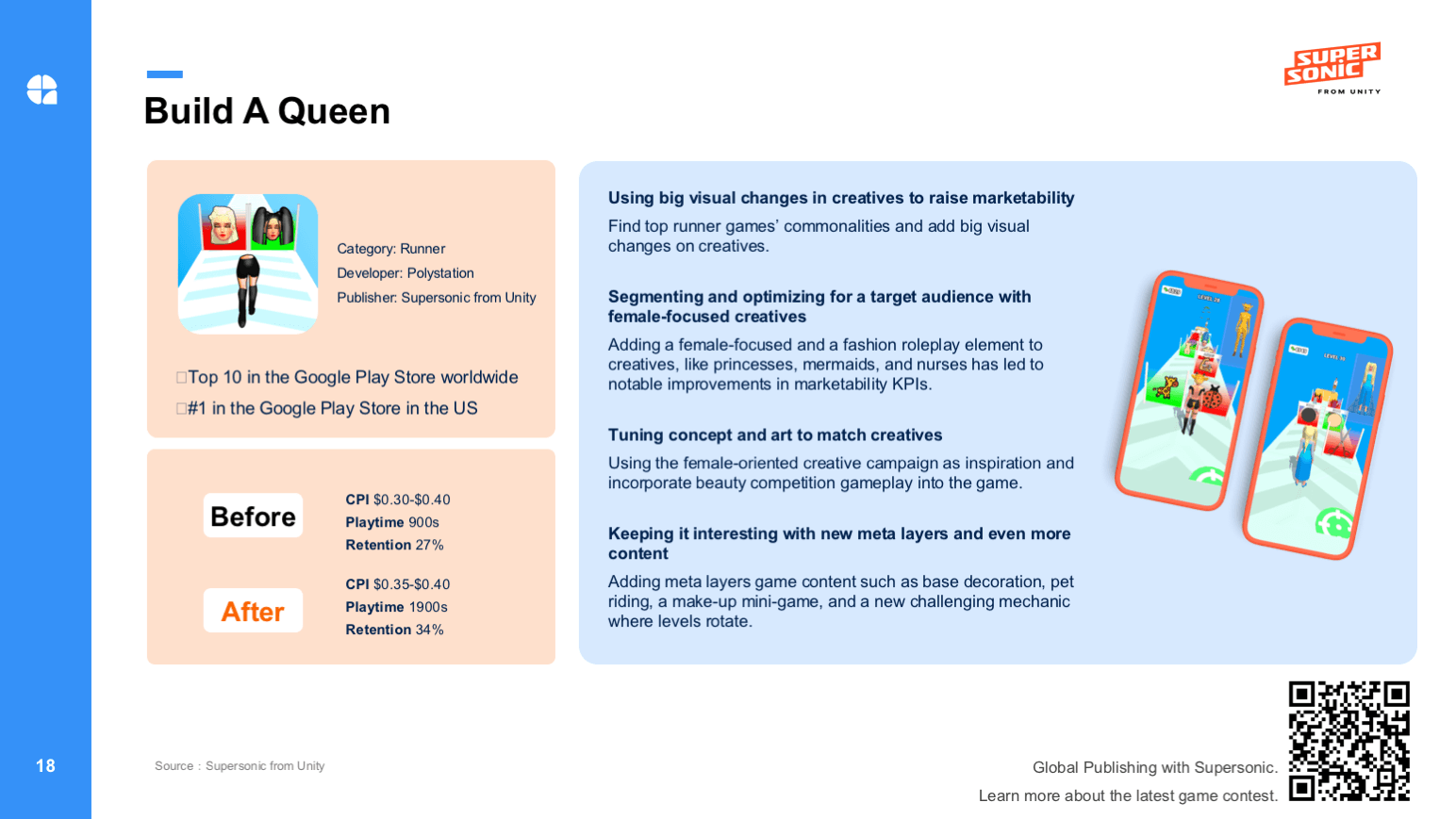

Climbing to the top of the US charts is Supersonic’s “Build A Queen”.

Hyper-casual, particularly parkour-style hyper-casual games, have long been a crucial sub-track within the casual gaming category. “Build A Queen,” a globally successful parkour game that has topped the US charts at #1, presents success factors that merit in-depth analysis.

“Build A Queen” analysis

Source: SocialPeta

The success of the game can first be attributed to its unique creativity. It combines parkour, puzzle-solving, and simulation elements, offering players a stimulating and challenging experience. In acquisition efforts, it identifies commonalities in parkour games and emphasizes visual variation in creatives, significantly enhancing marketability.

In terms of design, the game focuses on female players by incorporating elements geared toward women and fashionable character costumes, such as transforming into a princess, mermaid, or nurse, catering to the specific preferences of its target audience. The gameplay is also oriented towards female players, including beauty contest mechanics.

To avoid the homogeneity typical of hyper-casual parkour games, it also adds peripheral systems (like base decoration and makeup instant games) and new content (such as new level rotations and challenge mechanisms), greatly increasing the overall fun of the game.

Under the guidance of Supersonic, “Build A Queen” entered the top four on Google Play in the US in its launch month and quickly climbed to the top, achieving a top ten global ranking. The report also features more hyper-casual case studies, which are available for download.

For more detailed information, download the full report.