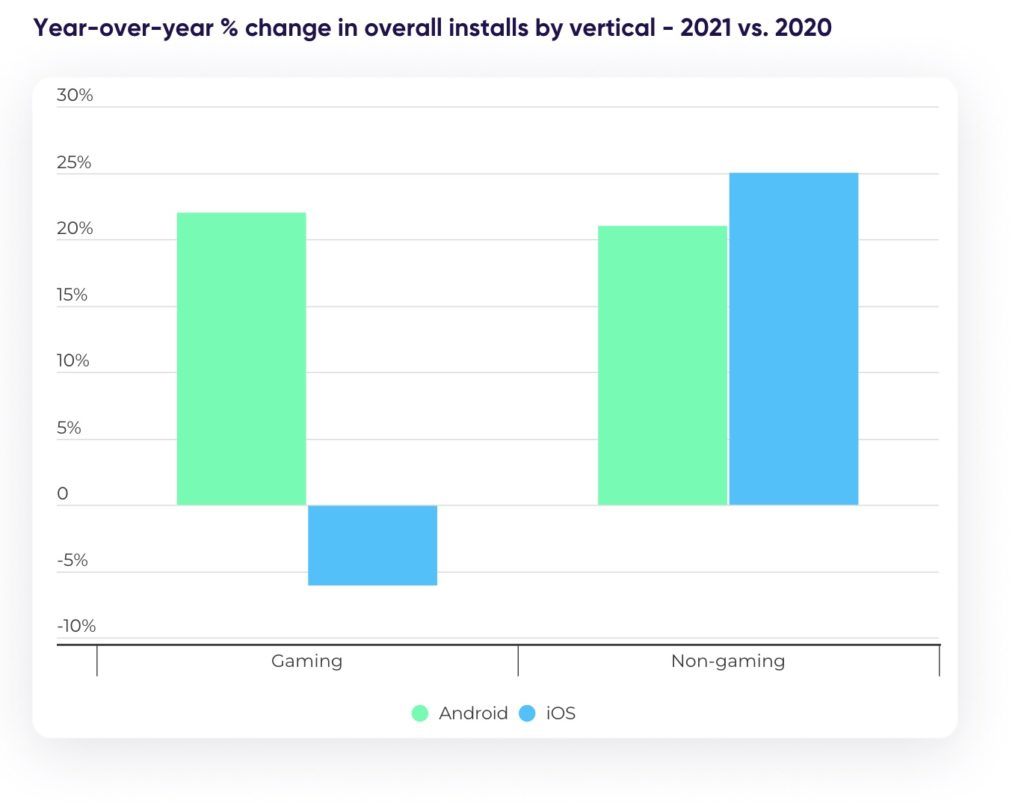

The number of gaming app installs on Android rose 22% last year according to new data released by app experts AppsFlyer.

The report finds that gaming app marketers struggled to measure non-organic installs in the wake of Apple’s App Tracking Transparency framework.

Adoption of Apple’s SKAdNetwork rose by 5x and gaming apps adopted SKAN faster than non-gaming apps, with 67% of iOS non-organic installs coming from SKAN.

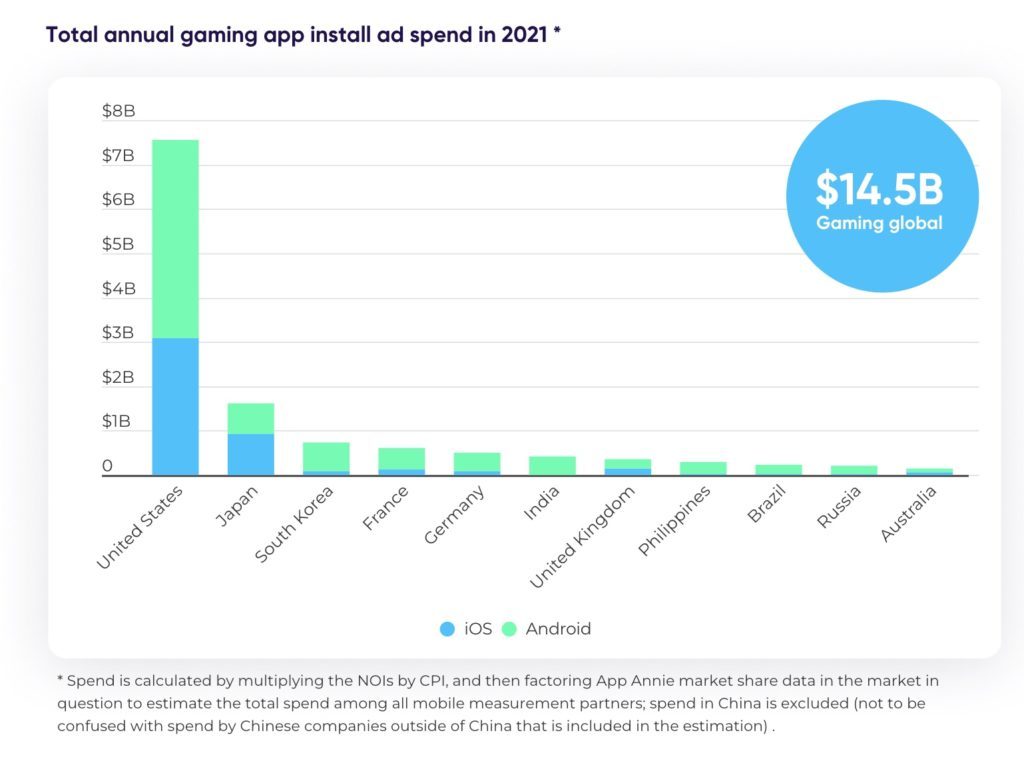

Marketers spent $14.5 billion on game app user acquisition last year, with the US responsible for half these budgets.

Android ad spending surged 35%.

Master Mobile Media Buying Design Secrets! 📱🚀

Ready to skyrocket your campaign results? Grab your free guide packed with design strategies for better ad performance.

Learn MoreThe limited data to measure game app installs on iOS led a 6% drop.

Marketer’s heavy reliance on user level data is also evident in the 21% and 25% increase in non-gaming apps for iOS and Android, respectively.

In-app purchase revenues in games fell 35% since June 2021 when iOS 14.5 changes gained traction.

“We currently find ourselves in the golden era of mobile Gaming. The rate of acceleration of mobile adoption paired with the ongoing investment in original Gaming content has made mobile Gaming a lucrative business,” said Shani Rosenfelder, Head of Content & Mobile Insights, AppsFlyer.

“That being said, since Apple’s implementation of the ATT framework in 2021, it’s gotten more challenging, and since marketing plays a major role in mobile gaming, the impact on overall downloads and revenue has been significant. Going into 2022, marketers must find new ways to effectively reach high value users in the new reality of data privacy.”

In the UK, gaming installs dropped 18% between September and November last year, but jumped in Decumber by 28%u

Hyper casual games and hardcore titles rose 62% on Android (29% iOS) and 26% on Android (6% iOS), respectively.

Users were also more keen on making in-app purchases in hardcore games (+17%) while in-app ad revenues doubled in these titles throughout much of 2021.

“Data privacy changes – specifically limitations around access to user-level data – have had a big impact on gaming marketers in the United Kingdom,” said Adam Smart, Director of Product, Gaming, AppsFlyer.

“Current opt-in rates of Apple’s ATT framework sit below the global average at 43%, and as a result, we’re seeing marketers explore new ways of acquiring and engaging users, and measuring campaigns. An increased focus on contextual advertising, diversifying traffic sources, and re-thinking measurement KPIs should be on the agenda for gaming marketers looking to succeed in 2022.”